The Economics of Lottery Business: Why Invest in One?

4 min Read October 6, 2024 at 8:30 AM UTC

The lottery business model, with its high margins, scalability, and consistent cash flows, offers a unique opportunity to capitalize on Africa’s economic growth story.

In recent years, the African continent has witnessed a surge in economic growth and development, creating new opportunities for investors across various sectors. One industry that has shown remarkable potential is the lottery business.

With a growing middle class, increased disposable income, and a cultural affinity for games of chance, Africa presents a fertile ground for lottery companies to thrive and generate substantial profits.

The lottery business model is inherently attractive due to its high-margin nature and relatively low operational costs. In Africa, where traditional investment avenues may be limited or risky, lottery companies offer a unique proposition for investors seeking substantial returns.

The economics of lottery businesses in Africa are particularly compelling, driven by favorable demographics, technological advancements, and regulatory environments that are gradually becoming more accommodating.

Also Read: Benin’s National Lottery Company to List on BRVM in Historic IPO

Demographic Dividend

One of the primary factors contributing to the profitability of lottery businesses in Africa is the continent’s large and youthful population. With over 1.3 billion people and a median age of just 19.7 years, Africa boasts a vast potential customer base.

Young adults, in particular, are more likely to participate in lottery games, viewing them as a form of entertainment and a chance to change their fortunes overnight. This demographic dividend provides a solid foundation for sustained growth in the lottery sector.

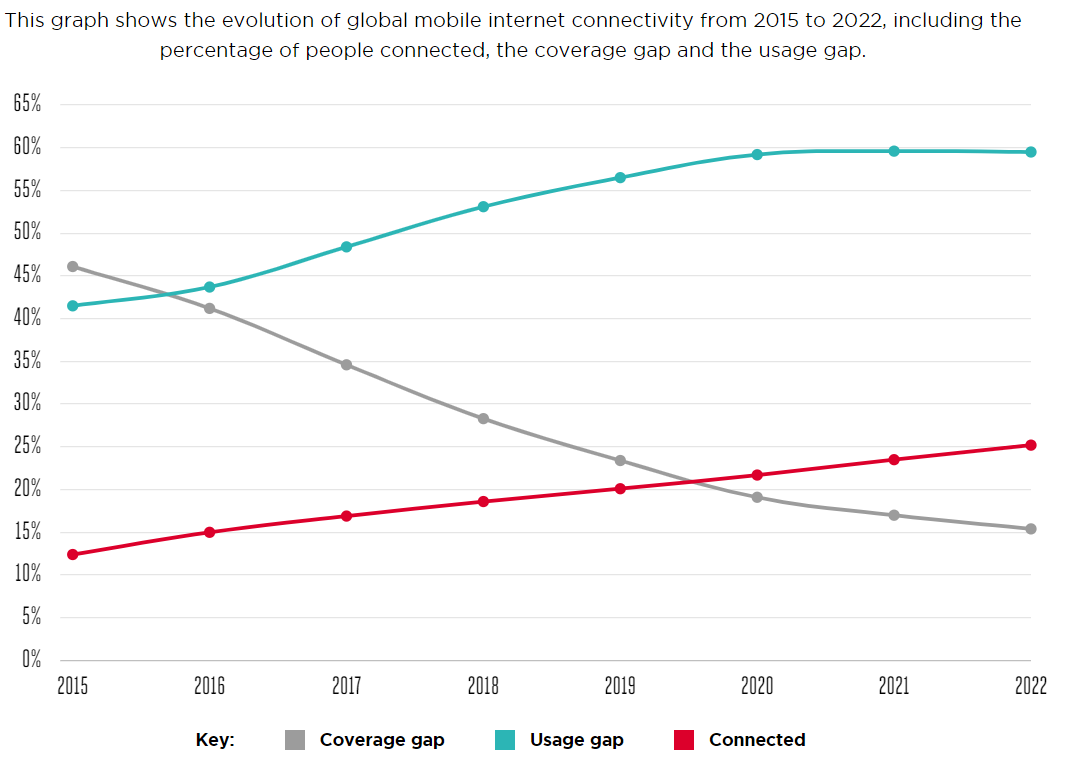

The rapid adoption of mobile technology across Africa has been a game-changer for lottery businesses. By the end of 2022, 17% of the population in Sub-Saharan Africa were using mobile internet on a smartphone.

This digital revolution has enabled lottery companies to reach customers in remote areas, reduce operational costs, and offer innovative gaming experiences. Mobile-based lottery platforms have significantly lowered barriers to entry for players, allowing them to participate in games with minimal effort and investment.

Economic Growth and Increasing Disposable Income

Furthermore, the economic landscape in many African countries has been improving, leading to increased disposable income among the population.

The World Bank reports that GDP per capita in Sub-Saharan Africa has grown from $1,484 in 2000 to $1,596 in 2019, despite recent challenges. This growth in purchasing power has translated into higher spending on entertainment and leisure activities, including lottery games.

The regulatory environment for lottery businesses in Africa is also evolving favorably. Many countries are recognizing the potential tax revenues and economic benefits that well-regulated lottery industries can bring.

Also Read: A high-stakes gambling boom

Operational Efficiency and Profitability

The profitability of lottery businesses in Africa is further enhanced by their relatively low operational costs compared to other industries.

With the advent of digital platforms, the need for extensive physical infrastructure has diminished. This allows companies to allocate more resources toward marketing, prize pools, and technology development, ultimately driving customer acquisition and retention.

One of the most compelling aspects of the lottery business model is its ability to generate consistent cash flows. Unlike many other industries that may face seasonal fluctuations or economic cycles, lottery sales tend to remain relatively stable throughout the year. This consistency provides investors with a reliable income stream and the ability to plan for long-term growth and expansion.

Moreover, lottery businesses in Africa often benefit from economies of scale. As the customer base grows, the cost per transaction decreases, leading to improved profit margins. This scalability is particularly attractive in the African context, where markets are often underserved and have significant room for growth.

The social impact of lottery businesses should not be overlooked when considering their investment potential. Many African countries mandate that a portion of lottery proceeds be directed toward social causes such as education, healthcare, and sports development. This corporate social responsibility aspect not only contributes to positive brand perception but also helps in securing government support and licenses.

Investors looking at the African lottery market should also consider the potential for regional expansion. As regulatory frameworks become more harmonized across the continent, successful lottery operators in one country can leverage their expertise and technology to enter neighboring markets, further driving growth and profitability.

While the lottery business in Africa presents significant opportunities, it is not without challenges. Regulatory compliance, competition from illegal gambling operations, and the need for continuous technological innovation are factors that investors must carefully consider. However, these challenges also present opportunities for well-managed companies to differentiate themselves and capture market share.

The economics of lottery businesses in Africa present a compelling investment case. The business model, with its high margins, scalability, and consistent cash flows, offers a unique opportunity to capitalize on Africa’s economic growth story. As such, for those looking to diversify their investment portfolio and tap into one of the world’s fastest-growing regions, the African lottery market represents an attractive and potentially lucrative venture.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.