Top 10 Diaspora Remittance Destinations in Africa

6 min Read July 20, 2025 at 11:46 AM UTC

Diaspora remittances, money individuals send to their home country from abroad, have become one of the most powerful engines of growth and resilience across the African continent.

As of 2023, Africa received over $100 billion in remittances, amounting to approximately 6% of the continent’s GDP.

This surpassed both official development assistance ($42 billion) and foreign direct investment (FDI) ($48 billion), highlighting a seismic shift in the region’s external financing dynamics.

Behind this surge lies the movement of over 40 million Africans living abroad, who, in pursuit of better incomes, political stability, and security, send financial support back to families and communities. These remittances not only meet essential household needs but also exceed FDI in many countries and are now a cornerstone of national economic stability.

Here are the top 10 African countries receiving the most in remittances in 2025—each playing a vital role in the continent’s development and resilience.

1. Egypt – $22.7 Billion

Egypt remains Africa’s top remittance destination, with inflows reaching $22.7 billion in 2024. This boost is due to the government’s liberalization of exchange rates and the introduction of high-yield savings instruments that attracted diaspora funds through formal banking systems.

Egypt’s global diaspora—especially across the Gulf, Europe, and North America—forms a strong support network. Their contributions help finance education, healthcare, and investment in small businesses, reinforcing macro-level financial stability and household-level resilience.

2. Nigeria – $19.8 Billion

Nigeria follows closely with $19.8 billion in remittances, representing 35% of Sub-Saharan Africa’s total inflows. These funds have overtaken traditional FDI in importance, offering a stable source of capital.

With remittances coming largely from the U.S. and U.K., Nigeria’s diaspora serves as a lifeline for millions. The government is considering the issuance of diaspora bonds and has targeted $1 billion in monthly inflows, seeing these transfers as a pathway to boost foreign reserves and diversify the economy.

3. Morocco – $12.05 Billion

Morocco received over $12 billion from its diaspora in 2024, making it the third-largest recipient in Africa. Moroccan migrants maintain strong ties to their homeland, contributing consistently to family support and national development.

These funds support household consumption and also finance infrastructure projects, home construction, and small-scale business ventures—offering a critical cushion in periods of global economic uncertainty.

4. Kenya – $4.94 Billion

Kenya recorded a historic high of $4.94 billion in remittances—an 18% increase over the previous year. These inflows now exceed tourism and agriculture as the country’s largest source of foreign exchange.

A major driver has been proactive government policy under President William Ruto, who has supported labor migration and bilateral work agreements to expand diaspora employment opportunities. Kenya’s diaspora, especially in North America and Europe, continues to be a driving force in its economic story.

5. Ghana – $4.6 Billion

Ghana’s remittance receipts reached $4.6 billion in 2024, helping to fund education, health care, and housing for millions of families. The country has invested in diaspora-targeted policies such as investment facilitation and financial literacy campaigns.

With the cost of living rising, these funds are also vital for consumption and social welfare, reinforcing the household safety net and improving national economic resilience.

6. Zimbabwe – $3.08 Billion

Zimbabwe received $3.08 billion from its diaspora—a critical buffer in a struggling economy marked by inflation and unemployment. Over the past decade, while FDI declined by 41%, remittances have increased by 57%, revealing a clear trend in global capital movement toward people-centric inflows.

Zimbabweans abroad are helping families pay for food, education, and small-scale enterprise, and the government is ramping up efforts to formalize these inflows through digital platforms and diaspora engagement programs.

