Africa’s Stock Markets Are Outperforming the World in 2025

1 min Read September 7, 2025 at 3:44 PM UTC

Nine months into 2025, African stock markets are leaving developed peers in the dust.

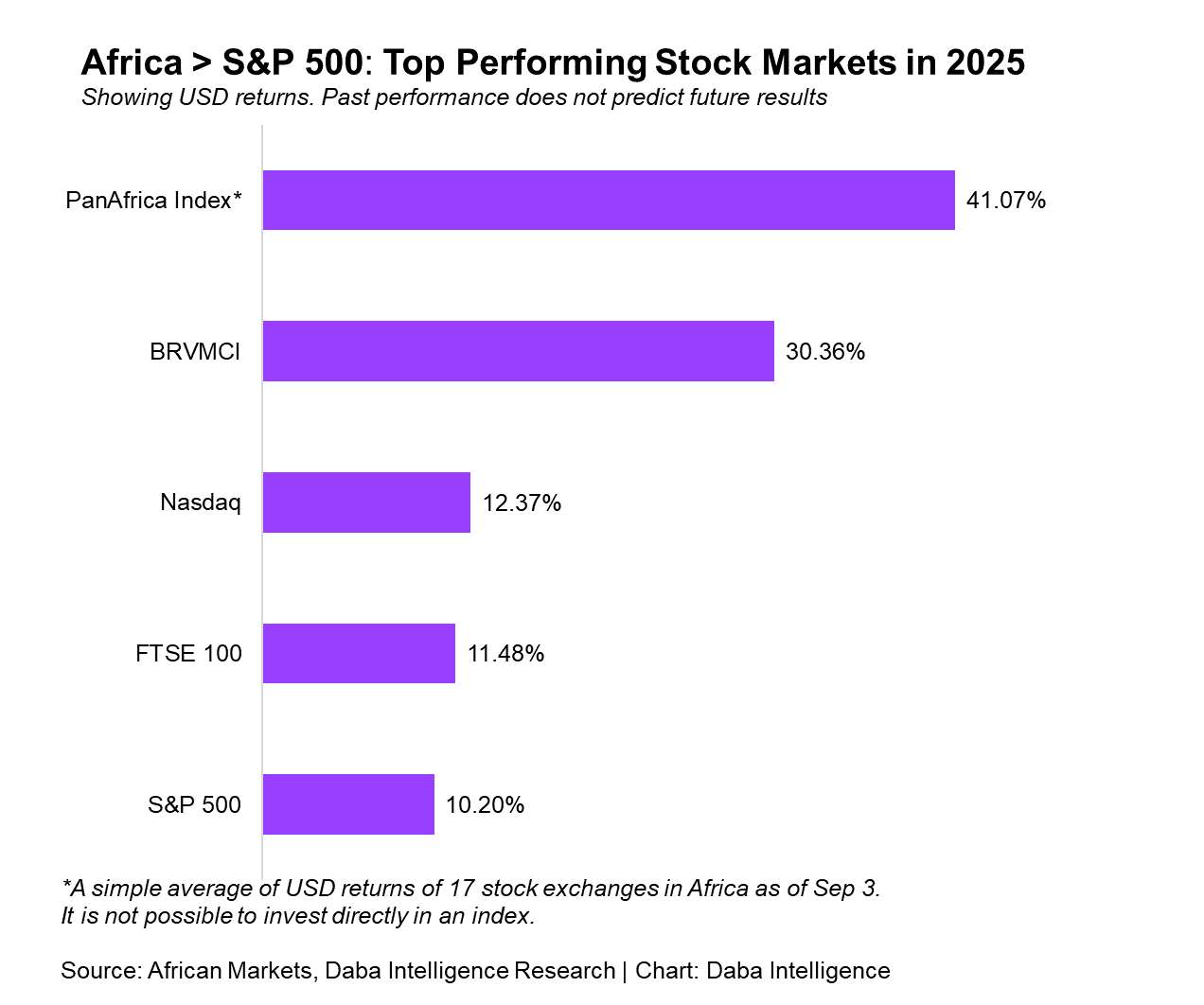

While global benchmarks like the S&P 500 (+10.2%), Nasdaq (+12.4%), and FTSE 100 (+11.5%) are enjoying solid gains, the story across Africa is far more explosive.

The PanAfrica Index—a simple average of USD returns from 17 stock exchanges—has surged more than 41% year-to-date, comfortably beating every major developed-market index.

