The Best-Performing BRVM Stocks in 2025

4 min Read January 2, 2026 at 11:14 AM UTC

The BRVM delivered one of its strongest years on record in 2025, with several stocks posting triple-digit gains and rewarding patient investors.

The benchmark BRVM Composite Index rose by 25.26%, extending the multi-year rally that has quietly positioned Francophone West Africa as one of Africa’s most compelling equity markets.

Beneath the strong headline index performance, a handful of stocks delivered exceptional, sometimes explosive, returns.

Performance was driven by a mix of earnings recovery, sector rotation, and renewed domestic investor participation.

Below is a breakdown of the ten standout performers that defined the year.

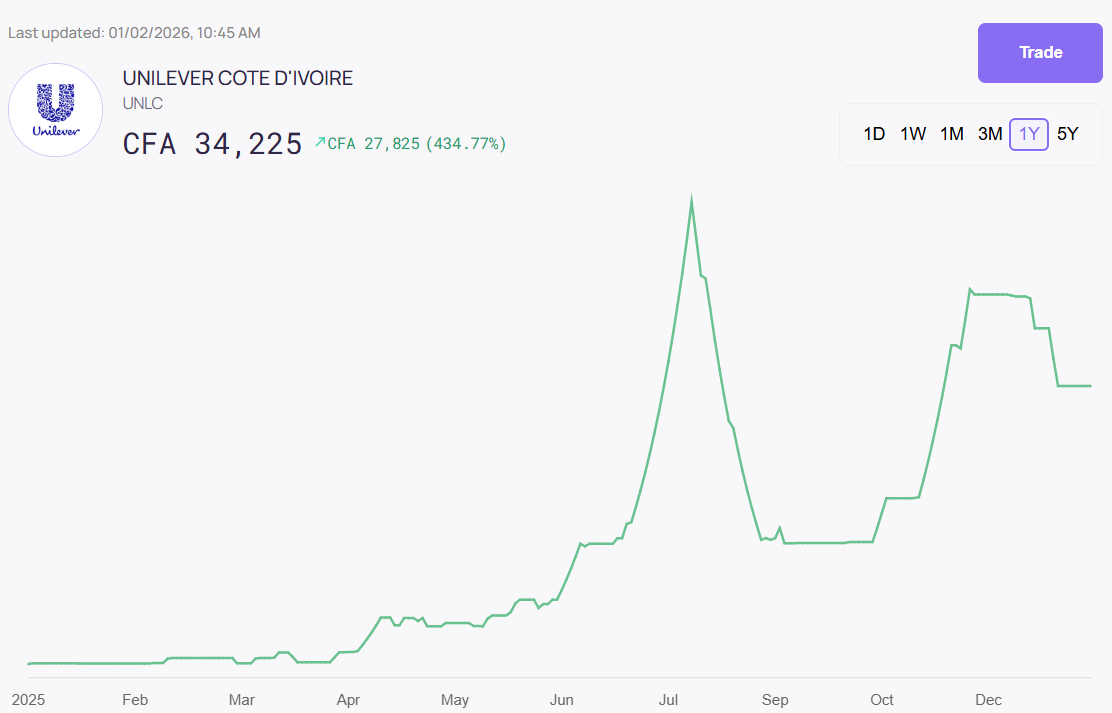

1. Unilever Côte d’Ivoire (UNLC) — +429%

Unilever was the undisputed star of 2025. Momentum began early in the year, accelerated sharply in the second quarter, and peaked around mid-year following strong earnings visibility. A sharp pullback in the final weeks reflected profit-taking, not a reversal of fundamentals.