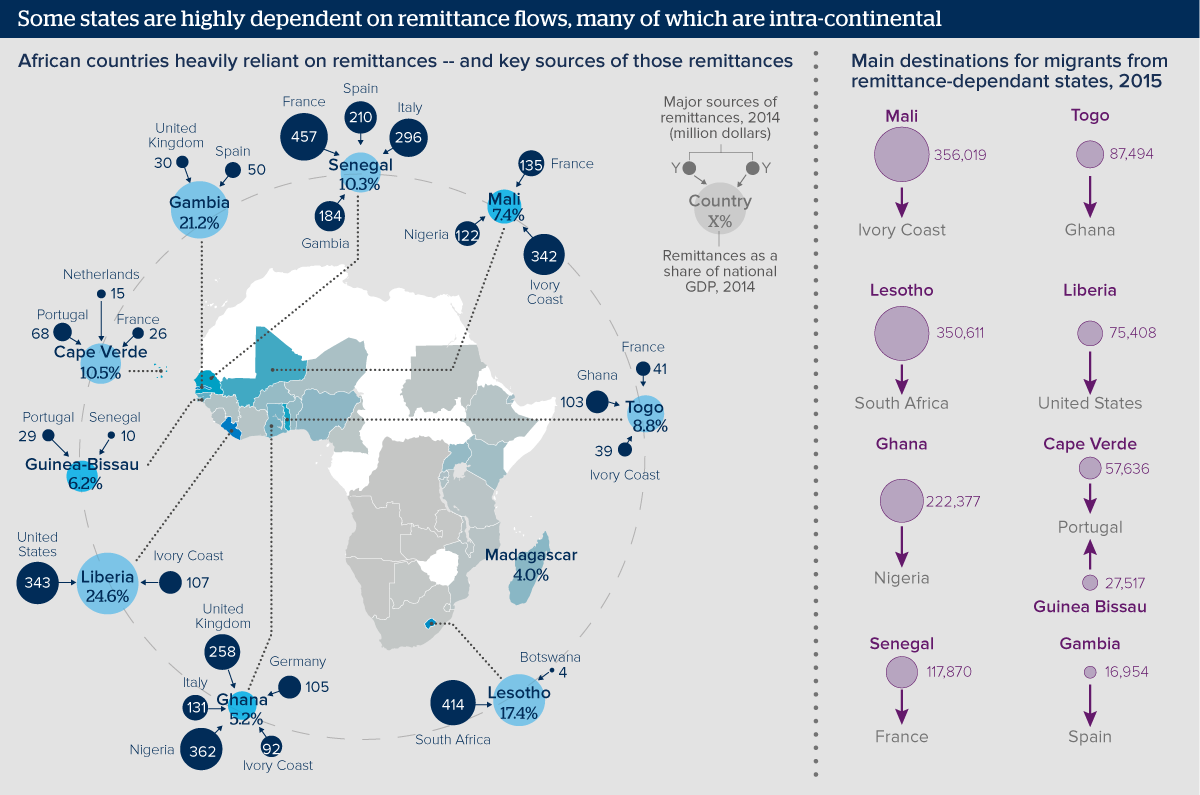

7. Senegal – $2.94 Billion

With remittances representing 11% of GDP, Senegal received $2.94 billion in 2024. The country is actively harnessing this inflow for development, with initiatives like a “diaspora bank” that encourages investment in tourism, agriculture, and housing.

These funds have become a dependable source of external financing—more stable than FDI, particularly during global downturns—and are shaping local entrepreneurship and infrastructure.

8. Tunisia – $2.8 Billion

Tunisia garnered $2.8 billion in remittances, placing it among the top contributors to North Africa’s economic stability. Tunisian migrants—especially in France and Germany—send funds primarily for family support and investment in land and housing.

The government is working to encourage formal transfer systems and reduce costs, in line with global calls to lower remittance fees to boost flows to Sub-Saharan Africa.

9. Algeria – $1.86 Billion

Algeria’s remittance inflow of $1.86 billion might seem modest, but it continues to be a vital component of the national income portfolio, particularly during periods of oil price volatility.

The country’s diaspora has also begun exploring more structured investment opportunities back home, such as fintech and real estate, though regulatory frameworks still need modernization.

10. Democratic Republic of Congo – $1.4 Billion

The DRC rounds out the top 10 with $1.4 billion in diaspora inflows. Despite a decline from previous years, remittances remain a crucial form of financial relief, especially in regions underserved by formal employment or social safety nets.

As climate change, economic hardship, and political instability drive continued migration, remittance inflows to countries like DRC are expected to rise in the coming years, especially if costs to send money are reduced.

Also Read: Pulse54: Rethinking the African dream

The Bigger Picture: Migration, Climate, and Remittance Trends

Africa’s remittance landscape is being shaped by a complex web of migration dynamics:

- Income disparities, especially between Africa and the global North.

- Political instability pushing people to seek security abroad.

- The growing impact of climate change, which displaces communities and forces migration.

With FDI declining and ODA often tied to policy conditions, remittances offer unconditional, flexible capital that goes directly to households. They fuel consumption, reduce poverty, and increasingly fund education, healthcare, housing, and entrepreneurship.

In nearly 25 countries globally, remittances make up over 10% of GDP—a threshold that reflects economic dependence on diaspora inflows. In Africa, this trend is only expected to grow.

Bottom Line: A $500B Opportunity

If African countries continue to invest in digital remittance channels, lower transfer costs, and integrate diaspora capital into national investment strategies, the World Bank estimates that inflows could reach $500 billion by 2035.

Diaspora communities aren’t just sending money—they’re investing in futures. African governments, fintech platforms, and policymakers must now work together to unlock the full development potential of these flows.

Stay informed on the African economic transformation.

Subscribe to our newsletter for weekly insights on remittances, investments, and the future of finance in Africa.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.