Diaspora Dollars to Africa: Scaling Up Business & Impact

3 min Read February 29, 2024 at 12:28 AM UTC

Africa’s business ecosystem holds immense potential but still faces capital gaps. Bridging this through diaspora investment can accelerate growth while providing compelling social impact opportunities.

The African startup and small business (SME) ecosystem holds immense growth potential but still faces challenges in accessing the patient capital needed to thrive.

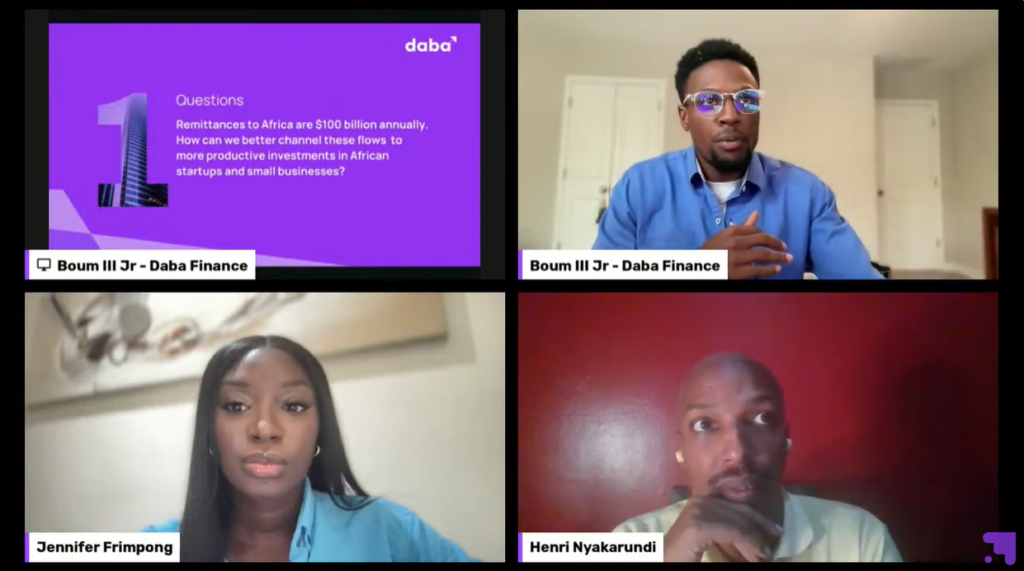

This was the key takeaway from a recent hour-long webinar hosted by Daba Finance focused on empowering African enterprises through diaspora investment.

With a young, tech-savvy population, rapidly growing middle class, and abundance of social and environmental challenges to solve – the opportunities for impact and returns are plentiful. However, critical funding gaps persist.

Bridging the Diaspora Capital Gap

With over $100 billion in remittances sent annually from the widespread African diaspora back to the continent, there is vast potential to channel these funds into promising early-stage ventures.

However, issues like lack of awareness, trust, negative perceptions, and quality deal access have hampered this.

Venture funding in Africa remains heavily skewed towards later stages, while early-stage startups struggle to raise pre-seed and seed funding to refine products and gain initial traction.

As discussed by expert panelists Jennifer Frimpong of Ma Adjaho & Co and ARED CEO Henri Nyakarundi during Part 1 of our Diaspora investment-focused webinar series, cultural familiarity bias also plays a role.

Diaspora investors often gravitate towards opportunities in their countries of origin due to personal ties and familiarity. But this limits the scope of potential investments.

Building trust and awareness for platforms like Daba that conduct rigorous due diligence and open access to thoroughly vetted, transparent deals across Africa is critical to overcoming this bias.

Empowering Startups and Investors in Africa

Frimpong explained that Startups need more support “professionalizing” to “investment readiness” to attract diaspora capital.

From sharpening their value propositions to refining financial modeling and crafting compelling pitches – startups need hands-on nurturing.

With the right acceleration of high-potential ventures, sectors from agribusiness to fintech, e-commerce, and beyond can offer diasporans compelling opportunities with social impact.

Seizing Africa’s Growth Momentum

Africa’s startup scene is set to thrive over the next decade, especially with the power of the diaspora and platforms like Daba expanding early-stage funding access.

But realizing this immense potential requires collective action across public, private, and non-profit spheres to foster entrepreneurial talent and inject growth capital into the ecosystem.

We encourage all those looking to support African enterprises – whether through investment, policy reform, incubation, or other means – to learn more and get involved and in touch.

The time is now to funnel diaspora capital into the continent’s brightest ventures. With coordinated efforts, Africa’s startup ecosystem can transform economies and uplift millions.

If you could not join the webinar or would like to watch it again, you can catch the recording on our YouTube channel. And to find more about how Daba enables investing in Africa opportunities for individual and institutional investors, visit our webpage or get our mobile app.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.