Why Ivory Coast is Africa’s Best Economic Success Story

4 min Read May 2, 2025 at 2:44 PM UTC

The francophone West African nation’s economic boom offers robust growth opportunities, with diversified sectors and strong government support creating fertile ground for international investors.

In a continent often characterized by economic challenges and political instability, Ivory Coast stands as a beacon of prosperity and progress.

While neighboring nations struggle with stagnation, inflation, and security concerns, this West African country of 31 million people has quietly transformed itself into one of Africa’s most compelling investment destinations.

Economic Powerhouse

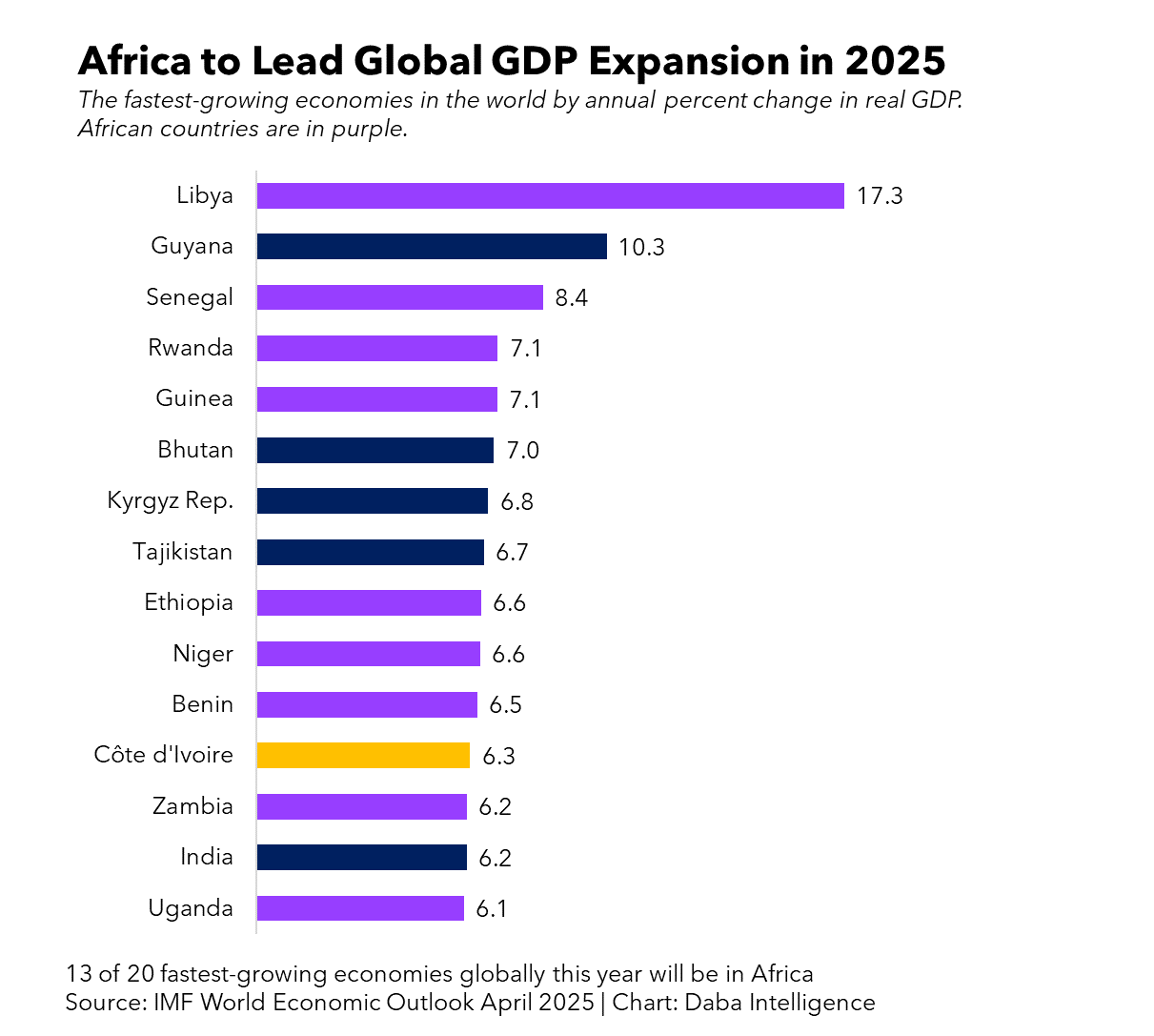

The numbers tell an impressive story. Ivory Coast’s economy expanded at a remarkable 7% annually between 2012 and 2023, with projections indicating continued strong growth of 6.3% in 2025, according to International Monetary Fund data.

What makes this achievement particularly notable is its consistency – the growth persisted even during the global disruption of the COVID-19 pandemic.

Unlike many African economies struggling with runaway inflation, Ivory Coast maintained price stability with a modest 3.8% inflation rate in 2024, far below the West African average of 21.6%. At $2,900 per capita, its GDP ranks highest in West Africa except for Cape Verde.

This economic stability creates an ideal environment for sustainable investment returns. Investors seeking African exposure without the typical volatility find Ivory Coast increasingly attractive.

