Africa’s Fastest-Growing Economies in 2026

7 min Read January 2, 2026 at 1:46 PM UTC

When most people think about economic growth, their minds drift to Silicon Valley tech companies, Chinese manufacturing giants, or European financial centers.

But right now, something remarkable is happening in Africa that barely makes headlines, and it’s reshaping where the world’s most explosive economic growth is actually occurring.

Here’s a number that should grab your attention: The International Monetary Fund (IMF) predicts sub-Saharan Africa will grow at 4.4% in 2026.

That might not sound revolutionary until you realize it’s faster than the global average of 3.1%.

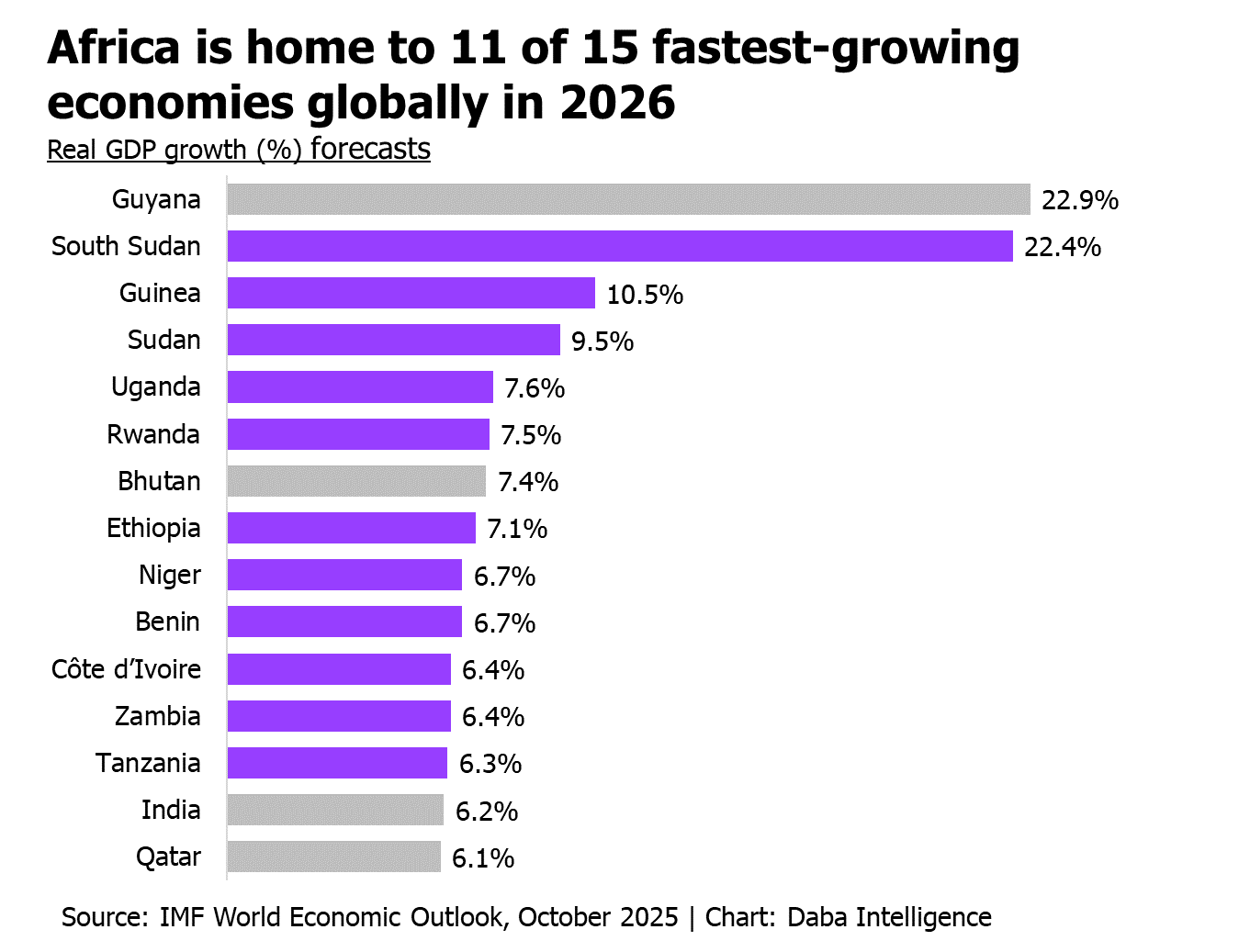

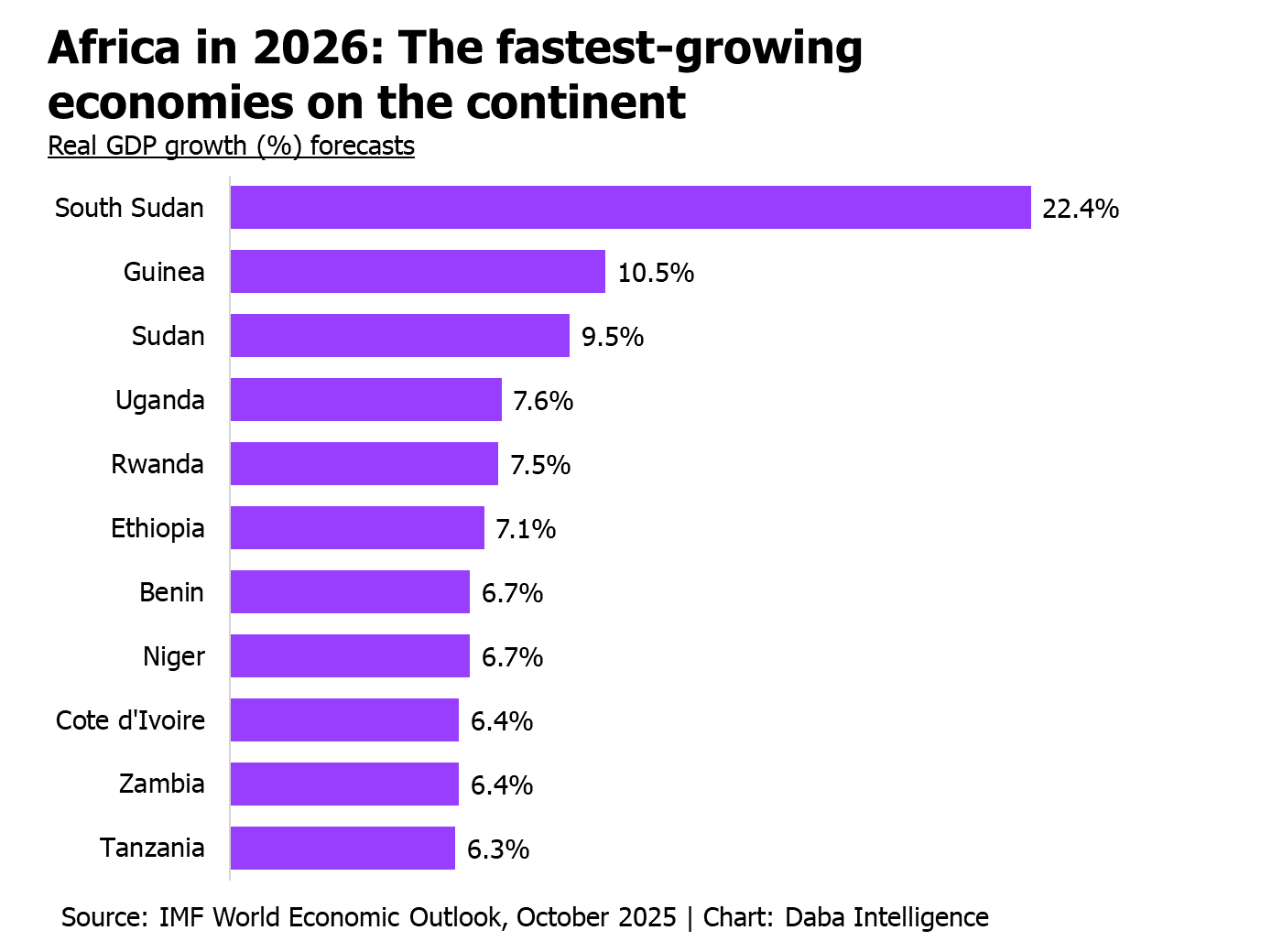

Even more eye-opening: eleven of the world’s fifteen fastest-growing economies are in Africa. This represents a fundamental shift in where economic energy and opportunity are flowing in our interconnected world.

But before we get carried away with excitement, there’s an important reality check. The IMF warns that many African economies are walking a tightrope.

They’re dealing with multiple challenges simultaneously: shaky monetary policies, fragile financial systems, external economic pressures, and government budget problems. Many countries are spending so much money paying off debts that they can’t invest adequately in schools, hospitals, and roads—the basic building blocks of long-term prosperity.

Here’s the simple truth: fast growth doesn’t mean all problems are solved.

Many African countries haven’t yet developed the strong government institutions and systems needed to maintain consistent economic performance year after year. When you depend heavily on selling natural resources like oil or minerals, your economy can boom when prices are high and crash when they drop. And impressive growth percentages don’t automatically translate into better lives for everyday people.

That said, the clustering of high-growth economies in Africa is real and significant.

For people looking to invest money, start businesses, or understand where global opportunities exist, this matters enormously.

Several powerful forces are colliding right now: more people moving to cities, rapid adoption of smartphones and digital technology, and a massive population of young people entering the workforce, all meeting markets that have barely been tapped. This combination is creating favorable conditions across many industries.

Three different paths to growth

Africa’s ten fastest-growing economies are taking three main routes to expansion. Some are recovering from conflicts and getting back on their feet. Others are ramping up mining and oil production. And some are making smart reforms and diversifying what their economies produce.

