June Markets Pulse | BRVM Winners Drive Market Rally

7 min Read July 1, 2025 at 2:04 PM UTC

West African stocks outpace regional index as Unilever leads surge, supporting broader market momentum across the eight-nation exchange

The Bourse Régionale des Valeurs Mobilières (BRVM) added $3.5 billion to its market capitalization over six months, reaching a record 12,070 billion CFA francs ($21.2 billion) as of June 24. The regional stock exchange serving eight West African Economic and Monetary Union (WAEMU) countries delivered strong performance across multiple sectors, with consumer goods companies and financial institutions leading the charge.

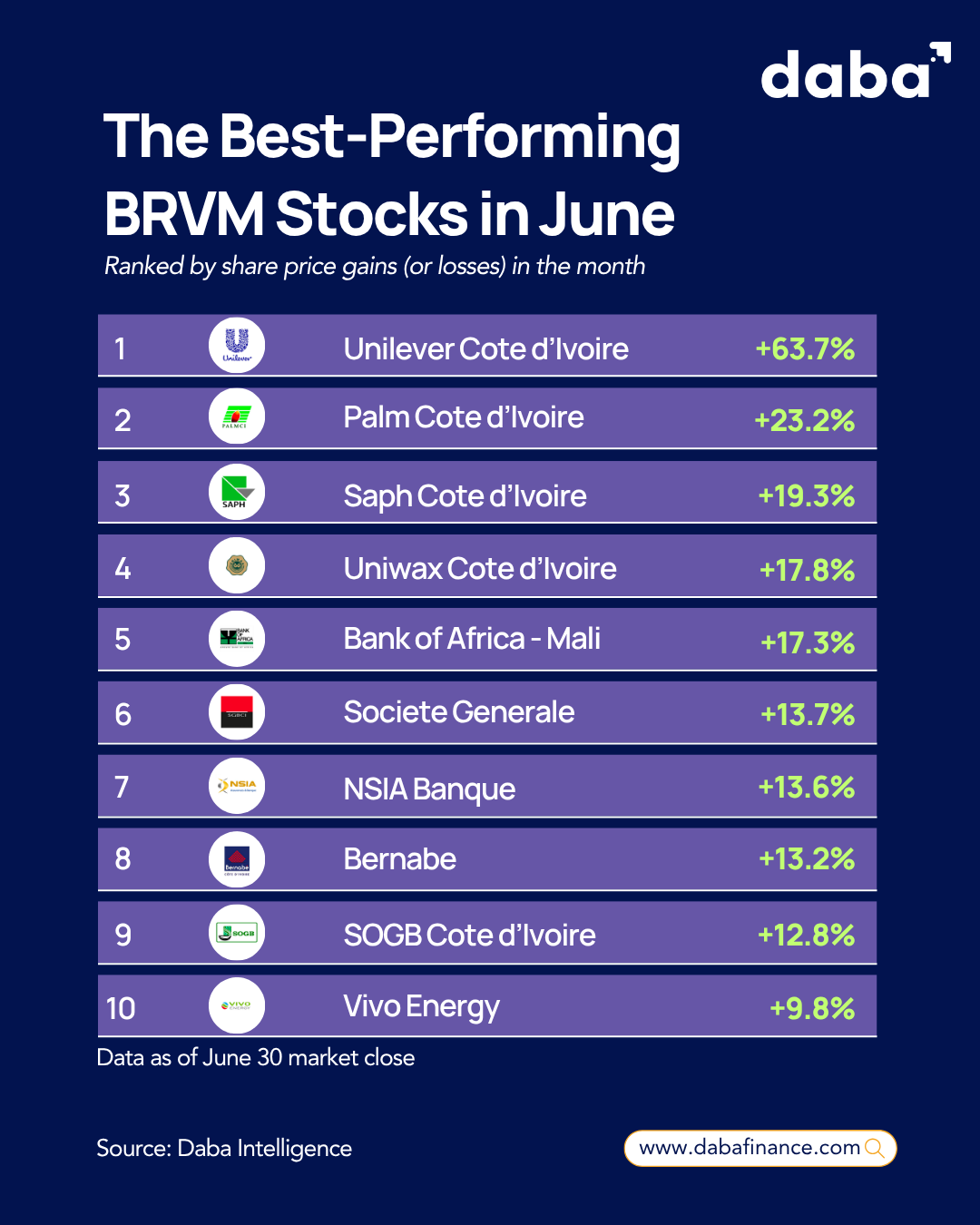

The BRVM Composite Index gained 3.07% during June, marking the continuation of a broader rally that has seen the exchange climb 13.03% since the start of 2024.

