African Startups Rise to the Climate Challenge

7 min Read February 2, 2024 at 1:06 PM UTC

Despite contributing only 3.8% of global greenhouse gas emissions, Africa faces the brunt of climate change’s wrath. Emerging VC-backed innovators aim to change the continent’s fortunes.

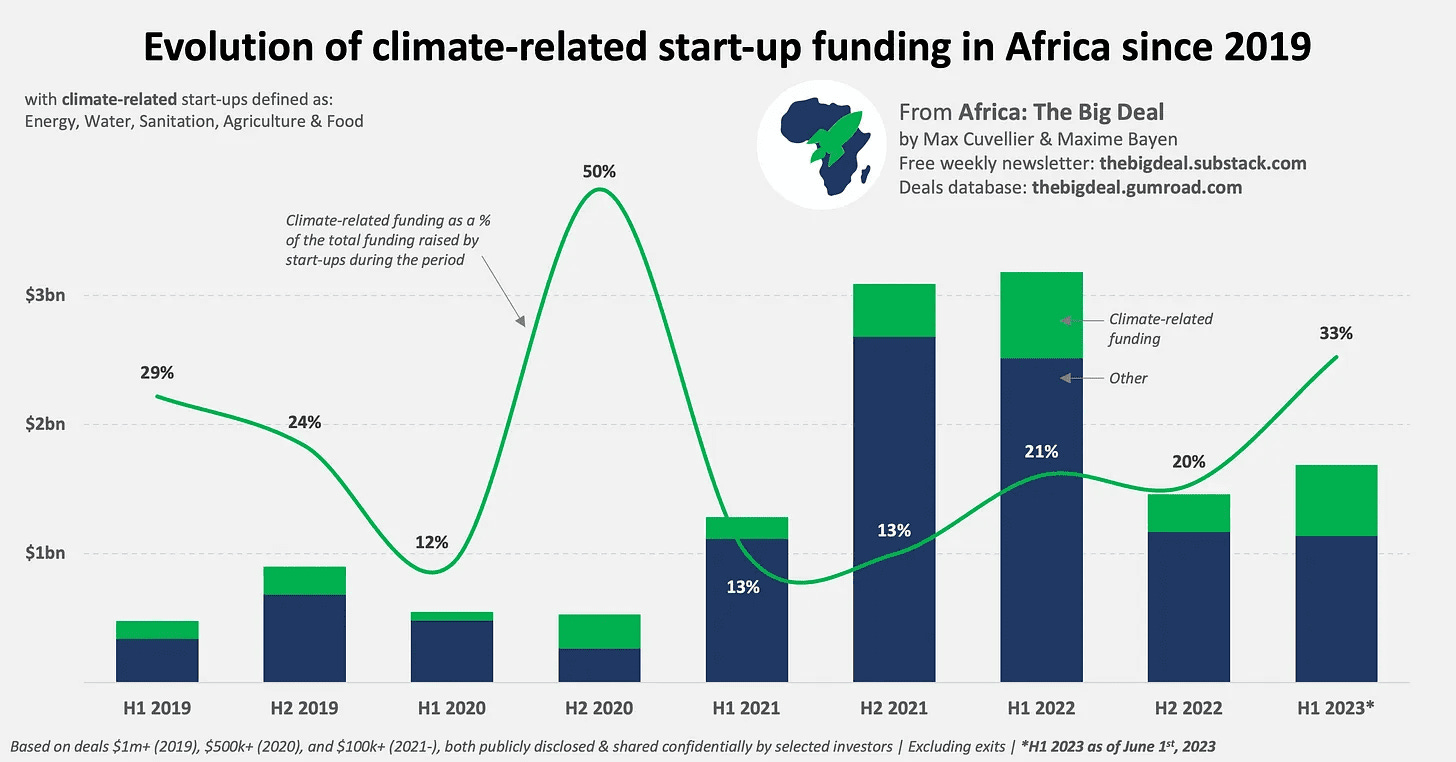

In 2022, climate-tech funding in Africa grew 3.5x to over $860m, making climate Africa’s most funded sector after fintech.

The funding was largely driven by clean energy technologies.

Broadly, the cleantech sector attracted the most foreign direct investment (FDI) flows into Africa, per the Africa Attractiveness Report by global consulting giant EY. (You can read our summary of the report here)

The timing of this surge in climate funding couldn’t be better.

Climate change comes to Africa

The scorching heat waves, drying water sources, and erratic weather patterns are no longer distant nightmares for Africa.

Climate change is here, and its impact is undeniable.

Despite contributing only 3.8% of global greenhouse gas emissions, Africa faces the brunt of climate change’s wrath.

For comparison, China, the United States, and the European Union account for 23%, 19%, and 13% respectively.

Yet in 2019, five of the ten countries most affected were African nations, bearing the consequences of devastating weather disasters.

Mozambique, Zimbabwe, Malawi, South Sudan, and Niger faced devastating weather disasters like Cyclone Idai, fueled by scorching temperatures that heated the Indian Ocean and led to heavy rainfall and flooding.

In East Africa though, rising temperatures have disrupted the traditional rain patterns that make Ethiopia, Northern Kenya, and Somalia green.

The year 2022 marked a record fifth rainless season in a row, leading to severe drought and hunger for millions in the Horn of Africa, where the United Nations estimates that around 13m people are dealing with severe hunger.

By 2050, the continent’s iconic glaciers on Mount Kilimanjaro, Mount Kenya, and the Ruwenzori Mountains will vanish, a stark reminder of the warming planet.

But Africa isn’t sitting idly by.

