The Future of Streaming Lies in Africa’s Overlooked Markets

5 min Read October 18, 2024 at 9:07 AM UTC

Africa’s streaming market is on the rise but the vast majority of the continent’s population is left behind due to limited internet and prohibitive costs.

Africa’s streaming market is on the rise, with platforms like Netflix, Prime Video, and Showmax gaining ground. However, these global giants primarily target the top income earners, leaving the majority of the population without affordable access to streaming services.

Projections indicate that video-on-demand subscribers on the continent will soar to 17 million by 2027. That’s barely a fraction of a population estimated at 1.3 billion people.

This gap presents an immense opportunity for startups and investors to serve a largely untapped market by providing affordable, localized content.

One company leading the charge is Wi-flix, a Ghana-based streaming platform catering to Africa’s mid- and low-income earners. Wi-flix’s journey offers valuable insights into the potential and challenges of capturing this underserved segment of the population.

Also Read: Africa’s streaming market heats up

A Solution for the Underserved

Wi-flix, launched in 2020, is the brainchild of two entrepreneurs with extensive experience in telecoms, media, and technology.

As one of the founders explained, the motivation for starting Wi-flix stemmed from a lack of affordable content in the African market. Initially, the goal was to create a music streaming platform, but challenges in monetization and content acquisition shifted the focus to video streaming.

“We realized that streaming in Africa was dominated by international players like Netflix, but their prices were too high for the average African consumer,” said one of the founders. “We wanted to create a platform that was not only affordable but also offered content that resonates with local audiences.”

Wi-flix charges as low as $0.65 per month, a stark contrast to Netflix’s pricing, which ranges between $4 and $7 in Africa. This affordability has been key to its success, attracting over 1.5 million subscribers in its first year.

The Untapped Market

Global streaming platforms, while successful, primarily cater to Africa’s wealthiest 5-15% of the population. The rest, over 80%, are priced out of these services.

With many Africans living on less than $2 a day, paying $7 a month for streaming simply isn’t feasible. Wi-flix’s strategy focuses on catering to this broader, underserved segment by offering low-cost access to entertainment.

“Our target market is the 80% of people who don’t have access to premium streaming services,” said the Wi-flix co-founder and CEO Louis Manu. “We believe entertainment should be for everyone, not just the wealthy. That’s why we’re committed to offering quality content at a price point that fits the budgets of mid- to low-income earners.”

One of the major barriers to streaming in Africa is not just subscription costs but also data prices. Streaming video requires a stable internet connection and significant data usage, both of which are expensive for the average consumer.

Wi-flix has partnered with telecom companies to offer subsidized data packages, allowing users to stream more affordably. In Zambia, for example, Wi-flix offers subscribers 250MB of free data as part of its daily packages.

In addition to lower costs, Wi-flix provides daily and weekly subscription options, understanding that many users may not have the funds to pay for an entire month upfront. This flexibility has resonated with African consumers, who often prefer pay-as-you-go services for essentials like electricity and water.

Localization Is Key

While price is an important factor, content is just as critical in capturing Africa’s streaming audience. Wi-flix focuses on localizing its content to meet the tastes and preferences of African viewers. The platform offers a mix of African movies, TV shows, and international content, but the co-founder noted that local content often outperforms international options.

“Nigerians love Nigerian movies, Ghanaians enjoy a mix of Ghanaian and Nigerian content, and Kenyans tend to prefer international movies,” he said. “We’ve found that by offering content that resonates with each market, we’re able to keep users engaged and coming back for more.”

One of the challenges of producing African content is the high cost of post-production. Many African filmmakers struggle to compete with international standards due to a lack of resources.

To address this, Wi-flix is building a post-production studio in Accra in partnership with Dolby Technologies. The studio will allow African filmmakers to enhance their content at no cost, improving the overall quality of locally produced content and helping it compete on a global scale.

Wi-flix is also adopting a revenue-sharing model with content creators, similar to Spotify’s approach in the music industry. This model allows filmmakers to earn based on the number of streams their content generates, providing an additional incentive for them to collaborate with the platform.

The Future of Streaming is Africa

As Africa’s streaming market continues to grow, there’s no doubt that the demand for affordable, localized content will only increase. Wi-flix’s rapid growth demonstrates the potential of capturing the underserved 80% of the population.

With its low-cost subscription model, partnerships with telecom providers, and a focus on local content, they are well-positioned to become a major player in Africa’s streaming industry.

For investors, the opportunities in Africa’s streaming market are immense. By backing startups like Wi-flix, they can tap into a high-growth market that global players have yet to fully explore.

“We’ve seen great interest from international investors who recognize the potential of the African market,” said the co-founder. “The key is to focus on affordability and localization—two things that global platforms haven’t fully mastered.”

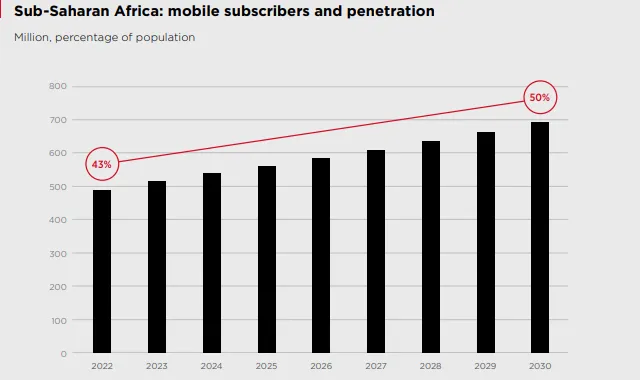

Wi-flix’s success is a testament to the untapped potential in Africa’s streaming market. As more Africans gain access to affordable internet and mobile devices, the demand for digital content will only grow.

For startups and investors looking to capitalize on this opportunity, the key lies in serving the millions of Africans who have been left behind by the global streaming giants.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.