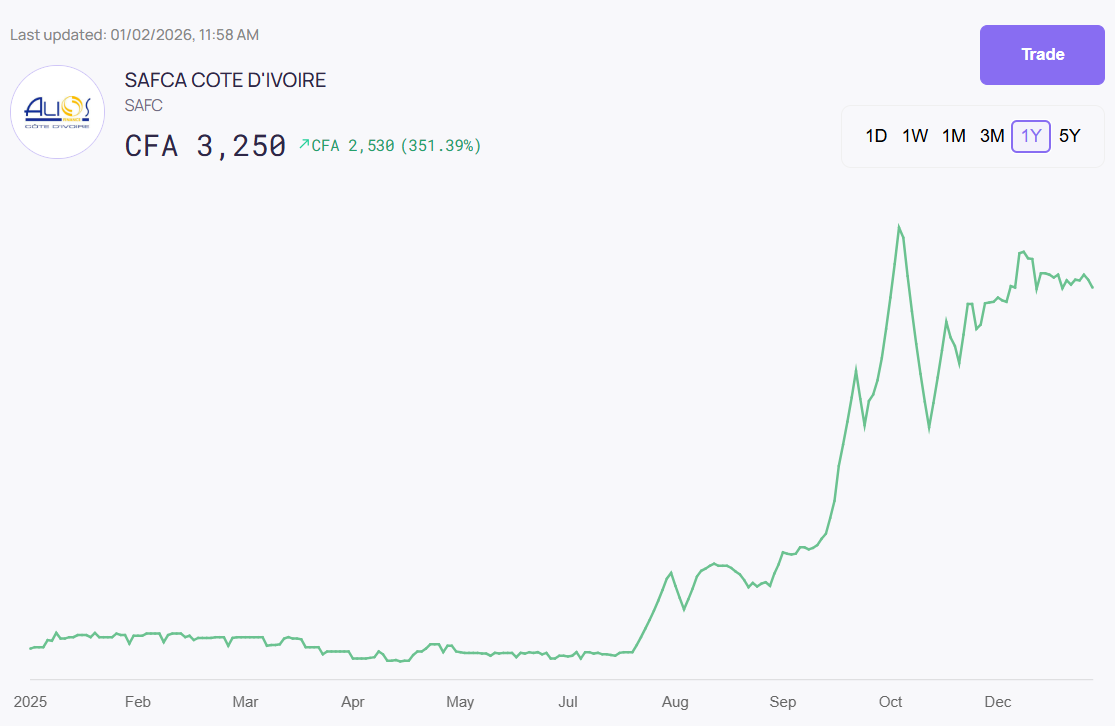

2. Safca Côte d’Ivoire (SAFC) — +359%

Safca’s rally gathered pace from mid-year as volumes surged. The stock experienced brief consolidations in September before reaching its peak in November. Low liquidity amplified price moves, favoring early entrants.

3. Uniwax Côte d’Ivoire (UNXC) — +241%

Uniwax’s momentum started in late Q2 and strengthened through Q3, supported by improving operational performance. The stock peaked in October before entering a sideways phase into year-end.

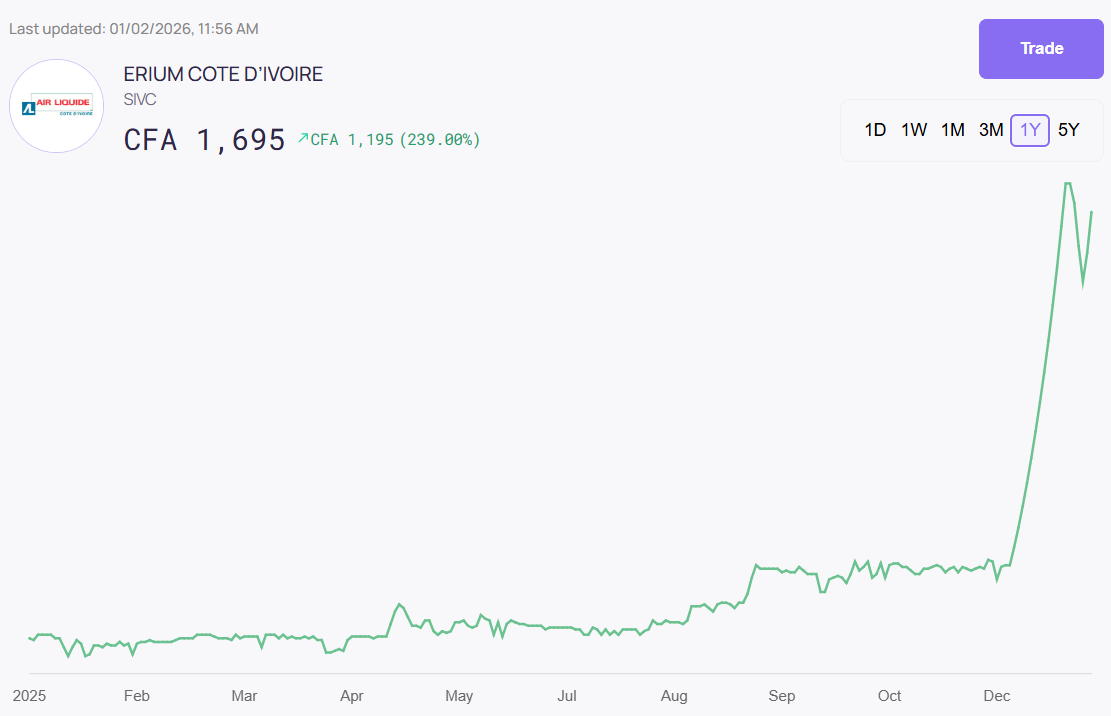

4. Air Liquide Côte d’Ivoire (SIVC) — +216%

Air Liquide delivered one of the most explosive late-year rallies. After a quiet first half, momentum accelerated in November and December, with the stock hitting its peak just before year-end.

