Which BRVM Stocks Will Pay Dividends in 2026?

4 min Read January 24, 2026 at 10:55 PM UTC

Dividend season on the BRVM is one of the most closely watched events on the regional stock exchange. After a strong run in prices and earnings across several sectors in 2025, the question on most income-focused investors is: who will pay cash in 2026?

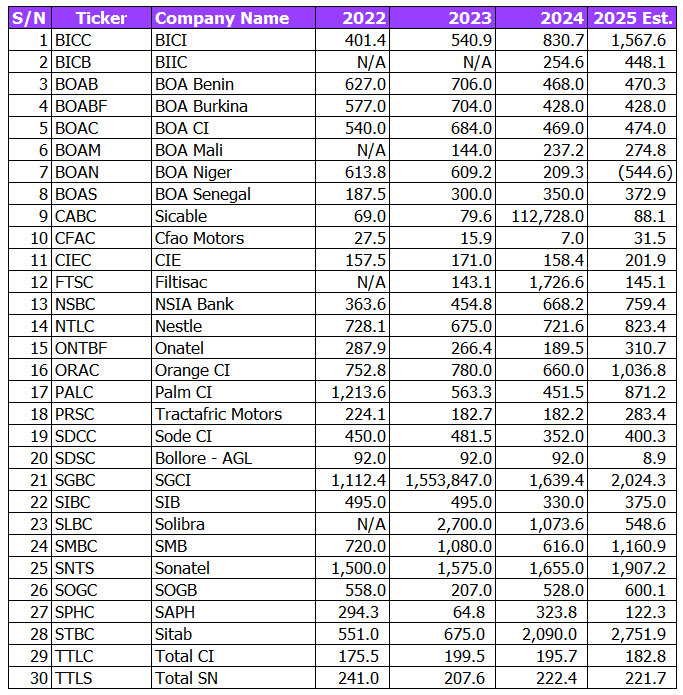

This analysis focuses on companies that have paid dividends at least once over the past 3 financial years, and estimates 2025 dividends to be paid in 2026, based on each company’s trailing 12-month (TTM) net income and historical payout ratios.

These are estimates, not official declarations—but they provide a useful framework for positioning portfolios ahead of confirmed announcements.

Where the dividends are coming from: sector breakdown

One thing stands out clearly: dividends on the BRVM tend to be highly sector-focused.

Banks and financial services dominate

The largest and most consistent dividend payers remain banks, particularly the Bank of Africa network and regional lenders. Institutions such as BOA Côte d’Ivoire, BOA Sénégal, and BOA Mali have maintained payout ratios ranging from roughly 45% to over 95% in recent years. Despite earnings volatility across markets, banking remains the backbone of BRVM dividend income.

Telecoms: fewer names, massive cash

Telecommunications remains a high-quality dividend sector, driven primarily by Sonatel and Orange Côte d’Ivoire. These companies combine scale, strong margins, and predictable cash flows. Their payout ratios have historically been disciplined, supporting steady dividend growth even in years of elevated capital expenditure.

Consumer staples and agribusiness

Companies tied to everyday consumption and agriculture—such as Nestlé Côte d’Ivoire, Palm Côte d’Ivoire, and SAPH—continue to reward shareholders. While dividends in this segment are more cyclical, earnings momentum in 2024 and early 2025 has improved visibility for 2026 payouts.

Industrials and logistics

Names like Bolloré Africa Logistics and select industrial processors appear less flashy but remain reliable contributors, often prioritizing balance-sheet strength while maintaining steady dividends.

Bottom line: if you are investing for income on the BRVM, you are effectively investing in banks, telecoms, and consumer staples.

Read Also: High-Yield Stocks for 2025 as BRVM Dividend Season Gets Underway

What Could Shareholders Receive in 2026? (With a Big Asterisk)

Based on TTM earnings and historical payout ratios, several companies are positioned to deliver meaningful cash returns in 2026.

- Let’s be crystal clear: these are estimated figures based on trailing twelve-month earnings and historical payout ratios. They’re educated guesses, not promises carved in stone.

- That said, here’s what the math suggests:

- BICICI could deliver around 1,567.6 per share, maintaining its stellar 94.3% payout ratio. BIIC is similarly aggressive at 94.3%, with an estimated 448.1 per share coming your way. Both banks are practically printing dividends.

- STBC (Sitab) looks absolutely wild on paper—2,751.9 per share estimated, with a 93.0% payout ratio. That’s the kind of number that makes dividend investors weak in the knees.

- On the telecom side, Sonatel remains king with an estimated 1,907.2, while Orange CI should come in around 1,036.8. Both maintain payout ratios above 130%, which raises eyebrows but reflects their cash-generative business models.

- Total CI (TTLC) is estimated at 182.8 with a staggering 148.9% payout ratio, while Nestle (NTLC) sits at 823.4 with a conservative 5.0% ratio. Two completely different dividend philosophies, both valid.

- The BOA family spreads dividends across the region: BOA Benin (470.3), BOA Burkina (428.0), BOA CI (474.0), BOA Mali (274.8), BOA Niger (544.6), and BOA Senegal (372.9)—regional banking diversification in action.

It is equally important to note what won’t pay. Several large companies—despite solid earnings—continue to retain profits, either for reinvestment or balance-sheet consolidation. This does not imply weak performance; it reflects deliberate capital allocation choices.

Important disclaimer: these are estimates

All figures discussed here are estimated dividends, calculated mechanically from TTM net income and last known payout ratios. They are not official proposals.

As soon as FY25 audited results begin to roll out and boards publish proposed dividends, we will release a detailed 2026 dividend calendar with confirmed amounts, ex-dividend dates, and payment timelines.

Also Read: Full List of BRVM Stocks That Will Pay Dividends in 2025

How to Position for BRVM Dividends in 2026

One of the easiest ways to position for BRVM dividends is to invest by sector rather than picking individual names.

On the Daba app, investors can access curated BRVM collections, including banking, telecoms, consumer goods, and industrials, allowing for exposure to dividend-paying companies in a single allocation.

In the meantime, if you want to track this live and get smarter about BRVM investing, check out

- Daba App to invest directly in BRVM stocks

- Daba Pro for weekly dividend insights and stock ideas

- Daba Academy to learn how dividend strategies work in practice

The takeaway

Dividends remain one of the BRVM’s strongest attractions. While price performance often grabs headlines, cash distributions continue quietly compounding investor returns. Banks provide consistency, telecoms deliver scale, and consumer stocks add balance.

With estimates pointing to another solid year of payouts in 2026—and official numbers soon to follow—dividend investors have every reason to stay attentive. On the BRVM, income is not an afterthought. It is the strategy.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.