Let’s break down what’s actually happening in each country:

South Sudan tops the list with a staggering 22.4% growth projection. The story here is simple but dramatic. This country gets roughly 98% of its government money from oil exports. When a pipeline was damaged in February 2024 during fighting in neighboring Sudan, oil shipments plummeted from 186,000 barrels per day down to just 58,000 barrels. Imagine losing more than two-thirds of your country’s income overnight. When oil exports resumed in April 2025, the economic rebound began. That’s why growth looks so spectacular—they’re essentially turning the lights back on after a forced blackout.

Guinea is projected to grow 10.5%, driven almost entirely by mining. The country is sitting on massive bauxite deposits—the raw material for making aluminum. Chinese demand has been enormous, and Guinea exported a record 99.8 million tons of bauxite in just the first six months of 2025, a 36% jump from the year before. To put this in perspective, Guinea now supplies over 70% of all the bauxite traded globally. They’ve also got a massive iron ore mine called Simandou that’s about to start shipping, which could transform the entire economy.

Sudan, growing at 9.5%, is in recovery mode after devastating conflict. The focus has shifted from simply surviving crisis to rebuilding the basic systems that make normal economic activity possible—fixing roads, getting communication networks running again, and restoring financial systems so businesses can operate. It’s the economic equivalent of rebuilding a house after a fire.

Uganda’s 7.6% growth comes from multiple sources. They’re exporting more gold and coffee, people are spending more money again, businesses are investing heavily, transportation links with neighboring countries are improving, and the government is spending more on development projects. Plus, they’re expected to start producing crude oil toward the end of 2026, which will add another revenue stream.

Rwanda is growing at 7.5% and represents something different—a country transforming itself through smart planning. Services like banking, telecommunications, and tourism now make up about 44% of their economy. They’re also growing mining, manufacturing, and construction, and building a new international airport. Rwanda has become a model for how consistent investment in infrastructure—ports, roads, power grids, internet—can create a foundation for ongoing growth rather than boom-and-bust cycles.

Ethiopia’s 7.1% growth is driven by significant investments in hydroelectric power, particularly the Grand Ethiopian Renaissance Dam. This is changing the country’s entire energy picture and making it possible to build more factories. They’re also producing more coffee, expanding mining, and implementing major economic reforms: addressing their debt problems, allowing their currency to trade more freely, establishing a stock exchange, and opening doors to private investors, both domestic and foreign.

Benin projects 6.7% growth through a combination of government reforms, expanding industries (particularly food processing and textile manufacturing), strong agricultural production, and major investments in their ports and trade infrastructure. They’re positioning themselves as a gateway for regional trade.

Niger, also at 6.7%, is pumping more oil and selling more of it internationally. They’re backing this up with increased government spending on agriculture and infrastructure projects that employ people and stimulate economic activity.

Côte d’Ivoire (also known as Ivory Coast) is growing at 6.4% through smart economic management. The government is maintaining stable policies while both public and private sectors invest heavily in transportation and digital networks. People are spending more, the country is adding more value to agricultural products before exporting them (processing cocoa into chocolate, for example), and oil production is rising. They’re also becoming a regional financial hub, and benefiting from high prices for gold and cocoa—their major exports.

Zambia rounds out the top ten with 6.4% growth, primarily from copper mining. The government wants to produce one million tons of copper in 2026. Mining accounts for 70% of what Zambia sells to other countries, but agriculture, information technology, energy, and tourism are also contributing to growth.

Read more on Africa’s largest economy in 2026, per IMF projections here.

Navigating the continent amid challenges

Despite all this growth, Africa faces serious obstacles. The African Development Bank calculates that the continent needs an additional $108 billion every year just to build the infrastructure it needs—roads, power plants, internet cables, ports, and railways. That’s a massive shortfall.

Other problems persist: governments sometimes change policies unpredictably, making planning difficult; there aren’t enough skilled workers in many fields; huge numbers of young people can’t find jobs; and many countries are drowning in debt payments.

For anyone looking to understand or engage with these markets, having the right tools makes a difference. Daba App provides straightforward access to African markets, while Daba Pro offers paid weekly stock recommendations and in-depth analysis that guide investment decisions.

Understanding these complex markets requires continuous education—Daba Academy provides resources for people who want to tap into Africa’s economic potential.

What this means for the world

Africa’s economic story in 2026 is ultimately about potential colliding with reality. The numbers clearly demonstrate momentum.

The question is whether that momentum can be channeled into a transformation that extends beyond temporary commodity price spikes and actually improves lives for Africa’s rapidly growing population—currently about 1.4 billion people and projected to reach 2.5 billion by 2050.

This isn’t just an African story anymore. As these economies grow, they’re becoming more integrated into global supply chains, attracting more investment, and representing larger consumer markets. Companies worldwide are watching. Investors are repositioning. And the next generation of entrepreneurs is emerging.

The concentration of the world’s fastest-growing economies in Africa challenges comfortable assumptions about where opportunity exists. But seizing that opportunity requires clear-eyed realism about the work remaining, patient investment willing to ride out volatility, and commitment to building genuine foundations for prosperity rather than just extracting resources.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.