Big Reset: Uranium-Rich Niger Set for Rapid Growth

4 min Read January 14, 2025 at 12:39 PM UTC

Following the withdrawal of French troops and a break from colonial ties, the West African country is forging a new path—one rooted in self-reliance.

Niger is at a turning point.

Following the withdrawal of French troops and a break from colonial ties, the West African country is forging a new path—one rooted in self-reliance.

This shift is not just about politics; it’s about unlocking the francophone nation’s potential as a rising economic force in Africa.

As Niger rebuilds, it’s offering a unique opportunity for investors to play a role in its transformation through the issuance of government bonds.

Breaking from the Past

In 2023, Niger took a bold step by asking French troops to leave, effectively ending more than a decade of military cooperation. The move came after a military coup in July, echoing similar shifts in Burkina Faso and Mali, where anti-French sentiment has grown in recent years.

For decades, Niger had been a key ally of France and the U.S., hosting large military bases that played a central role in fighting insurgent groups linked to ISIS and al-Qaeda.

But this break marks a new era. Niger is seeking to redefine its relationships and shed its reliance on Western powers. It’s pivoting toward building new alliances and focusing on its own resources and strategies to fuel growth and stability.

While the coup and its aftermath made global headlines, there’s much more to Niger than its political upheavals.

A Wealth of Resources and Untapped Potential

Niger is rich in natural resources, most notably uranium.

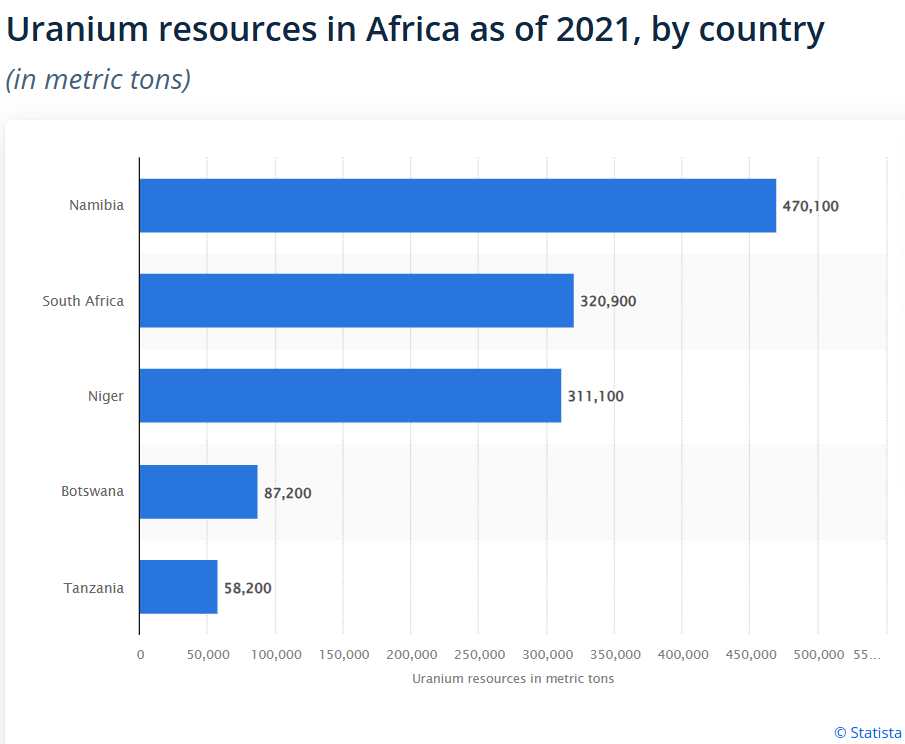

It is the world’s seventh-biggest producer of uranium, according to the World Nuclear Association (WNA). With an estimated 311,000 tons of reserves, it also ranks among the top producers of this critical material used in nuclear energy.

More so, Niger has Africa’s highest-grade uranium ores and produced 2,020 metric tons of uranium in 2022, about 5% of world mining output.

The radioactive metal is the most widely used fuel for nuclear energy. It is also used in treating cancer, for naval propulsion, and in nuclear weapons.

Today, uranium ore makes up 75% of Niger’s foreign exports. But that’s not all. The country also boasts deposits of gold, coal, and oil—resources that position it as a potential powerhouse in the global market.

Despite its wealth, Niger has long been one of the world’s poorest nations. Its economy depends heavily on agriculture, which employs more than 80% of its population.

