What Next for Côte d’Ivoire After 2025 Elections?

7 min Read November 13, 2025 at 10:44 PM UTC

With President Alassane Ouattara winning another term in Côte d’Ivoire’s 2025 elections, investors can now turn their attention from political questions to economic opportunities.

Ouattara has held power since a civil war ended in 2010, and the economy has been one of Africa’s fastest-growing since he took office, bolstered by large infrastructure investments and the discovery of oil.

Experts at a recent webinar hosted by Daba Finance and Tellimer see the country’s economy continuing its strong performance, despite global challenges and some domestic concerns.

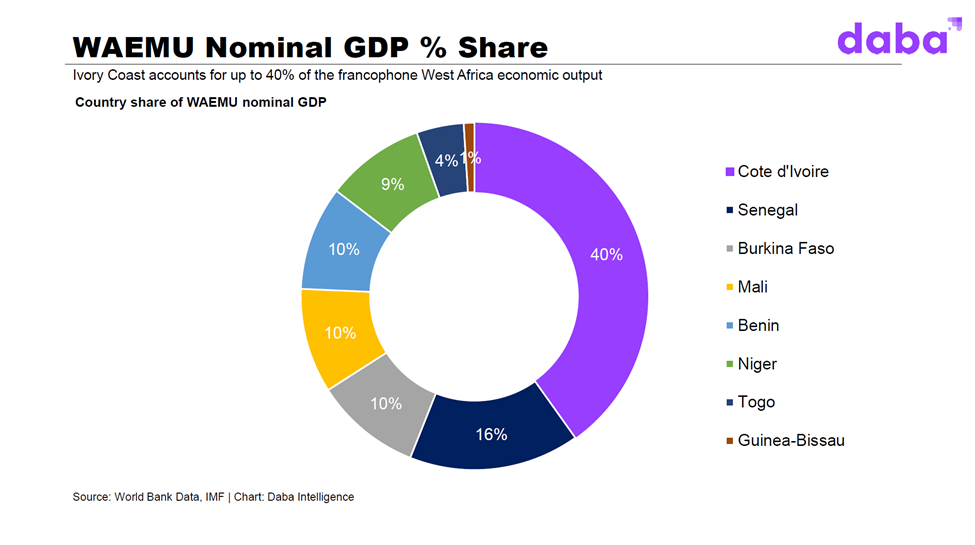

Côte d’Ivoire is francophone West Africa’s economic powerhouse, making up about 40% of the regional bloc’s $238 billion economy.

The continuity of Ouattara’s leadership gives investors something rare in developing markets: predictability.

However, the government still faces significant challenges, including diversifying the economy beyond raw materials, managing security threats from neighboring countries, and securing international financing.

A Decade of Impressive Growth

The numbers tell a compelling story.