Beyond Cocoa

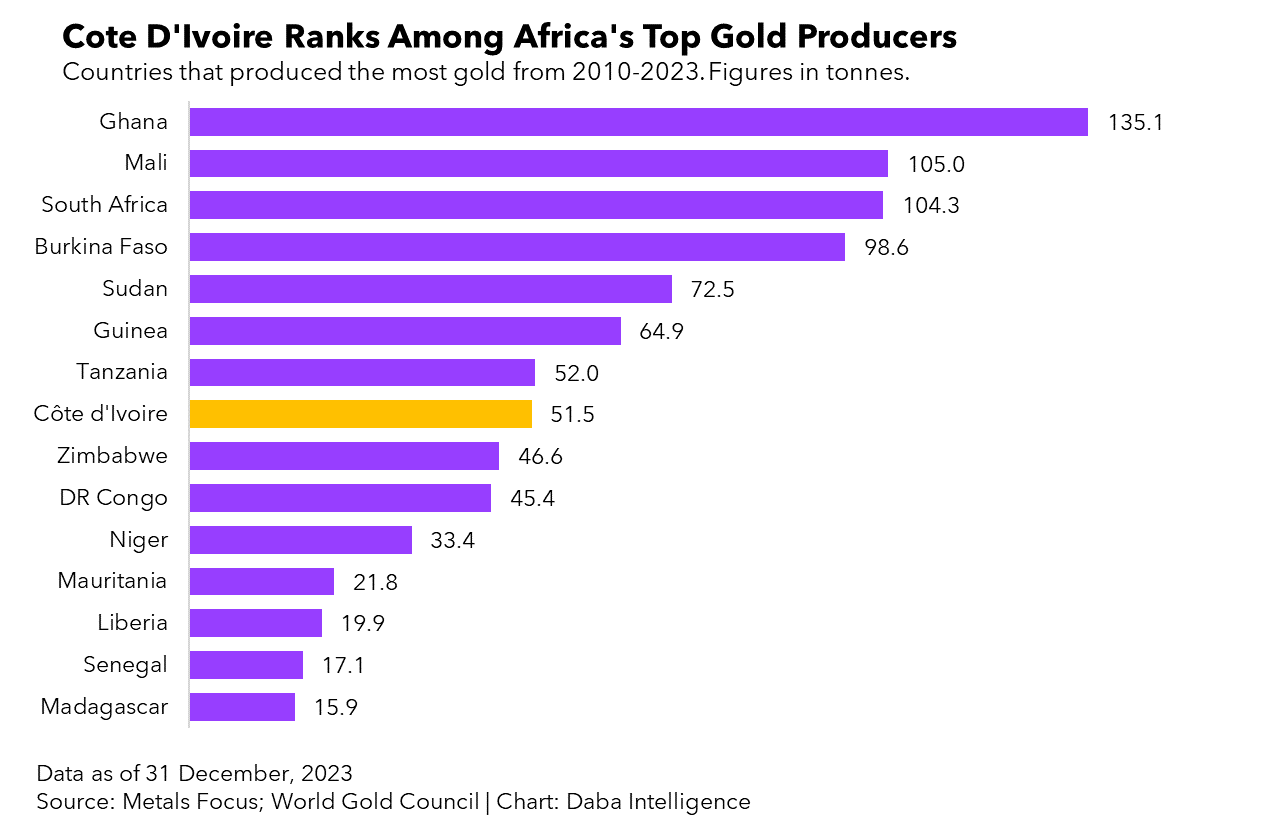

Once primarily dependent on cocoa production – it remains the world’s largest producer – Ivory Coast has successfully diversified its economy. Services now account for over half of GDP, while industrial activity has grown from 16% in 2000 to approximately 25% today. This diversification provides crucial insulation against commodity price fluctuations.

The manufacturing sector has shown particular promise, with food processing, consumer goods production, and construction materials leading the way. Technology startups are also gaining momentum, especially in financial services and agricultural technology.

Capital Magnet

Private investment inflows have increased at an impressive 8.6% annually over the past decade. According to the African Development Bank, Ivory Coast has the smallest “financing gap” on the continent – a critical indicator of economic health.

Foreign direct investment has benefited from President Alassane Ouattara’s business-friendly policies. The 2018 investment code offers substantial tax incentives and customs waivers for significant investments that create local employment. These policies have catalyzed investment across sectors ranging from banking to manufacturing.

Infrastructure Boom

Infrastructure development remains central to Ivory Coast’s growth strategy. New roads, bridges, and ports have dramatically improved transportation efficiency – the journey from Abidjan to Saint Pedro now takes half the time it did previously. Electricity access has skyrocketed from 34% in 2013 to approximately 94% today.

Energy sector development continues apace, with Italian firm Eni investing $10 billion in the offshore Baleine field. Current production stands at 60,000 barrels of oil and 70 million cubic feet of gas daily, with projections indicating potential production of 200,000 barrels daily by 2027.

Challenges and Outlook

