Africa in 2025: The Fastest-Growing Economies

5 min Read January 7, 2025 at 9:52 AM UTC

Despite challenges such as geopolitical tensions and hot inflation, Africa will have some of the fastest-growing economies in the world in 2025.

Africa’s economic landscape in 2025 showcases a region ripe with opportunities.

Despite global challenges such as geopolitical tensions, inflationary pressures, and lingering effects of the COVID-19 pandemic, many African economies are on a trajectory of robust growth.

The International Monetary Fund (IMF) projects that Sub-Saharan Africa’s gross domestic product (GDP) will grow by 4.2% in 2025, with some countries outpacing global averages and becoming magnets for investment.

We delve into the fastest-growing economies in Africa, highlighting the drivers behind their growth and why they’re worth watching for prospective and existing investors.

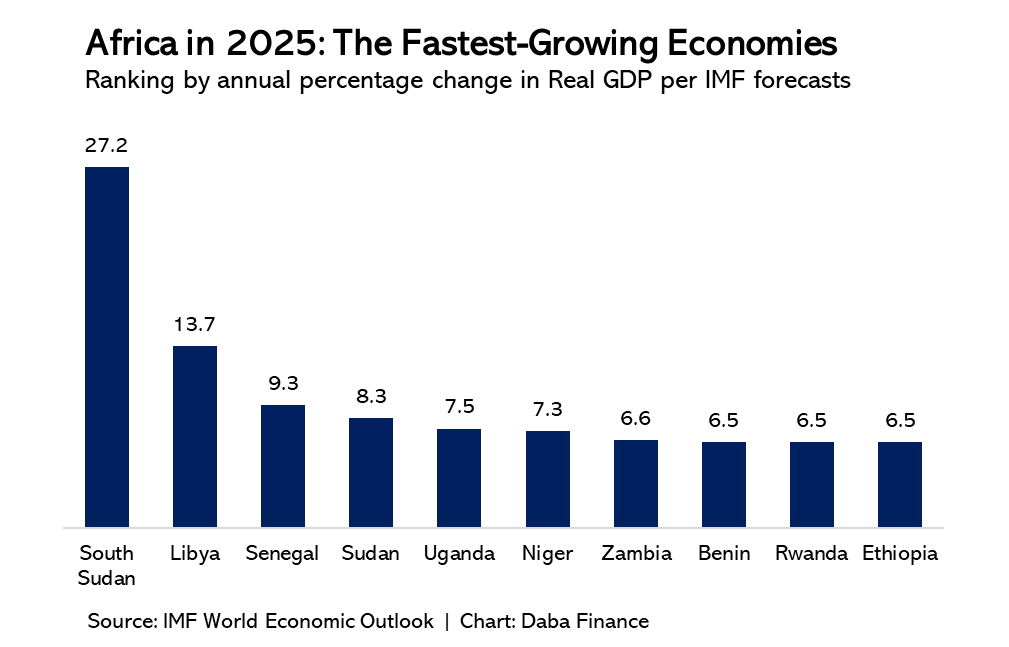

The Fastest-Growing African Economies in 2025

South Sudan – 27.2%

South Sudan tops the list as Africa’s fastest-growing economy in 2025. Following a sharp contraction of 26.4% in 2024 due to conflict spillovers, the IMF forecasts a significant rebound. The growth will be driven by reconstruction efforts and renewed oil production, which is the lifeblood of the economy. However, investors should approach with caution given the country’s high inflation (expected to decline to 74% from 120% in 2024) and fragile political environment.

Libya – 13.7%

Libya’s economic resurgence comes on the back of stabilized oil production, which resumed fully in late 2024. As Africa’s second-largest oil producer, Libya’s growth is tied closely to global oil prices and domestic political stability. While risks persist, the opportunities in oil and gas infrastructure are substantial.

Senegal – 9.3%

Senegal’s economic rise is fueled by its burgeoning hydrocarbon sector. The country’s transition into an oil and gas producer is complemented by a stable macroeconomic environment and low inflation (2% in 2025). Senegal’s growth story also extends to its investments in agriculture, infrastructure, and digital transformation, making it a prime target for diversified investments.

