Beyond the Noise: Why Invest in Frontier Markets Amid Global Stocks Rout

3 min Read April 8, 2025 at 11:06 AM UTC

As the world reels from fresh tariff hikes and rising geopolitical tensions, many investors are asking: where can I find stability, growth, and protection from global volatility?

The answer may lie in a place few are looking — frontier markets.

Turmoil in the Global Markets

The recent decision by President Trump to intensify tariffs on China has sent shockwaves through global markets. On April 7, 2025, the S&P 500 fell into a technical correction, down more than 10% from its peak, while the Dow dropped 349 points in one day.

Investors scrambled for clarity, as even a false rumor about paused tariffs temporarily sparked a 900-point rebound, only to be dismissed by the White House moments later.

Meanwhile, the Nasdaq showed slight resilience (+0.1%), and the broader volatility reflected how nervous markets have become.

Asian markets were hit hard: Hong Kong’s Hang Seng plunged 13.2% in a single session, its worst drop since 1997. In Europe, the FTSE 100, DAX, and CAC 40 managed a mild rebound (+1.4–1.5%) following signs of upcoming trade talks, but the uncertainty persists.

More than $5 trillion has been wiped off the value of global stock markets since Trump’s address last Wednesday.

Frontier Markets: The Unexpected Winners

In contrast to the turmoil in developed markets last year, frontier markets quietly posted remarkable returns in 2024.

According to a Morgan Stanley report, the five best-performing stock markets last year were Argentina (+114%), Kenya (+79%), Pakistan (+79%), Sri Lanka (+70%), and Tanzania (+33%) — all in USD terms.

These markets were driven by:

- Economic reforms and low valuations

- Insulation from global trade wars

- Strong domestic demand and demographic growth

While larger emerging markets remain deeply tied to China and global trade, frontier markets like Kenya, Nigeria, and Bangladesh are less exposed.

In fact, trade comprises only about one-third of GDP in many of these countries, compared to nearly half in traditional emerging markets. As a result, they’ve been largely shielded from tariff shocks and currency turmoil.

2025 Performance: Frontier vs. Developed Markets

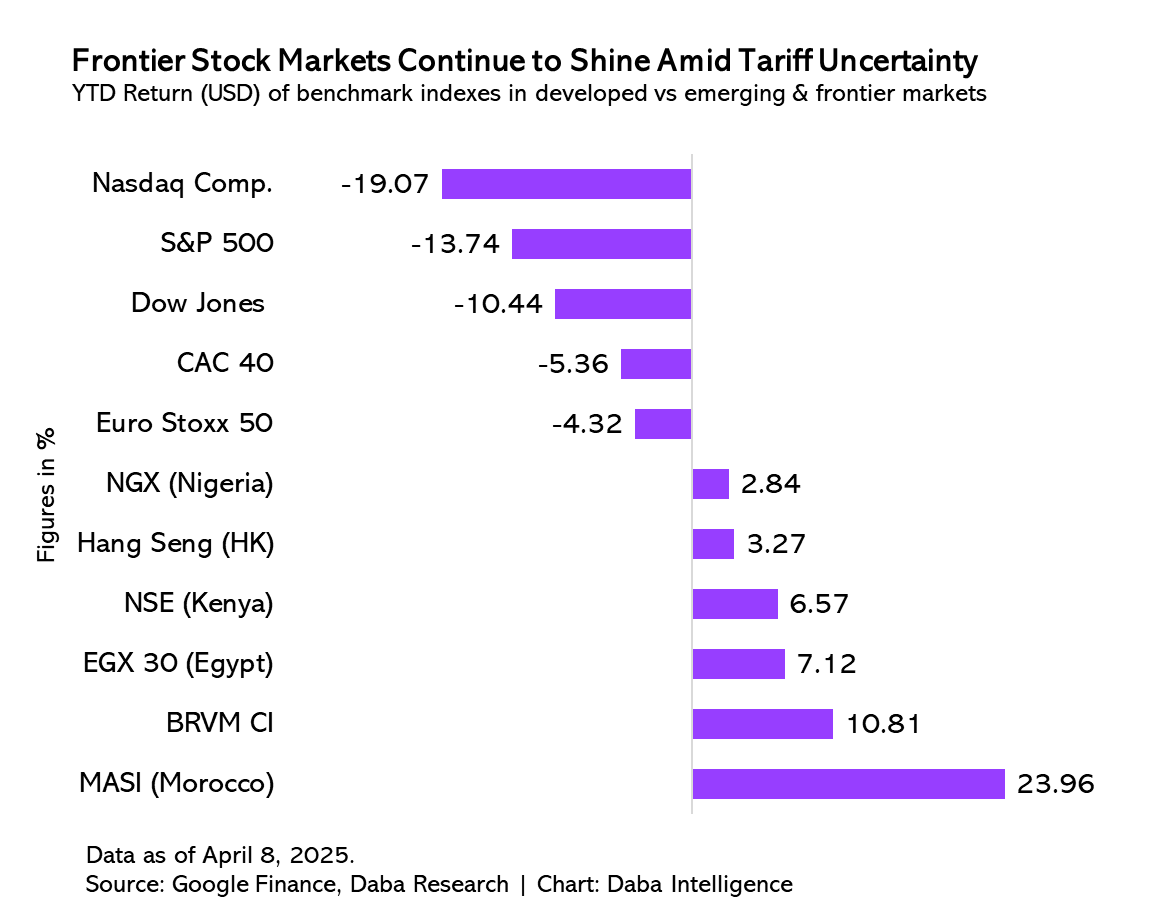

While Western markets falter under the weight of trade wars and tightening monetary policy, African frontier markets are quietly delivering hard-currency returns.

As of Q1 2025, frontier African markets are showing strong resilience amid chaos compared to their global peers. Based on available performance data (USD).

How to Invest in Frontier Markets: Enter Daba

Daba makes investing in Africa’s frontier markets easier than ever. With a simple app and a growing suite of financial products, Daba opens access to opportunities traditionally reserved for institutional investors.

1. Stocks

Buy shares of companies listed on African stock exchanges like the BRVM. These include well-known brands in telecom, banking, and consumer goods. Stocks offer growth and often pay dividends between 6–10%.

2. Bonds

Lend to governments or companies and earn fixed returns. Bonds on Daba’s platform provide stability and income, often with yields above global averages.

3. Collections

Curated bundles of stocks grouped by theme (e.g. infrastructure, green energy, or tech). Collections simplify diversification for beginners and help users invest around trends.

4. Managed Funds

Don’t want to choose? Let experts manage your investments based on your risk profile. This option is ideal for passive investors seeking long-term growth with minimal effort.

All these products are available directly through the Daba app — no paperwork, no middlemen, just smart investing.

Looking Beyond the Noise

Global markets are rattled.

Tariffs, inflation, geopolitical rivalries — all signs point to a new era of volatility. In these uncertain times, frontier markets offer something rare: growth that’s independent of global shocks.

With strong fundamentals, bold reforms, and powerful demographic trends, these markets are quietly outperforming — and investors who move early will reap the rewards.

Get the Daba app today and take control of your financial future. Start investing in Africa’s rise — one stock, bond, or fund at a time.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.