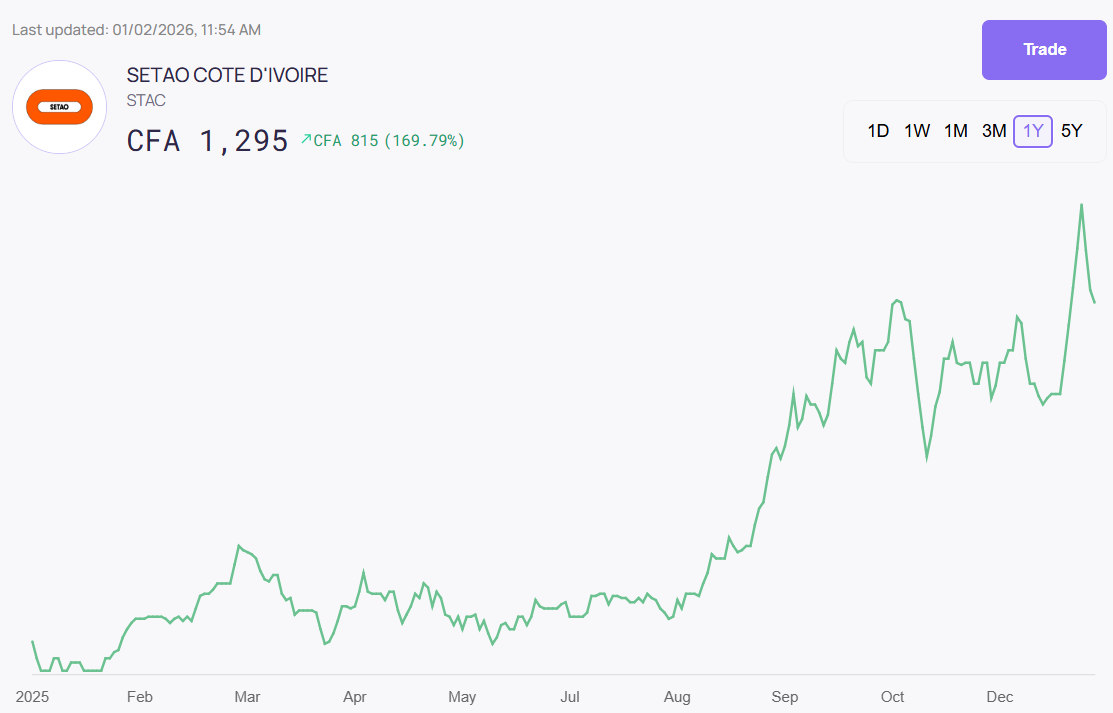

5. Setao Côte d’Ivoire (STAC) — +194%

Setao began trending upward early in the year, driven by infrastructure-related optimism. The strongest gains came between August and October, followed by volatility and profit-taking in December.

6. Sitab Côte d’Ivoire (STBC) — +171%

Sitab showed steady appreciation throughout the year, with a decisive breakout mid-year. The stock peaked in the third quarter and maintained elevated levels thanks to strong cash flows and dividends.