Ten companies delivered double-digit returns during the month, with gains ranging from 63.7% at the top to 9.8% for the tenth-best performer. The performance reflects growing investor confidence in the region’s economic prospects and the increasing attractiveness of West African equities to both domestic and international investors.

Unilever Côte d’Ivoire Commands the Field

Unilever Côte d’Ivoire (UNLC) topped the performance rankings with a 63.7% gain in June, closing at 18,440 CFA francs per share. The consumer goods giant, which operates as the local subsidiary of the global Unilever Group, manufactures and distributes household products, personal care items, and food products across the Ivorian market.

The company’s stock price trajectory during June showed a gradual build-up through the first three weeks of the month, trading in a range between 10,000 and 13,000 CFA francs. The breakthrough came in the final week of June, when shares surged from approximately 13,000 CFA francs to peak at 17,500 CFA francs before settling at the month-end close. This performance significantly outpaced the broader market, generating returns more than 20 times the benchmark index gain.

The consumer staples sector has benefited from stable demand patterns and the region’s growing middle class, positioning companies like Unilever to capture increased purchasing power across urban centers in Côte d’Ivoire.

Palm Oil Producer Delivers Strong Returns

Palmindustrie Côte d’Ivoire (PALC) secured second place with a 23.2% gain, reaching 8,380 CFA francs per share. The company operates in the agricultural sector, focusing on palm oil production and processing in Côte d’Ivoire, one of the world’s major palm oil producing regions.

PALC shares demonstrated steady upward momentum throughout June, starting the month around 6,800 CFA francs and climbing consistently to breach the 8,000 CFA franc level by mid-month. The stock maintained this elevated trading range through the final weeks, with some volatility but overall positive direction. The performance represents nearly eight times the benchmark return, reflecting strong fundamentals in the palm oil sector.

Palm oil prices have remained supported by global demand for edible oils and biofuel applications, while Côte d’Ivoire’s position as a major producer provides companies like PALC with competitive advantages in both domestic and export markets.

