ETFs in Africa: A Complete Investing Guide

8 min Read June 27, 2024 at 10:00 AM UTC

When it comes to African ETFs, these funds typically track indices that represent a basket of African companies or specific sectors within the African economy.

The global investment community is increasingly turning its attention to the African continent, recognizing its immense growth potential and diverse economic opportunities.

As a result, a growing number of Exchange-Traded Funds (ETFs) now feature significant African stock holdings, providing investors with a convenient way to tap into this emerging market.

However, it’s crucial to understand that Africa is not a homogeneous entity. It’s a vast continent comprising 54 countries, each with its unique cultural, political, and economic landscape. This diversity presents both opportunities and challenges for investors looking to gain exposure to African markets.

For those seeking to add African investments to their portfolio, ETFs offer an excellent entry point. This comprehensive guide will help you understand what African ETFs are, how they work, and how you can leverage them to achieve your investment goals.

Also Read: What is an Exchange-Traded Fund (ETF)?

Demystifying African ETFs: Structure and Function

Exchange-traded funds (ETFs) are investment vehicles that aim to replicate the performance of a specific market index or commodity.

When it comes to African ETFs, these funds typically track indices that represent a basket of African companies or specific sectors within the African economy.

Key Features of African ETFs

Diversification: African ETFs provide exposure to a range of companies across different countries and sectors, helping to spread risk.

Liquidity: ETFs are traded on stock exchanges, offering investors the ability to buy and sell shares throughout the trading day.

Transparency: Most ETFs disclose their holdings daily, allowing investors to know exactly what they own.

Cost-efficiency: Generally, ETFs have lower expense ratios compared to actively managed mutual funds.

Accessibility: Investors can gain exposure to African markets without the complexities of direct stock ownership in foreign markets.

Types of ETFs

Simple ETFs: These funds directly hold the stocks that make up the index they track. They are often more cost-effective and straightforward.

Complex ETFs: These may use derivatives or other strategies to achieve their investment objectives. While potentially offering unique benefits, they may carry additional risks and costs.

Investors should carefully consider which type aligns best with their investment strategy and risk tolerance.

The African ETF Market: Available Options

The African ETF market, while still developing, offers a range of options for investors. Here’s an overview of some key players in this space:

Continental Titans: Broad-Based African ETFs

The Vanguard FTSE Africa Index Fund ETF (KWA)

KWA stands out as the largest African ETF by assets under management (AUM), boasting $2.5 billion. This fund provides exposure to 40 major companies across the continent, including giants like South Africa’s Standard Bank and Nigeria’s First Bank.

Key features of KWA:

- Broad continental exposure

- Focus on large-cap stocks

- Relatively low expense ratio of 0.08%

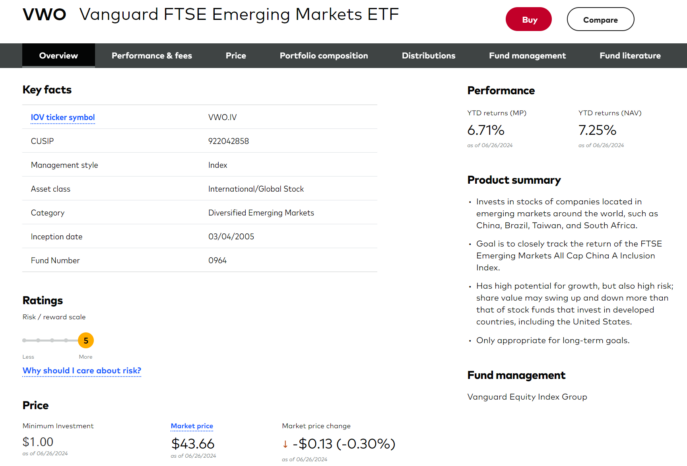

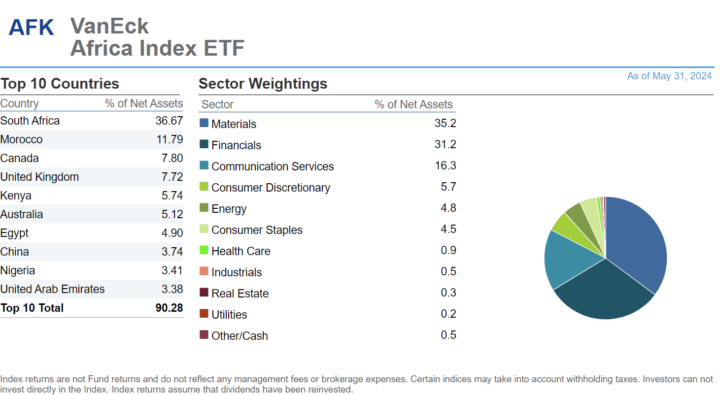

The VanEck Africa Index ETF (AFK®)

AFK seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS® GDP Africa Index (MVAFKTR), which includes local listings of companies that are incorporated in Africa and listings of companies incorporated outside of Africa but that have at least 50% of their revenues/related assets in Africa.

