BIIC IPO: Why You Should Invest in Promising Opportunity from Benin

4 min Read January 12, 2025 at 7:33 PM UTC

The upcoming IPO of BIIC on the BRVM is an opportunity for emerging market investors to tap into Benin’s dynamic and reform-driven economy.

Rarely do we see investment opportunities emerge from often-overlooked markets, but when they do, the returns can be transformative.

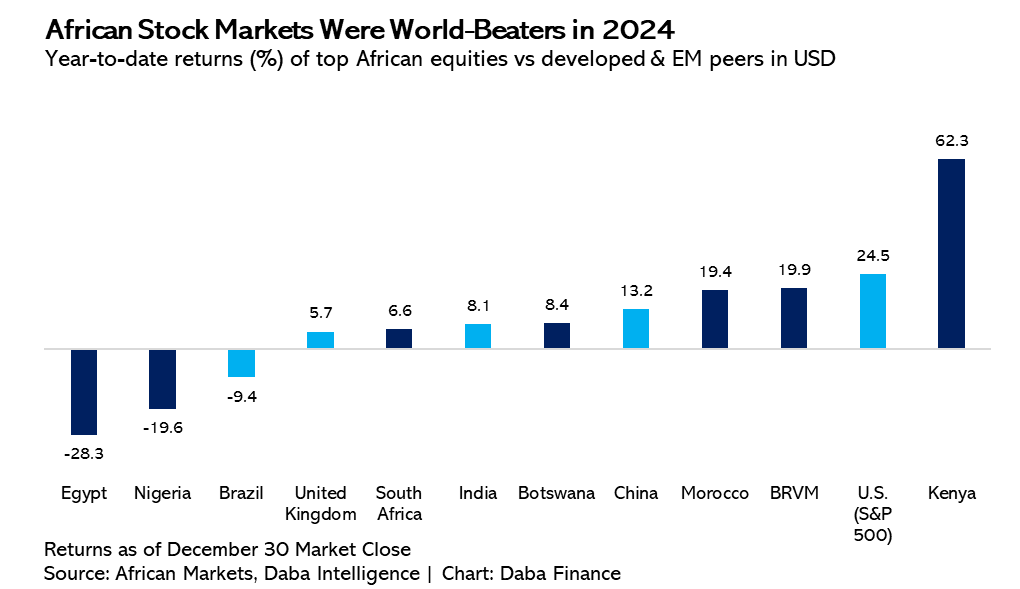

Africa’s emerging and frontier equity markets were silent outperformers in 2024, with key indices like the BRVM delivering impressive returns in USD terms.

Against this backdrop, the upcoming IPO of Banque Internationale pour l’Industrie et le Commerce (BIIC) on the BRVM presents a unique investment opportunity for emerging markets (EM) investors to tap into Benin’s dynamic and reform-driven economy.

The Rise of BIIC and Lessons from Orange Côte d’Ivoire

The story of Orange Côte d’Ivoire (ORAC), which went public on the BRVM in December 2022, serves as a benchmark for the potential of IPOs in the region.

Orange Côte d’Ivoire’s stock surged from its IPO price of 9,500 CFA to 17,005 CFA currently, delivering a staggering gain of over 79%. Add to this its consistent dividend payouts of 7-8%, and it becomes evident why the BRVM is becoming a hotspot for value-seeking investors.

BIIC’s IPO, scheduled to open this month, has all the markers of similar success. Established in 2020 through the merger of Banque Internationale du Bénin and Banque Africaine pour l’Industrie et le Commerce, BIIC has rapidly cemented its position as the leader in Benin’s banking sector.

With total assets surging by 125% in just three years to reach 1,411 billion CFA and net income growing at an average rate of 117% annually, BIIC is a formidable player ready to make its mark on the public market.

Benin’s Economic Transformation: A Strong Backdrop

Benin, once known primarily for its cotton exports, is undergoing an economic renaissance. Reforms spearheaded by President Patrice Talon have turned the nation into Africa’s leading cotton producer while driving diversification into industrial manufacturing, technology, and financial services.

The Glo-Djigbé Industrial Zone (GDIZ) exemplifies this shift, aiming to transform raw cotton into textiles and garments, with exports expected to add $5 billion to $10 billion to the economy by 2030.

Benin’s macroeconomic stability further strengthens the investment case.

The country enjoys a stable currency, the CFA franc, pegged to the euro. Its membership in the West African Economic and Monetary Union (WAEMU) and preferential trade access to the EU bolster its external trade environment.

Despite challenges like high poverty and dependence on Nigeria, Benin’s 6.3% GDP growth in 2022 and a similar outlook for 2024-2026 provide a robust foundation for long-term investment.

Also Read: Benin Republic – Small Country, Big Dreams

The BIIC Opportunity: Why It Stands Out

BIIC’s IPO is priced at 5,250 CFA per share, with the government selling up to 40% of its stake to raise 121 billion CFA ($192.3 million). This offering represents a strategic move to diversify state holdings while fostering private sector participation in the financial ecosystem.

The bank’s financials are compelling. BIIC holds a 22% share of Benin’s banking assets, 23% of loans, and 21% of deposits. Its profitability metrics are equally impressive, with net income rising from 5.7 billion CFA in 2021 to 27.2 billion CFA in 2023. Such dominance reflects a well-managed institution with strong growth potential.

Moreover, BIIC is not resting on its laurels. With plans to integrate Société Générale’s Benin operations, BIIC’s assets could expand by an additional 300 billion CFA, further solidifying its position in the banking sector.

The bank’s focus on digitalization and innovative products like mobile money aligns with the broader financial inclusion trends and technological adoption in Benin.

A Rare Investment Opportunity

BIIC’s IPO represents a chance to participate in Benin’s economic transformation through a market leader in the banking sector. The offering is more than a financial transaction; it’s an entry point into a rapidly modernizing economy with strong governance and significant growth prospects.

For those interested in learning more, BIIC’s IPO is available on the Daba app, Africa’s premier platform for investment opportunities. Please note that this is not a solicitation to invest.

If you want to explore further details about this offering, visit the Daba app and discover why BIIC might be the investment that positions your portfolio for Africa’s next growth frontier.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.