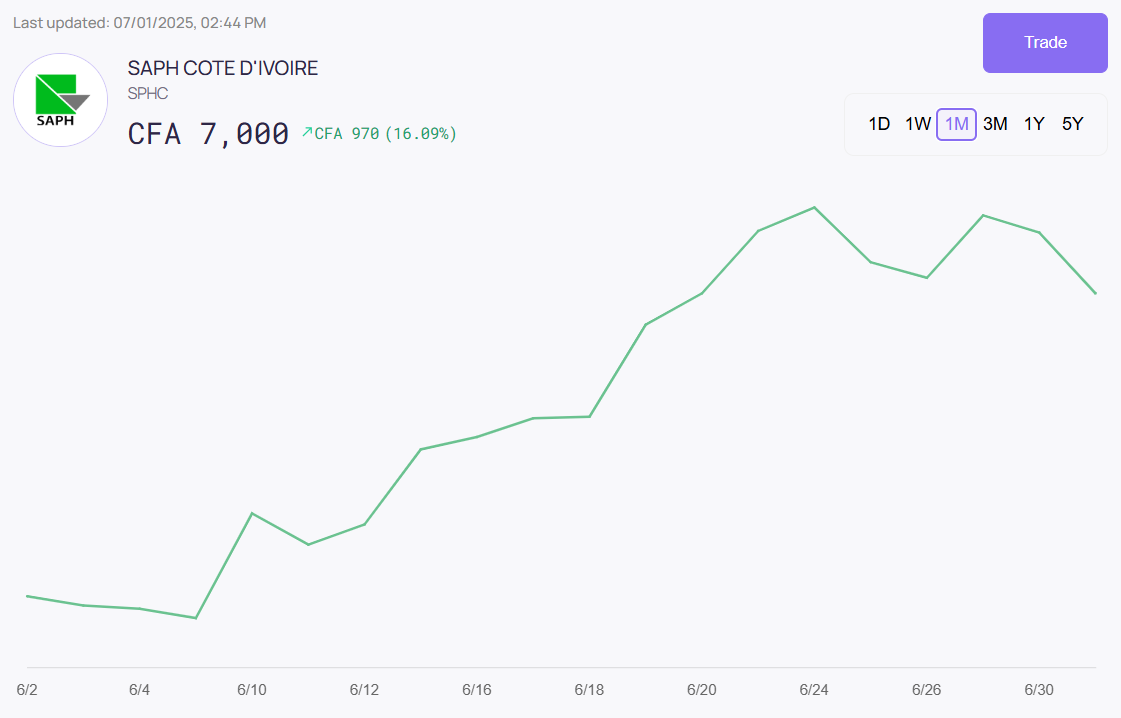

Rubber Processing Company Shows Resilience

Société Africaine de Plantations d’Hévéas (SAPH) claimed third position with 19.3% growth, closing at 7,195 CFA francs. SAPH operates rubber plantations and processing facilities, serving both local and international markets for natural rubber products.

The company’s share price movement during June reflected the volatile nature of commodity markets, with early-month weakness followed by strong recovery.

Starting around 6,000 CFA francs, shares declined to approximately 5,900 CFA francs in the first week before beginning a steady climb that accelerated through the middle of the month. The stock reached peaks near 7,400 CFA francs before settling at the month-end close, delivering returns more than six times the index performance.

Natural rubber demand has been supported by global automotive production recovery and infrastructure development projects across emerging markets, providing a favorable backdrop for plantation companies operating in West Africa.

Manufacturing Conglomerate Gains Ground

Uniwax Côte d’Ivoire (UNXC) finished fourth with 17.8% gains, reaching 595 CFA francs per share. The company operates in textile manufacturing and distribution, producing traditional African wax prints and other fabric products for regional and international markets.

UNXC shares displayed a pattern of consolidation followed by breakout during June. The stock began the month around 510 CFA francs and traded sideways through the first two weeks with modest fluctuations. A significant move higher began in mid-June, pushing shares above 580 CFA francs where they remained for the balance of the month. This performance delivered nearly six times the benchmark return, highlighting the strength in consumer discretionary sectors.

The textile industry in West Africa has benefited from both domestic demand growth and increasing recognition of African fashion and traditional designs in global markets, creating opportunities for established players like Uniwax.