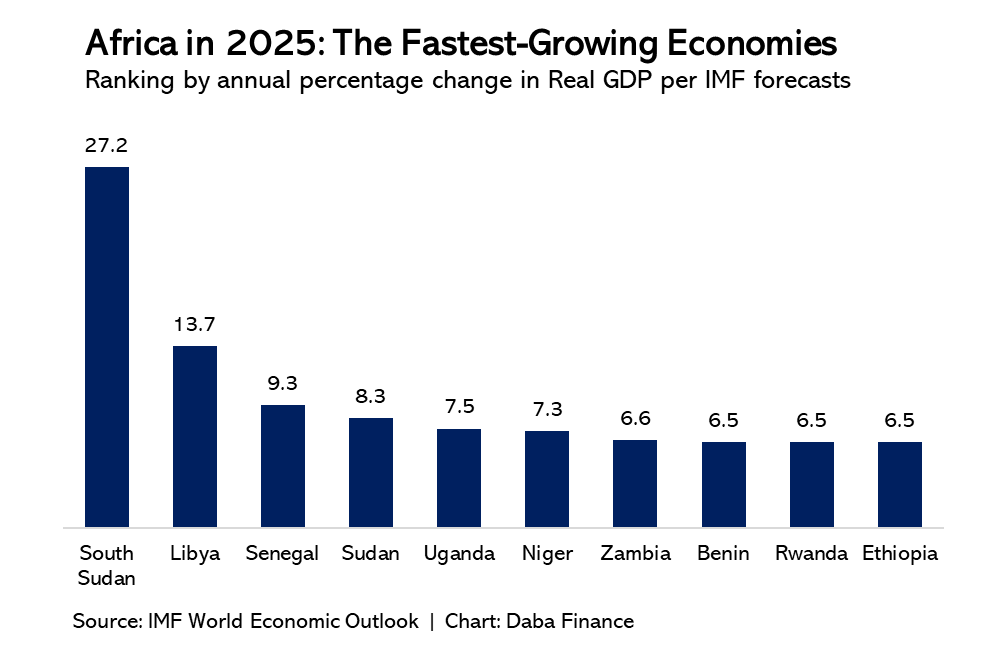

However, with a projected GDP growth rate of 7.3% in 2025, Niger is showing signs of resilience and determination to climb higher. The country’s role as a key player in West Africa’s food security and its strategic location make it critical to regional stability and development.

For those unfamiliar with the region, it’s worth noting that Niger is often confused with its much larger neighbor, Nigeria. But these two nations are vastly different—not just in size but in their economic trajectories. While Nigeria is Africa’s largest economy, Niger represents an untapped opportunity, rich in resources and ready to grow.

Investing in Niger’s Future

As part of its effort to rebuild and attract capital, Niger has introduced two government bonds—TPNE 6.60% 2025–2030 and TPNE 6.90% 2025–2032. These bonds offer attractive returns and provide investors a chance to support Niger’s economic recovery.

The TPNE 6.60% bond, with a five-year term, offers a yield to maturity of 33%. Investors earn annual interest of 6.6%, making it an appealing option for those seeking stability and predictable returns.

For instance, investing 1,000,000 CFA francs in this bond would grow to approximately 1,330,000 CFA francs by the end of the term.

Meanwhile, the TPNE 6.90% bond has a longer duration of nearly seven years and offers an even higher yield to maturity of 48.3%.

With annual interest payments of 6.9%, the same 1,000,000 CFA franc investment would yield around 1,483,000 CFA francs by maturity.

Both bonds provide investors with solid returns while contributing to Niger’s broader economic goals.

These funds are critical for Niger’s development. They will help finance infrastructure projects, improve public services, and fuel economic growth. By investing in these bonds, individuals and institutions are not just earning a return—they’re helping build roads, schools, and hospitals in a country that’s striving for a brighter future.

Rebuilding with Purpose

Niger’s path forward is about more than numbers; it’s about independence and resilience.

The country is working to reduce its reliance on external powers and take control of its economic future. The bond offerings represent a key part of this strategy, showing Niger’s commitment to rebuilding itself while inviting others to participate in its success story.

This isn’t just a financial opportunity—it’s a chance to be part of Niger’s transformation. As the country turns the page on its colonial past and embraces a future of self-reliance, its people and economy are ready to rise.

To learn more about these bond opportunities and Niger’s journey, click here to explore details on the Daba app.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.