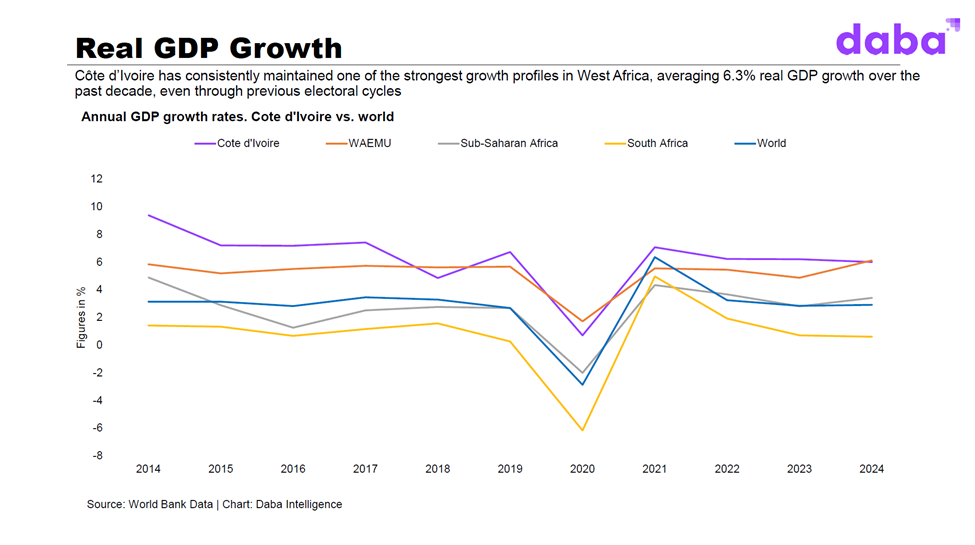

Over the past ten years, Côte d’Ivoire has grown at an average rate of 6.3% annually—faster than both Sub-Saharan Africa as a whole and major economies like South Africa.

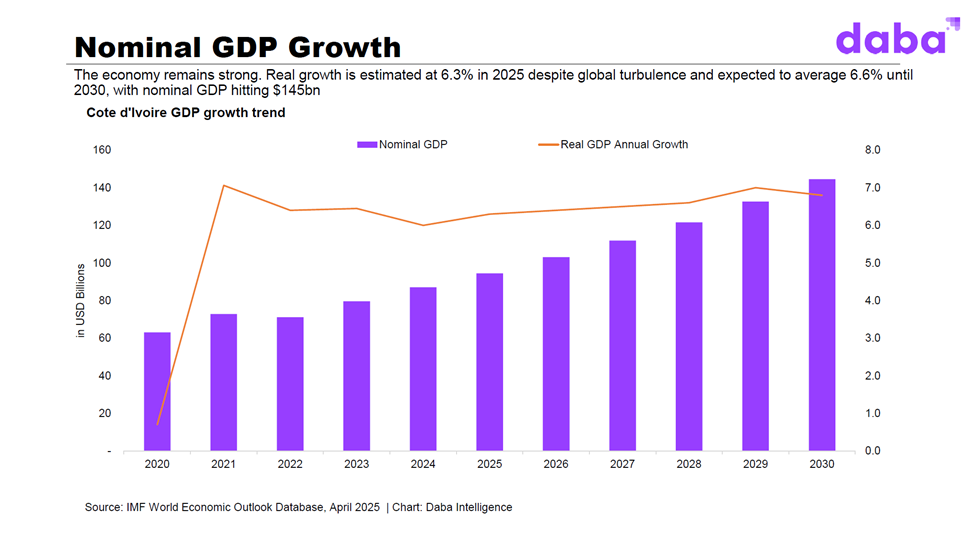

The International Monetary Fund expects this momentum to continue, projecting 6.3% growth in 2025 and an average of 6.6% through 2030.

By the end of the decade, the country’s economy could reach $145 billion, a 60% jump from 2023.

What’s driving this growth?