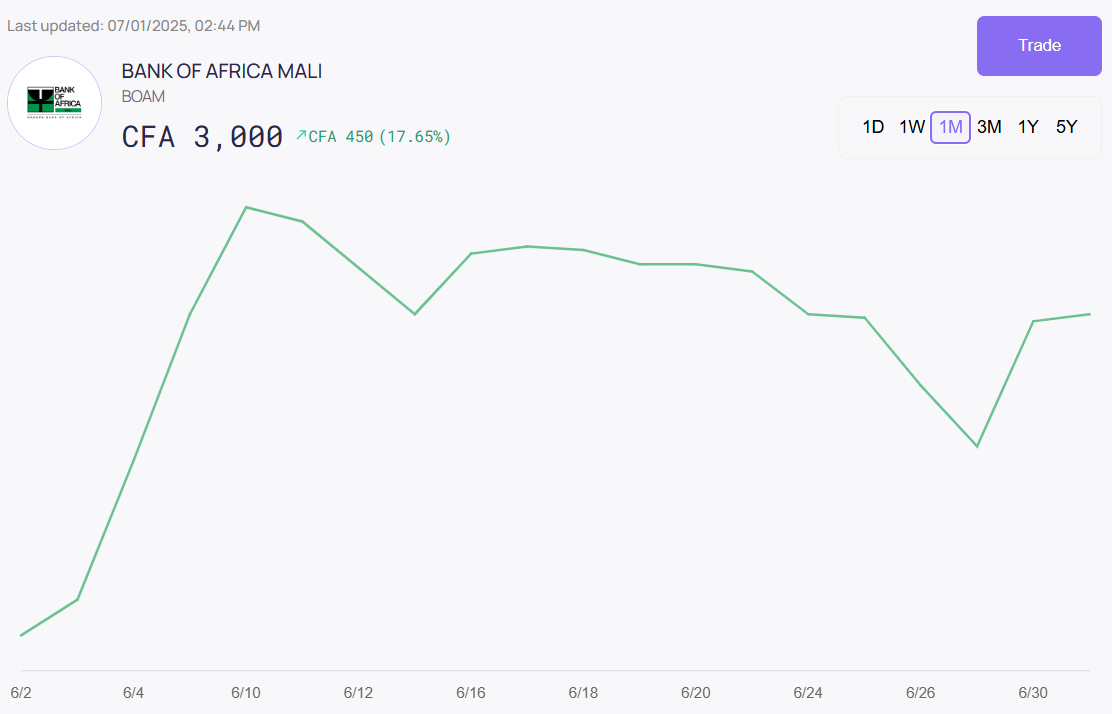

Bank of Africa Mali Leads Financial Sector

Bank of Africa Mali (BOAM) rounded out the top five with 17.3% gains, closing at 2,990 CFA francs. The financial institution provides commercial banking services, including corporate banking, retail banking, and trade finance across Mali and the broader WAEMU region.

BOAM shares experienced significant volatility during June, starting the month around 2,550 CFA francs before surging to peaks above 3,100 CFA francs in the second week. The stock then entered a consolidation phase, trading between 2,800 and 3,100 CFA francs for most of the month before closing near the lower end of this range. Despite the intra-month fluctuations, the overall performance exceeded the benchmark by more than five times.

The banking sector across WAEMU has benefited from economic growth, increased financial inclusion initiatives, and supportive monetary policy from the Central Bank of West African States (BCEAO). Regional banks with strong franchises have been particular beneficiaries of these trends.

Solid Performance Across Remaining Top Ten

The remaining top ten performers all delivered double-digit returns, demonstrating the breadth of the June rally across sectors. Société Générale Côte d’Ivoire gained 13.7%, reflecting strength in the financial services sector alongside Bank of Africa Mali. NSIA Banque added 13.6%, while Bernabé rose 13.2%, both contributing to the strong showing of financial institutions during the month.

SOGB Côte d’Ivoire, another consumer goods company, gained 12.8%, indicating that the consumer sector strength extended beyond Unilever’s exceptional performance. Vivo Energy completed the top ten with 9.8% gains, representing the energy distribution sector.

These companies all significantly outperformed the 3.07% benchmark return, with gains ranging from more than three to more than four times the index performance. The diverse sector representation among top performers suggests broad-based investor confidence rather than narrow sector rotation, supporting the sustainability of the current market momentum.

The strong performance across multiple sectors and companies reflects the improving macroeconomic environment in the WAEMU region, supported by political stability, economic reforms, and accommodative monetary policy. The BRVM’s position as the fifth-largest exchange in Africa continues to attract both regional and international investor interest, contributing to the sustained capital inflows that have driven market capitalization to record levels.

Investors looking to tap into West Africa’s dynamic growth can access real-time data, in-depth research, and powerful portfolio tools through the Daba app. From live pricing to strategic market insights, Daba makes it easier than ever to invest confidently across the region.

The Daba Academy provides step-by-step learning for both beginners and experienced investors, helping them understand regional market dynamics and build strong investment foundations.

Daba Pro gives all investors access to premium research, weekly stock recommendations, and advanced market insights. The upcoming Daba 2025 BRVM Dividends Calendar will help users track income opportunities across the exchange throughout the year.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.