BRVM in 2025: Stocks End Year With Solid Gains

2 min Read January 2, 2026 at 12:11 PM UTC

The Regional Stock Exchange (BRVM) closed 2025 with one of its strongest performances in recent history.

The BRVM Composite Index rose by 25.26% (42% in USD terms), extending the multi-year rally that has quietly positioned francophone West Africa as one of Africa’s most compelling equity markets.

But beyond the headline number, 2025 was a year of sharp contrasts, selective opportunities, and clear lessons for investors.

Big Winners, Big Gaps

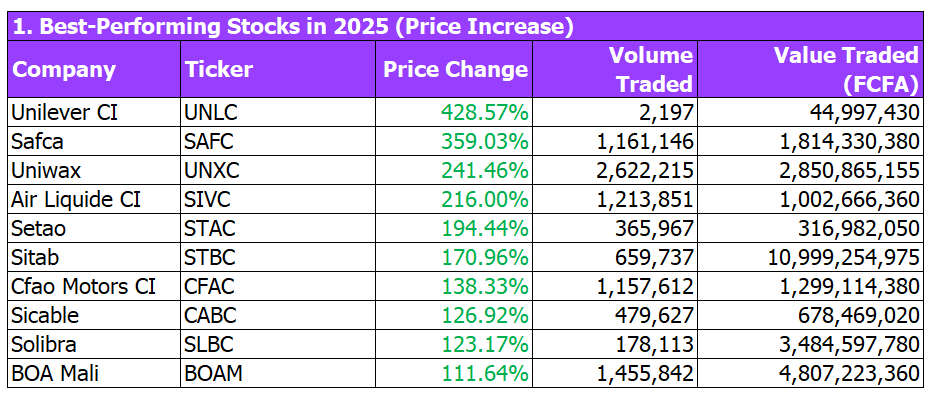

Stock performance in 2025 was far from uniform. Several consumer and industrial names delivered triple-digit gains, rewarding patient investors who focused on fundamentals rather than short-term noise.

Companies like Unilever CI, Safca, Uniwax, Air Liquide CI, and Setao stood out with spectacular price appreciation, underscoring the power of long-term positioning in quality businesses.

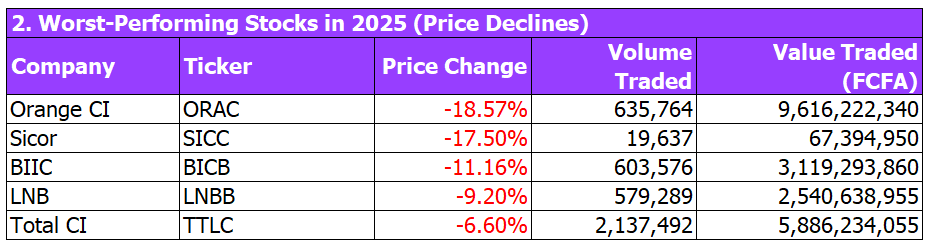

At the same time, a handful of large names finished the year in the red, reminding investors that a rising market does not lift all boats equally. Selectivity mattered more than ever.

Sector Performance: Consumption Led the Way

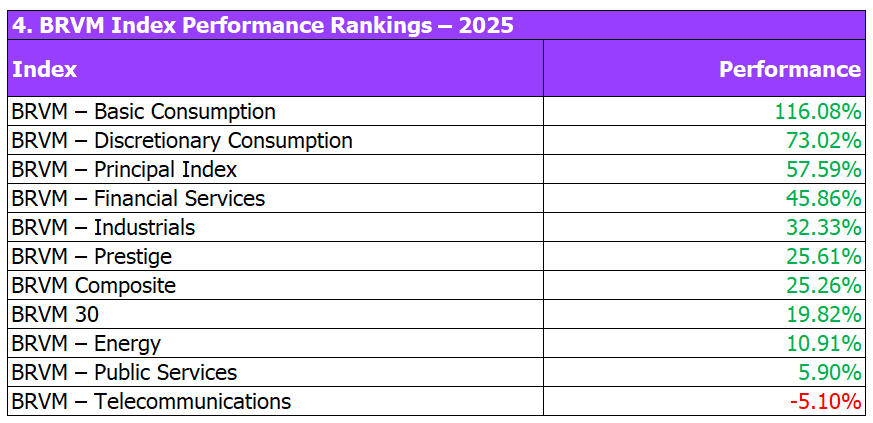

Sector indices told a similar story. Basic Consumption and Discretionary Consumption were the clear outperformers in 2025, reflecting resilient domestic demand across the region.

Financial services and industrials also posted solid gains, while the Telecommunications sector lagged, ending the year slightly negative.

This dispersion reinforced a key truth of the BRVM: returns are driven by sectors and stocks, not just the index.

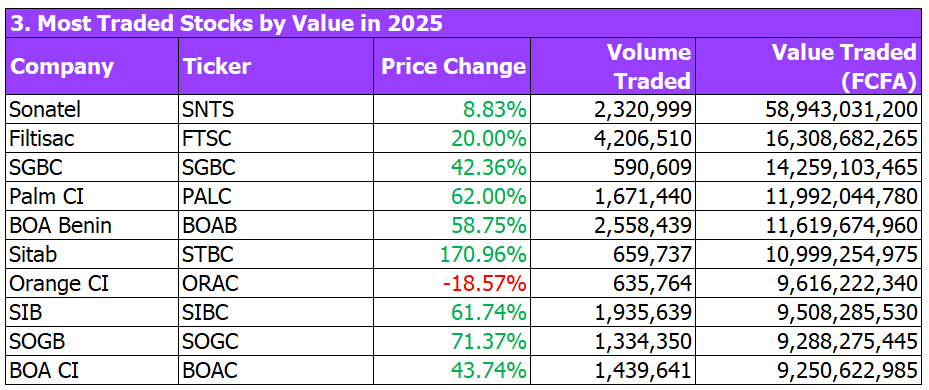

Liquidity and Dividends: Still Uneven

Trading activity remained concentrated in a small group of large-cap stocks, including Sonatel, Palm CI, BOA subsidiaries, and Orange CI. While liquidity improved overall, many smaller stocks remained thinly traded.

On dividends, several listed companies did not distribute payouts in 2025, highlighting the importance of understanding income reliability—not just price performance—when building a portfolio.

What This Means for Investors in 2026

The takeaway from 2025 is clear: the BRVM rewards structured investors.

Those who relied on research, discipline, and long-term conviction significantly outperformed those who simply followed market momentum.

If you want to invest directly in BRVM stocks and African assets, you can do so through the Daba app.

For deeper insights, stock picks, and weekly recommendations, Daba Pro helps investors stay ahead of the market.

And for those looking to build strong investing foundations, Daba Academy offers practical, beginner-friendly financial education.

As 2026 begins, the real question is not whether the market will rise—but whether you are investing with a clearer strategy than last year.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.