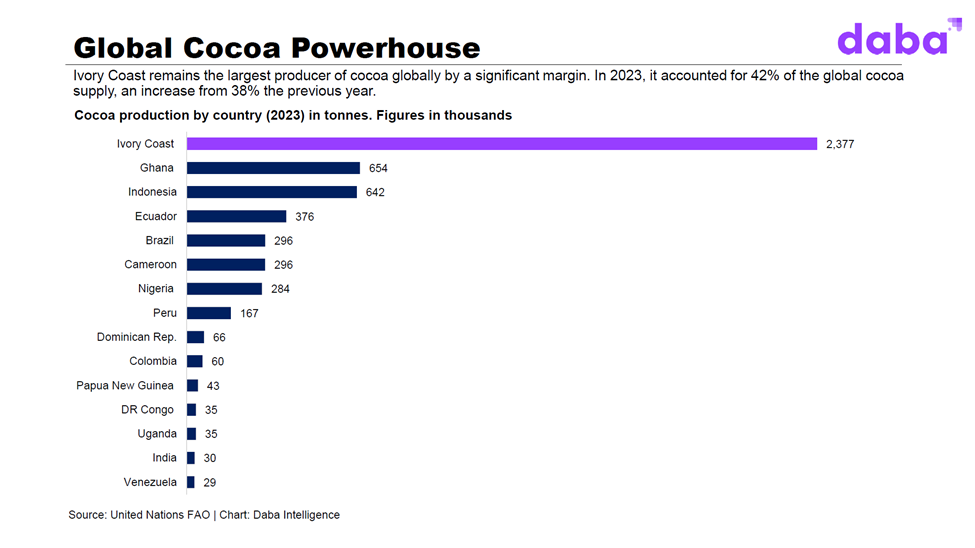

Traditionally, it’s been cocoa exports (Côte d’Ivoire produces 42% of the world’s cocoa), gold mining, and newly developed offshore oil fields.

But something important is changing.

The country is increasingly focused on processing raw materials domestically rather than just shipping them abroad.

“Côte d’Ivoire is no longer just a raw commodity exporter,” explains James Blanning, a senior economist at Tellimer. “We’re seeing increasing refinement of cocoa and other agricultural goods, and this is where the medium-term growth story lies.”

This shift toward manufacturing and processing, particularly in food processing, energy, and light industry, represents an effort to capture more value from the country’s natural resources.

Managing Debt Responsibly

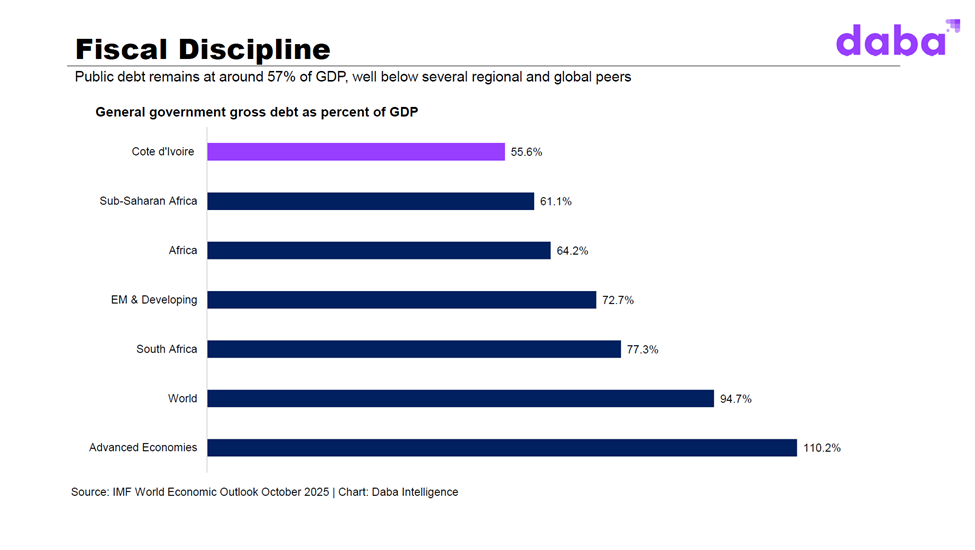

One reason investors feel confident about Côte d’Ivoire is its careful management of government debt.

The country’s public debt sits at around 57% of GDP, lower than the Sub-Saharan African average of 61% and well below the global emerging-market average of 72%.

