2023 Recap: African Largest VC Rounds

3 min Read December 24, 2023 at 2:33 PM UTC

Flagging. That’s how we would describe the African tech startup funding scene in 2023.

Global macro headwinds saw investors cut fewer checks and some reportedly backed down from commitments, forcing a slew of startup shutdowns and downsizing.

While on the surface, it seems Africa’s VC funding figures fell far from 2021 and 2022 levels, available estimates suggest the continent’s startups still managed to attract more than $5 billion.

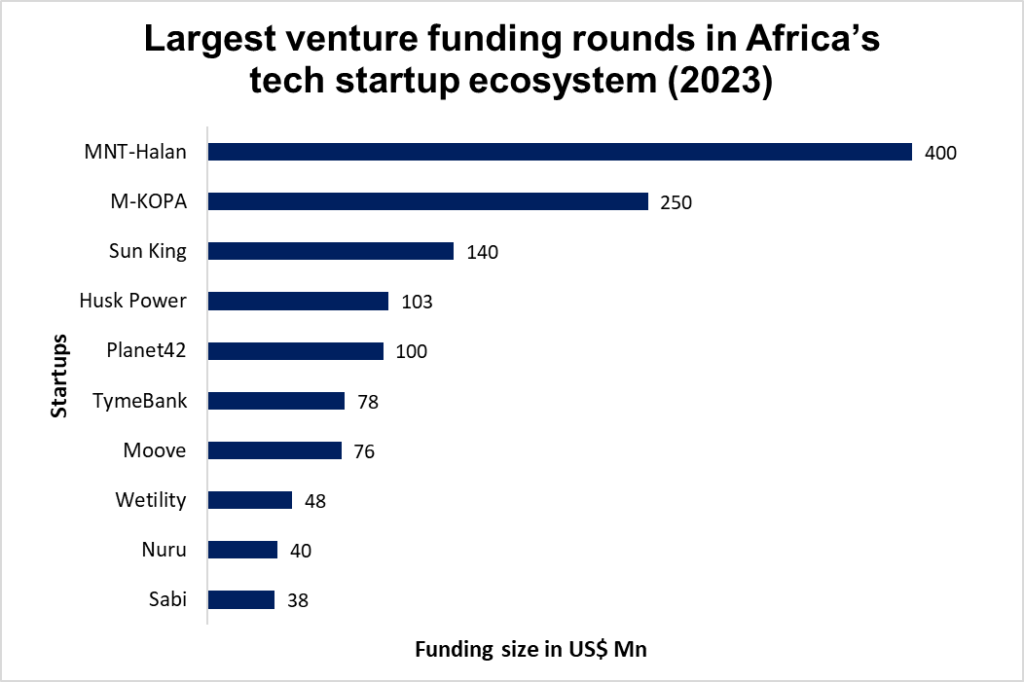

Before the year’s scorecards start to roll out, we take a look at the top 10 largest fundraising rounds in the African tech startup industry this year and the trends they reveal.

Fewer mega-deals (just four >$100m rounds vs nine in 2022):

This signifies a shift towards cautious optimism from investors.

While big bets still happen, they’re rarer, with investors preferring to spread their bets on multiple promising startups.

This could lead to a more sustainable ecosystem, with startups forced to focus on stronger fundamentals and traction before securing large funding rounds.

MNT-Halan‘s $400 million round in Egypt and M-KOPA‘s $250 million in Kenya are rare exceptions, highlighting their established market positions and potential for significant impact.

Fintech takes the top spot but the landscape is more diverse:

Fintech remains a dominant sector due to its potential to address financial inclusion challenges in Africa.

However, other sectors like cleantech and mobility are gaining traction, indicating diversification in investor interest.

This diversification can lead to a more balanced and resilient ecosystem, as the success of the startup scene is not solely dependent on one sector.

The presence of Husk Power, Wetility, Nuru, Planet42, and Moove in the top 10 shows the growing importance of these sectors in attracting investor attention.

The rising prominence of debt + equity rounds:

This hybrid approach combines the flexibility of equity with the stability of debt, offering startups a more tailored financing solution.

It can be particularly useful for startups with strong revenue models but limited access to traditional equity funding.

This trend could democratize access to funding for startups, especially in emerging markets, as it caters to startups at different stages of growth and risk profiles.

MNT-Halan, M-KOPA, Planet42, and Moove all used debt + equity rounds, demonstrating the growing popularity of this approach.

Geographical distribution

The top 10 deals primarily focus on South Africa, Kenya, and Nigeria, showcasing the continued dominance of these countries in the African startup scene.

The Democratic Republic of Congo (DRC) emerged as a surprise entry in the top 10 thanks to Nuru‘s sizable Series B round.

Series B dominance

The majority of deals being Series B raises indicates a focus on mature startups with proven traction and scalability, further highlighting likely investor risk aversion.

Overall, the top 10 fundraising rounds paint a picture of a resilient African tech ecosystem adapting to a challenging global environment.

While mega-deals were scarce, the diversity of sectors, financing models, and geographical representation suggests potential for sustainable growth in the long term.

Stay tuned to our blog for a broader piece that explores standout trends in Africa’s tech landscape in 2023 and our high-conviction themes for the new year—to be published soon!

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.