The continent hosted its first-ever Africa Climate Change Summit in September, culminating in the historic “Nairobi Declaration.”

This declaration saw African leaders commit to combat climate change through increased investments, a carbon tax, and sustainable development goals.

However, the fight requires more than just declarations.

This is where climate-focused tech startups take center stage.

African innovators to the rescue

Over 500 startups have emerged across Africa in the last 15 years, offering innovative solutions in agriculture, clean energy, sustainable materials, e-mobility, and nature-based solutions, per a 2022 report by Briter Bridges.

In Ethiopia, for instance, a booming urban population and single-use plastic have seen waste generation skyrocket from 9,700 tonnes/day in 2015 to 12,200 tonnes/day in 2020.

This trend is fueling environmental and health woes and projections warn this figure could double by 2030.

Enter Kubik.

Founded in 2021, the cleantech startup transforms hard-to-recycle plastic waste into low-carbon, affordable building materials.

Buildings account for up to 40% of total global carbon emissions.

This is because of how building materials are produced, what materials are used, and the properties’ energy efficiency once they’re up and running.

Kubik’s mission is to build clean and affordable living for all, solving Africa’s housing and waste crises simultaneously.

Its solution boasts several advantages:

- Cost-effective: Significantly cheaper than conventional materials

- Time-saving: Constructions are twice as fast as traditional methods

- Eco-friendly: Over 5 times less polluting than cement

In a recent oversubscribed seed round, Kubik secured $3.34 million to fuel its growth and expand its reach.

This investment affirms the potential of Kubik’s solution to tackle waste, improve housing, and protect the environment.

A look at the types of solutions that populate the climate sector reveals that agriculture and energy—specifically pay-as-you-go solar scale-ups—dominate.

However, the space is getting broader with startups addressing a range of issues.

Here are some other startups leading the charge:

- Coliba: Specializing in the collection and recycling of plastic waste, which is converted into granules and then resold to various industries.

- Amini: Bridging the environmental data gap with AI-powered sensors that monitor air quality and water resources.

- Figorr: Tackling food waste through its AI-powered platform that connects farmers with buyers for unsold produce.

- Powerstove: Providing clean and efficient cookstoves that reduce reliance on firewood and improve health.

- Daystar Solar: Bringing affordable solar power to off-grid communities, empowering households and businesses.

- PEG Africa: Offering pay-as-you-go solar home systems, reaching over 1m customers across Ghana, Senegal, Mali, and Ivory Coast.

- M-Kopa: Another Kenyan champion, providing clean energy solutions to off-grid communities through its pay-as-you-go model.

- Solar Freeze: Empowering smallholder farmers with off-grid solar-powered refrigeration to preserve their produce.

- BasiGo: An electric bus company leasing vehicles to bus owners on a pay-as-you-drive model, facilitating the transition to clean mobility without high upfront costs.

The rise of these startups is fueled by a surge in investor backing.

Globally, climate tech ventures are attracting more capital, and Africa is no exception.

Out of the 500 identified climate-tech startups on the continent, 147 have secured funding since 2015.

More so, at least 230 deals over $1m have been signed in the climate-tech space since 2019, just over 20% of all the deals signed in Africa.

Around 73% of this funding went to energy startups.

This trend is set to be further bolstered by the launch of new climate-tech funds over the past year—despite the global VC funding cooldown.

Some of these include…

- Pan-African venture firm Novastar’s $200m Africa People + Planet fund for startups developing agriculture and climate solutions.

- VC firm Equator’s $40m fundraising to back seed and Series A startups in energy, agriculture, and mobility.

- Catalyst Fund’s new climate-focused $30m fund, now investing in its first cohort of startups.

- Satgana, a new climate tech firm launched in late 2022, with plans to allocate up to 40% of its funds to “planet-positive” startups in Africa.

- There’s the $250m AfricaGoGreen Fund (AAGF), which closed the second tranche of its fundraising in February and counts pay-as-you-go solar providers BBOXX and Solarise as part of its portfolio.

- Also, the Energy Entrepreneurs Growth Fund (EEGF), backed by Shell and Canadian investor FinDev, raised $110m for startups that increase access to clean and reliable energy for African households and businesses.

- E3 Capital (formerly Energy Access Ventures)’s Low Carbon Economy Fund for Africa (E3LCEF), hit its first close in May at $48m.

- Oxfam Novib and Goodwell also recently launched a new $22m Pepea fund to provide venture debt to startups in this space.

- Climate venture builder, Persistent Energy, recently closed a $10m Series C funding round to strengthen its team and scale climate activities in Africa.

- Also, the Climate Investment Funds (CIF), implemented by the AfDB, has supported the development of 39 investment plans across 27 African countries to unlock climate action.

These dedicated funds show a sustained commitment to supporting climate-tech innovation in Africa.

While the funding landscape is promising, challenges remain.

Africa still needs more financing for its countries to meet their climate goals by 2030.

Overall climate financing would need to grow from current levels of around $30bn a year to nearly $300bn to meet mitigation and adaptation needs.

Only 14% of total climate finance comes from the private sector, and with only 23 early-stage climate-focused funds in Africa, the pool of investors is limited.

Additionally, the low number of exits (10, all in energy) indicates a long road ahead for commercial capital to enter at scale.

Still, the momentum is undeniable.

Climate-related startups in Africa have raised $3.4bn between 2019-2023, nearly 60% of the total funding volume invested in the much more mature fintech sector.

That, coupled with the emergence of innovative solutions and government-backed initiatives, demonstrates a commitment to tackling climate challenges.

Africa is not just facing the brunt of climate change; it is also becoming a breeding ground for innovative solutions that can inspire the world.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.