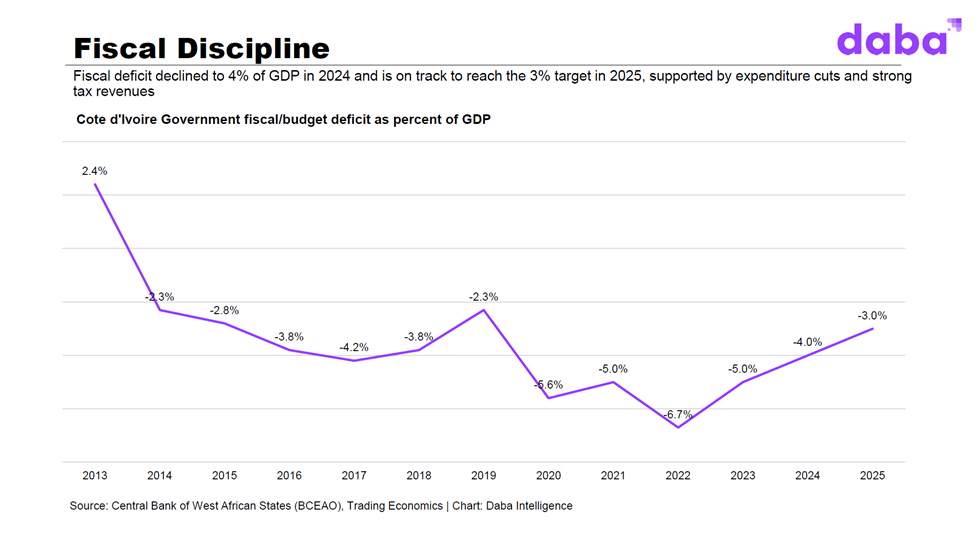

The government has also reduced its budget deficit from higher levels to 4% of GDP in 2024, with plans to hit the regional target of 3% in 2025.

This financial discipline hasn’t happened by accident.

Boum Jr III, CEO of Daba Finance, notes it reflects “the government’s maturity in managing debt and leveraging investor confidence.”

The country has successfully borrowed money from international investors, raising $1.75 billion through Eurobonds earlier this year, plus €335 million in local-currency bonds.

Carol Ndia, Head of Institutional Client Services at Hudson Securities, expects this borrowing pattern to continue.

“Given ongoing infrastructure and social investments, we’ll likely see another active issuance year in 2026,” she notes. The government will look for the best rates, whether from international or local markets.

Beyond international borrowing, Côte d’Ivoire is developing its domestic financial markets.

Weekly government bond auctions on the regional stock exchange (BRVM) provide regular investment opportunities, with local banks and pension funds increasingly buying government and corporate debt.

However, there’s a challenge here.

Despite being part of a regional economic union, investors in each country tend to buy only their own country’s bonds—Ivorians buy Ivorian bonds, Senegalese buy Senegalese bonds, and so on. Tax rules favor this home bias, limiting the potential for regional capital to flow where it’s most needed.

“Information asymmetry remains the biggest barrier to capital inflows,” says Boum. Companies like Daba Finance are working to solve this problem by improving access to data and making it easier for investors to access opportunities across the entire West African region, not just in their home countries.

The Cocoa Conundrum

While Côte d’Ivoire’s agricultural dominance has been a blessing, it also presents risks. The country’s heavy reliance on cocoa is a “double-edged sword,” as the experts put it.

International cocoa prices have fallen 36% this year, which will hurt export revenues and the country’s current account balance. Fortunately, rising gold prices and increasing oil production are helping to offset these losses.

The government’s investment in oil and gas production is paying off in the short term, with commercial output ramping up through 2025.

However, as the world shifts away from fossil fuels, this revenue source may not be sustainable long-term.

“Oil and gas will be key for fiscal stability in the medium term,” cautions Kwei Quaye-Foli, Head of Government Services at Intelligensis Risk and Strategy, “but the long-term future depends on diversification into value-added processing and renewable energy.”

To manage oil wealth wisely, the government is designing a sovereign wealth fund, similar to successful models in Botswana or Norway, that would channel hydrocarbon revenues into productive long-term investments.

Infrastructure Investment and Fiscal Pressures

Côte d’Ivoire has been on an infrastructure building spree, constructing highways, industrial parks, and impressive new stadiums that hosted the Africa Cup of Nations tournament. These projects have boosted the economy and public support for the government.

But now comes the hard part.

International development financing has dropped by nearly 70% since 2021, meaning the government will have tighter budgets going forward. “The real test comes now that the elections are over,” warns Kwei. Abidjan will need to focus on projects that either generate quick economic returns or attract private investment.

Despite these constraints, the government’s revenue collection is improving. The IMF projects that tax revenues will reach 17.4% of GDP in 2025, a significant step toward the country’s goal of 20% by 2030. This improved tax collection gives the government more financial flexibility without relying solely on borrowing.