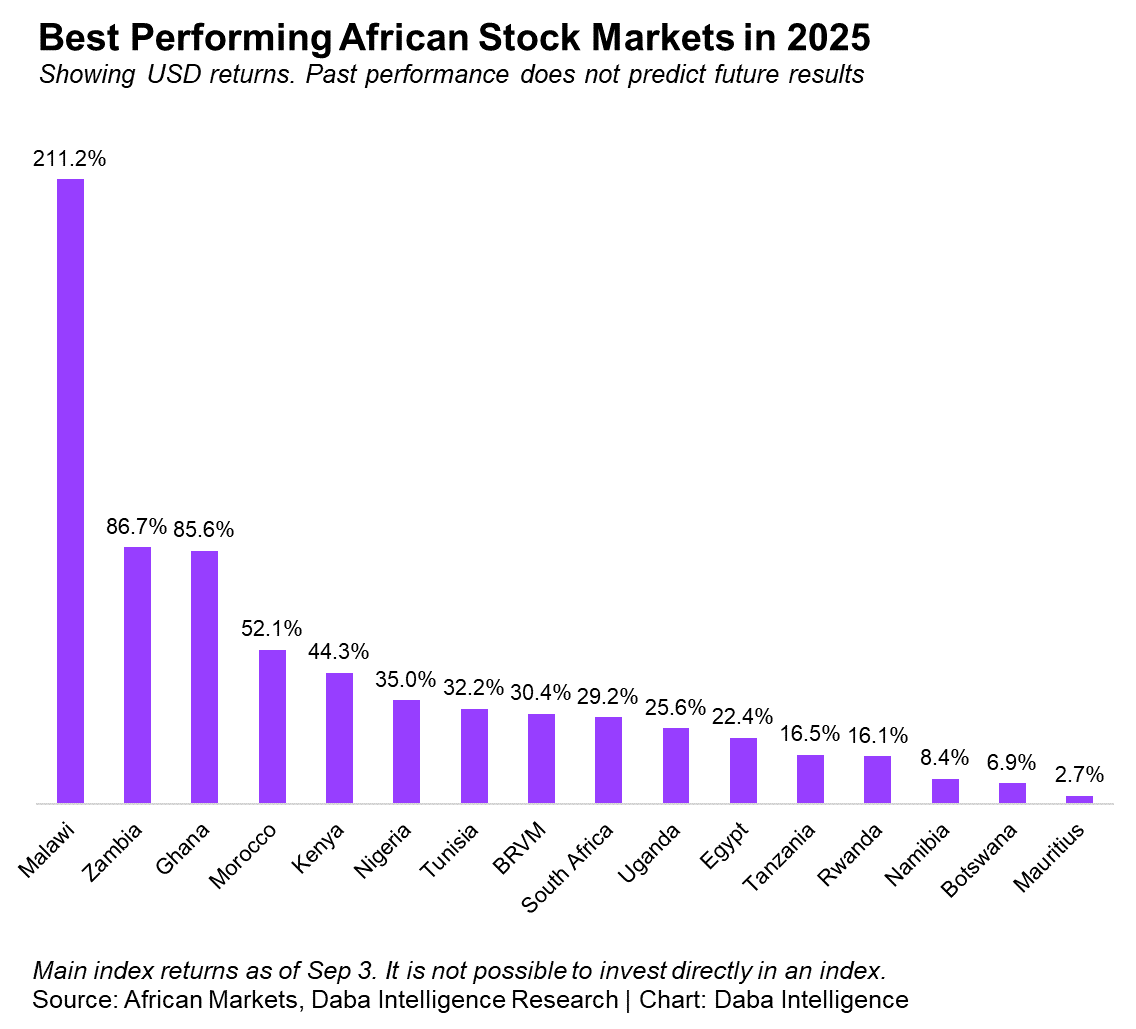

Individual African markets are seeing returns that would make any global investor pause:

- Malawi leads the pack with a stunning +211% in USD terms.

- Zambia (+87%) and Ghana (+86%) follow closely, fueled by strong currency stability and domestic investor activity.

- Morocco (+52%), Kenya (+44%), and Nigeria (+35%) have also posted world-class gains.

- Even the BRVM, West Africa’s regional exchange, has climbed +30%, far ahead of London or New York.

This performance is not an outlier. African markets are benefiting from structural reforms, rising domestic participation, and global demand for resources.

Yet, despite these outsized returns, most global investors remain underexposed.

Traditionally, accessing African markets has been complex—global brokers like Fidelity or Robinhood don’t offer these opportunities.

That’s where Daba comes in. With the Daba app, anyone can seamlessly invest in stocks, bonds, and funds across Africa’s fastest-growing economies.

For deeper insights and strategies, Daba Pro provides premium research, curated stock picks, and market intelligence.

The numbers are clear: Africa is not just catching up—it’s outperforming.

The only question is whether you’re positioned to benefit. With Daba, you finally can.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.