Sudan – 8.3%

Emerging from economic contraction and conflict, Sudan’s projected growth in 2025 is largely driven by reconstruction efforts and increased activity across various sectors. Social services and infrastructure investments are key focus areas, offering investment opportunities despite the inherent risks of a volatile political environment.

Uganda – 7.5%

Uganda’s growth trajectory is supported by its oil and gas sector, particularly as production ramps up from its Lake Albert project. The country also benefits from higher gold prices and increased investment in agriculture. With a consistent focus on infrastructure, Uganda offers compelling opportunities for long-term investors.

Niger – 7.3%

Despite recent political upheavals, Niger is expected to record strong growth due to its natural resource base, particularly uranium and oil. Infrastructure development and regional trade integration further bolster its growth prospects.

Zambia – 6.6%

Zambia’s economic rebound from 2.3% in 2024 to 6.6% in 2025 highlights the country’s resilience. Copper remains the backbone of its economy, but diversification efforts into agriculture and renewable energy present exciting opportunities.

Benin – 6.5%

Benin’s growth remains stable, driven by agricultural exports and infrastructure projects. Its proximity to Nigeria and integration into regional trade blocs make it a strategic investment destination in West Africa.

Rwanda – 6.5%

Known for its pro-business environment, Rwanda continues to attract foreign direct investment (FDI) in technology, tourism, and manufacturing. With low inflation and government-led initiatives to support private sector growth, Rwanda remains a model for economic resilience in Africa.

Ethiopia – 6.5%

Ethiopia’s growth is underpinned by its manufacturing and services sectors, along with large-scale infrastructure projects. However, challenges such as exchange rate volatility and high inflation persist, requiring careful navigation by investors.

Why These Economies Are Thriving

Several factors contribute to the impressive growth rates of these economies:

Natural Resource Endowments: Countries like Libya, South Sudan, and Uganda are leveraging their oil and gas reserves to drive economic expansion.

Infrastructure Development: Investments in roads, railways, and energy projects are creating jobs and boosting productivity.

Economic Reforms: Nations like Rwanda and Senegal have implemented policies to attract FDI and enhance business competitiveness.

Regional Trade: Participation in regional trade blocs like the African Continental Free Trade Area (AfCFTA) is fostering economic integration and growth.

Challenges to Consider

While the opportunities are immense, investors must be aware of the challenges:

Political Instability: Countries like South Sudan and Libya face risks from fragile political environments.

Economic Volatility: High inflation and currency depreciation, as seen in Ethiopia, can erode returns.

Infrastructure Gaps: Despite progress, many African nations still lack the infrastructure needed to support rapid economic growth.

Currency Risk: Fluctuations in exchange rates in some African economies such as Nigeria and Egypt can significantly impact returns, particularly for foreign investors.

How Daba Can Help You Tap into Africa’s Potential

For investors eager to access these burgeoning markets, Daba offers a seamless solution. As Africa’s premier multi-asset investment platform, Daba provides:

Access to Stock Markets: Invest in companies listed on African stock exchanges, such as Senegal’s BRVM.

Bonds and Fixed Income: Explore government and corporate bonds from high-growth economies like Uganda and Zambia.

Startups: Tap into Africa’s tech and innovation scene with curated startup investment opportunities.

Managed Investments: Benefit from expertly managed portfolios tailored to your risk profile.

Daba empowers both retail and institutional investors with reliable information, transparency, and the tools to make high-quality investments across Africa. With a user-friendly interface and deep market insights, the Daba app is your gateway to participating in Africa’s economic transformation.

Tapping into Africa’s Growth

Africa’s fastest-growing economies in 2025 are more than just statistics; they represent a continent’s resilience, potential, and promise.

By understanding the trends and leveraging platforms like Daba, investors can not only achieve substantial returns but also contribute to the region’s sustainable development.

Now is the time to explore the untapped opportunities that Africa’s growth story offers.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.