Regional Success Story

Côte d’Ivoire’s story is increasingly tied to its neighbors.

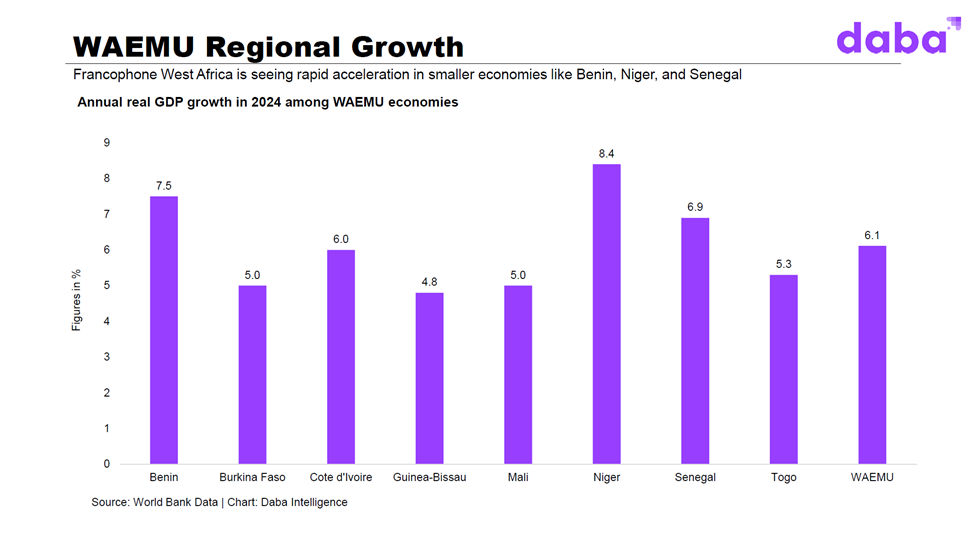

Other French-speaking West African countries, Benin, Niger, and Senegal, are actually growing even faster, with growth rates of 7.5%, 8.4%, and 6.9% respectively.

As these economies industrialize and integrate more closely with Côte d’Ivoire’s economy, the entire region could become a more attractive investment destination.

“As these countries industrialize and integrate more deeply with Abidjan,” explains Boum, “we’ll see a regional rebalancing of capital flows. Investors are already beginning to look at ‘Côte d’Ivoire plus’—a combined WAEMU growth story.”

This regional approach could help transform Abidjan’s stock exchange into a gateway for pan-African investment, something Daba and Tellimer have been actively promoting.

Managing the Risks

Of course, risks remain.

Security threats continue along the northern borders with Mali and Burkina Faso, where insurgent groups operate.

There are also questions about what happens when the aging leadership eventually changes. External economic shocks, like the recent drop in cocoa prices, can quickly impact the economy.

However, most investors already factor these risks into their decisions. “Resilience is part of Côte d’Ivoire’s DNA,” says Carol. “Each electoral cycle brings tension, but the institutions endure.”

One key strength is the professional civil service that continues functioning regardless of political changes. “Even when cabinets change,” she adds, “the same technocrats execute policy. The machinery doesn’t stop.”

On security, Kwei emphasizes that the northern insurgency threat is as much about economic exclusion as ideology.

“Abidjan’s containment has been effective so far, but sustainability requires long-term economic opportunities in the north.” In other words, the government needs to ensure that economic growth benefits all regions, not just the prosperous south.

The Bottom Line

After the 2025 elections, the message from investment experts is clear: Côte d’Ivoire offers a rare combination of political stability, economic ambition, and proven resilience in an increasingly uncertain world.

With GDP growth above 6%, manageable debt levels, and ongoing structural reforms, the country continues to lead francophone West Africa’s economic development.

The transition from raw commodity exporter to a more diversified, processing-based economy won’t happen overnight, and challenges remain. But for investors willing to look beyond short-term volatility, Côte d’Ivoire presents a compelling long-term opportunity in one of the world’s fastest-growing regions.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.