Key features of AFK:

- Continental exposure to Africa’s largest economies

- Focus on large-cap stocks and sector diversity

- An expense ratio of 1.13%

Country-Specific Opportunities: Targeted African ETFs

For investors seeking exposure to specific African economies, some ETFs focus on individual countries:

iShares MSCI South Africa ETF (EZA)

The iShares MSCI South Africa ETF seeks to track the investment results of an index composed of South African equities. It offers exposure to large and mid-sized companies in South Africa, targeted access to the South African stock market, and is used to express a single-country view.

Until its recent liquidation, BlackRock operated the $400 million iShares ETF in Nigeria and Kenya.

These country-specific ETFs allow investors to target economies they believe have particular growth potential or to diversify their African exposure across multiple country-focused funds.

Commodity or Sector-Specific African ETFs

Some ETFs focus on particular sectors within the African economy or certain commodities.

Market Vectors Africa Index ETF (AFK)

The ETF provides exposure to publicly traded companies that are headquartered in Africa or generate the majority of their revenues in Africa.

NewGold Exchange Traded Fund (ETF)

The NewGold Exchange Traded Fund (ETF) enables investors to invest in a debt instrument, the value of which tracks the price of gold.

Sector-specific ETFs can be useful for investors who have insights into particular industries or want to capitalize on specific economic trends within Africa.

Mitigating Risk: Currency-Hedged African ETFs

Investing in foreign markets always involves currency risk. When you invest in a standard African ETF, you’re not only exposed to the performance of the underlying stocks but also to fluctuations in the exchange rate between your home currency and the currencies of the African countries represented in the ETF.

Currency-hedged ETFs aim to mitigate this risk. These funds use various financial instruments to offset the impact of currency fluctuations on the ETF’s performance.

For example, the hypothetical Vanguard FTSE Africa Hedged Index Fund ETF (VFA) would aim to provide the returns of African stocks while minimizing the impact of currency movements.

Key benefits of currency-hedged ETFs:

- Reduced volatility from currency fluctuations

- Clearer focus on the performance of the underlying stocks

- Potential for more stable returns in times of currency market turbulence

However, it’s important to note that hedging can also limit potential gains if the African currencies appreciate against your home currency.

African ETF Indices: The Backbone of Fund Construction

Most African ETFs are built around two primary indices:

MSCI Emerging and Frontier (EFM) Africa Top 50 Capped Index

- Tracks the 50 largest companies from emerging and frontier markets in Africa

- Caps the weighting of individual countries and companies to ensure diversification

- Provides a balanced exposure to the continent’s largest economies

- Follows 30 large stocks listed in Africa or predominantly exploring African assets

- Equally exposed to three zones: South Africa, Northern Africa (including Morocco and Egypt), and Sub-Saharan Africa (excluding South Africa)

- Caps individual constituents at 10% to prevent overconcentration

These indices provide different approaches to capturing the African market, allowing investors to choose the exposure that best fits their investment thesis.

How to Invest in African ETFs

Investors have several options for adding African ETFs to their portfolios:

Traditional Brokerage Accounts: Most major online brokerages offer access to a wide range of ETFs, including those focused on Africa. Investors can purchase shares of African ETFs just as they would any other stock or ETF.

Robo-Advisors: Some robo-advisor platforms have begun including African ETFs in their automated portfolio allocations, particularly for investors seeking emerging market exposure.

Digital Investment Platforms: The rise of fintech in Africa has led to new, innovative ways to invest in African markets. Daba, for instance, allows investors from everywhere to buy shares of African companies and ETFs on the regional BRVM stock exchange and provides educational resources to help investors understand African markets.

Embracing the African Opportunity

As Africa continues to develop and its economies mature, ETFs offer an attractive way for investors to participate in this growth.

Whether you choose broad market ETFs for continental exposure, country-specific funds to target particular economies or leverage new digital platforms for more granular access, there are numerous options to align with your investment strategy.

Key Takeaways on Investing in African ETFs

- Understand the diversity of African economies and the varying risk profiles

- Consider your investment goals and risk tolerance when selecting ETFs

- Explore both traditional and innovative platforms for accessing African ETFs

- Stay informed about economic and political developments that may impact African markets

- Consider consulting with a financial advisor to ensure African ETFs fit within your overall investment strategy

As with any investment, thorough research and careful consideration are essential. African ETFs can offer exciting growth potential and diversification benefits, but they also come with unique risks.

By taking a thoughtful, informed approach, investors can potentially benefit from Africa’s economic journey while building a more globally diversified portfolio.

For those looking to invest in foreign stocks listed on the BRVM with ease and expert guidance, Daba offers a platform that simplifies the process, providing access to a wide range of stocks, bonds, ETFs, and investment services.

You can download the Daba Investment app from the Play Store. If you are an iPhone user, you can also download the Daba investment app from the App Store.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.