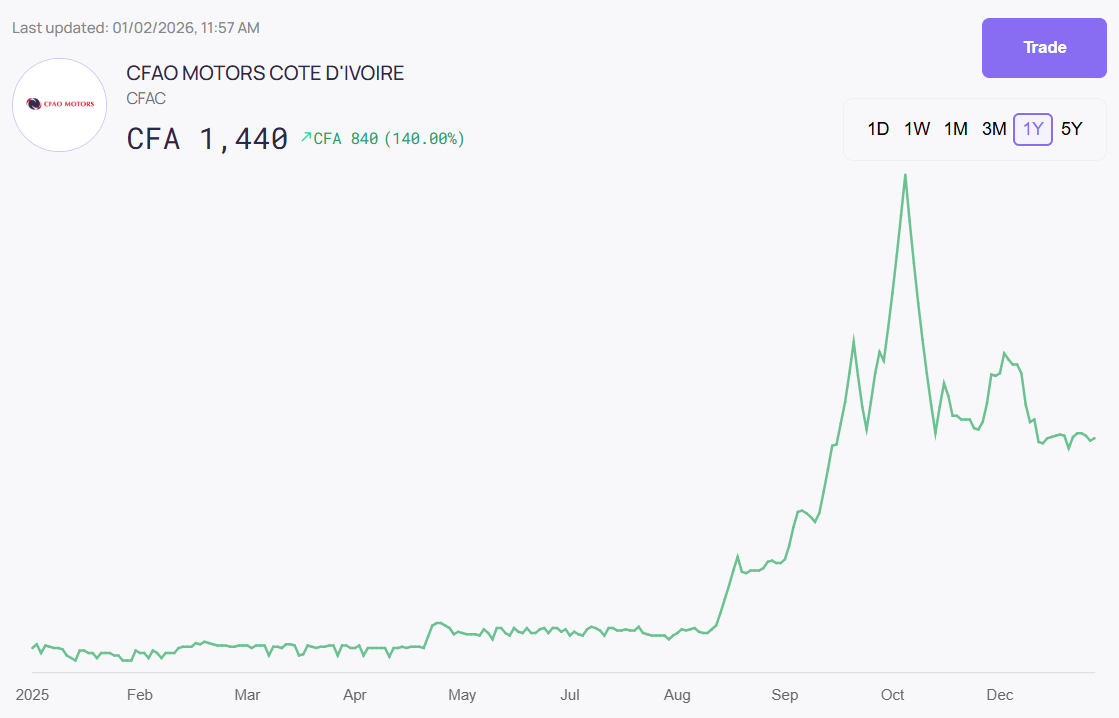

7. CFAO Motors Côte d’Ivoire (CFAC) — +138%

CFAC rallied sharply from the second quarter, tracking consumer recovery and vehicle demand. Momentum slowed toward year-end, with a notable correction after its October peak.

8. Sicable Côte d’Ivoire (CABC) — +127%

Sicable’s performance accelerated in the second half of the year, driven by industrial demand. After peaking in November, the stock consolidated at higher levels into December.

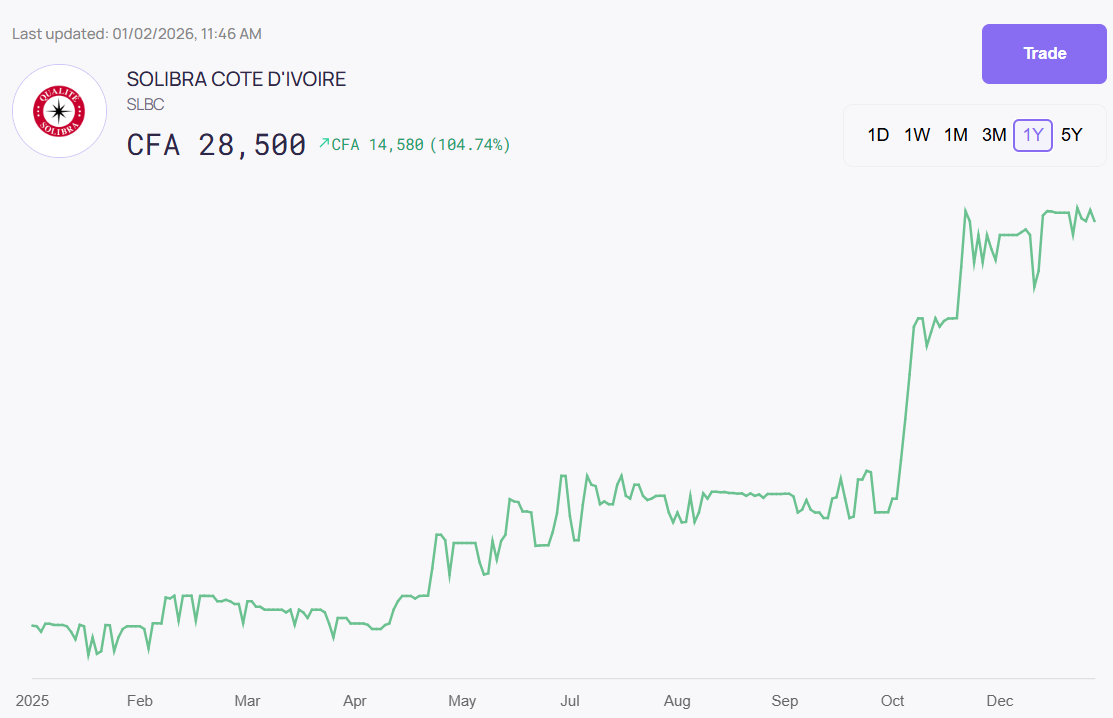

9. Solibra Côte d’Ivoire (SLBC) — +123%

Solibra delivered consistent gains through the year, with momentum strongest in Q3. Defensive characteristics helped it retain value during market pullbacks.

10. Bank of Africa Mali (BOAM) — +112%

BOAM’s rally was gradual but persistent, supported by improving banking sector fundamentals. The stock peaked late in the year after sustained accumulation.

How to invest in BRVM stocks

To invest in BRVM stocks, track momentum, and execute trades seamlessly, download the Daba App. For weekly stock picks, timing signals, and deeper analysis, upgrade to Daba Pro. And to master African markets step by step, explore Daba Academy.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.