Despite its impressive trajectory, Ivory Coast faces challenges. Skills gaps remain a concern for employers, a lingering effect of educational disruption during past conflicts. Environmental considerations also raise questions about the sustainability of fossil fuel expansion.

Political stability represents the most significant variable for investors. President Ouattara, now 83, has led the country since 2010 and may seek another term despite constitutional term limits. The upcoming presidential election will be closely watched by investors.

Nevertheless, analysts remain optimistic about Ivory Coast’s economic prospects. Unlike many regional neighbors, the country has maintained a decade-plus of consistent growth, creating widespread economic improvement.

Ivory Coast offers what investors seek in emerging markets – growth momentum, policy stability, and expanding opportunities. The fundamentals remain strong regardless of political developments.

Investing in Cote d’Ivoire With Daba

For investors seeking exposure to Ivory Coast’s growth story, digital investment platform Daba now offers multiple entry points.

Through the app, international investors can access Ivorian stocks traded on the regional BRVM exchange, government bonds providing stable yields, curated collections of high-potential Ivorian companies, and managed funds focused specifically on this dynamic market.

These investment vehicles provide exposure to leading Ivorian businesses across banking, telecommunications, consumer goods, and industrial sectors – companies benefiting directly from the country’s remarkable economic expansion.

As Africa continues to present both challenges and opportunities for global investors, Ivory Coast’s combination of growth, stability, and market access makes it an increasingly compelling destination for capital seeking both returns and diversification.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.