How ETIT Stock Doubled in Less Than Two Years

4 min Read February 14, 2026 at 5:17 PM UTC

In the world of investing, finding a stock that doubles your money is like striking gold.

For investors who followed Daba Pro‘s recommendations, that golden opportunity came in the form of Togo-based Ecobank Transnational Inc (ETIT).

This stock, listed on regional stock exchange BRVM, has delivered exceptional returns and validated the power of patient, fundamentals-based investing.

The Growth Journey

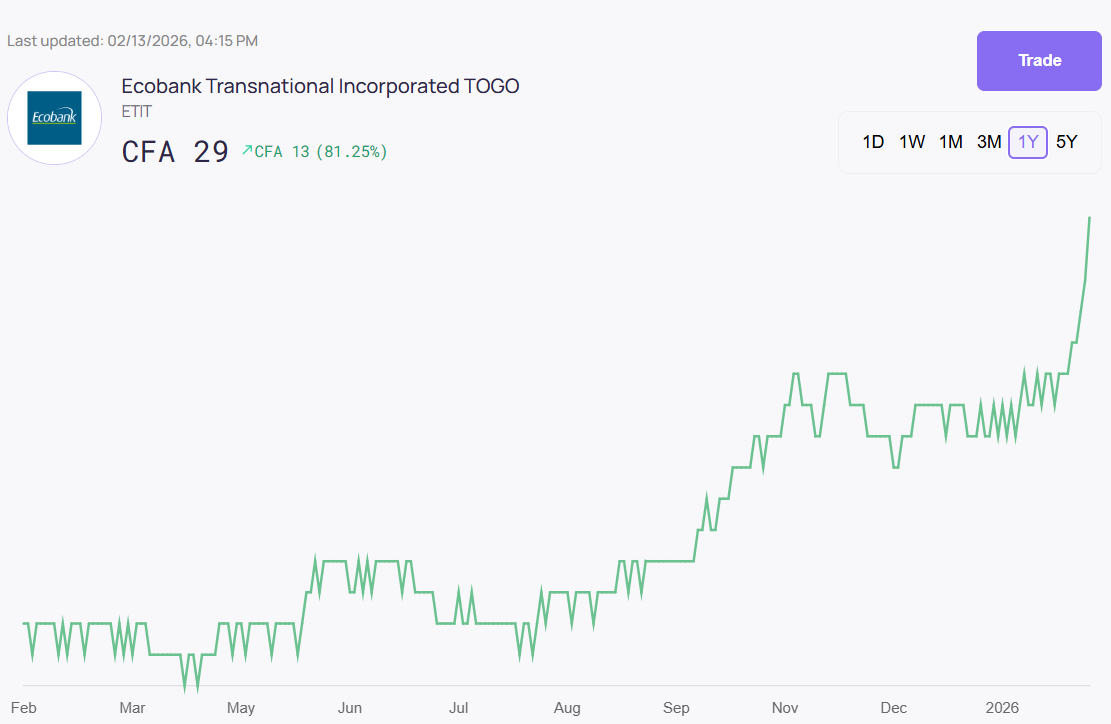

ETIT is currently trading at 29 XOF after closing at that price on February 13, 2026, representing a gain of 26.1% or 27.7% in USD year-to-date.

However, the real story becomes even more impressive when viewed over a longer timeframe.

Just two years ago, savvy investors could have purchased ETIT shares for around 14-15 XOF.

Fast forward to today, and the stock now trades at 29 XOF – nearly doubling investors’ money in less than 24 months.

That’s a return that outpaces most savings accounts, bonds, and many other investment options available to investors.

Let’s break down the gains across different periods:

- Year-to-date (2026): +26.1%

- Past year: +81.3%

- Past 6 months: +70.6%

- Past 3 months: +26.1%

- Past month: +26.1%

- Past week: +20.8%

These aren’t just good numbers – they’re exceptional. The stock began 2026 at 23 XOF and has since climbed to 29 XOF, showing consistent upward momentum.

Daba Pro Called It Early

What makes this success story even sweeter is that ETIT has been featured on Daba Pro’s buy stock recommendations list since 2025, with a target price of 28 XOF.

The stock has now surpassed that target, validating the research and analysis that went into our recommendation.

For those unfamiliar, Daba Pro provides professional-grade stock analysis and investment recommendations for the African market, helping investors identify opportunities before they become obvious to everyone else.

ETIT is a perfect example of how following solid research can pay off handsomely.

Strong Fundamentals Behind the Rally

This isn’t a speculative bubble – ETIT’s price appreciation is backed by genuine business performance. Let’s look at the numbers:

Revenue Growth: In the trailing twelve months, Ecobank Transnational had revenue of $1.96 billion with 11.35% year-over-year growth. The company has shown consistent revenue expansion, growing from $1.45 billion in 2020 to $1.78 billion in 2024.

Profitability: The company earned $411.34 million in net income for the trailing twelve months, demonstrating strong profitability. Net income has grown impressively from just $4.2 million in 2020 to $333.18 million in 2024.

Balance Sheet Strength: Total assets reached $32.4 billion in the trailing twelve months, showing the company’s substantial size and capacity. The bank maintains $4.3 billion in cash and equivalents against $1.9 billion in total debt, indicating a healthy financial position.

Valuation Metrics: Despite the strong rally, ETIT still trades at attractive valuations with a PE ratio of just 1.80 and a price-to-sales ratio of 0.39 – suggesting there may still be room for further appreciation.

Returns: The company has a current return on equity (ROE) of 29.39%, which is excellent by any standard and demonstrates efficient use of shareholder capital.

Market Position and Trading Activity

Ecobank Transnational is the most actively traded stock on the BRVM Stock Exchange over the past three months, with millions of shares changing hands regularly.

This liquidity makes it easy for investors to enter and exit positions.

With a market capitalization of 524 billion XOF (about $950 million), ETIT ranks as the seventh most valuable stock on the BRVM, commanding approximately 3.51% of the entire exchange’s equity market.

The Bottom Line

ETIT’s journey from 14-15 XOF to 29 XOF represents more than just a successful investment – it’s a testament to the opportunities available in West African markets for those willing to do their homework.

The combination of strong fundamentals, consistent growth, and reasonable valuations created a perfect recipe for outsized returns.

Whether you’re a seasoned investor or just starting out, stories like ETIT’s highlight why education and research matter.

Want to learn more about investing in West African stocks? Check out Daba Academy for courses and resources, download the Daba App to start tracking stocks, or subscribe to Daba Pro for professional investment recommendations.

Remember: past performance doesn’t guarantee future results, but understanding what drives stock prices – solid businesses, growing revenues, and strong profitability – never goes out of style.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.