How Daba’s Recurring Investment Can Help You Build Long-Term Wealth

5 min Read June 15, 2025 at 11:41 PM UTC

Investing in Africa’s growing stock markets—especially the BRVM (Bourse Régionale des Valeurs Mobilières)—has never been easier, safer, or more consistent.

With the launch of Daba Recurring Investment, investors now have access to a simple yet powerful investment strategy known as Dollar-Cost Averaging (DCA). This new feature helps users consistently build wealth over time, without worrying about timing the market or reacting emotionally to daily price changes.

Here’s everything you need to know about Daba Recurring Investment, how it works, and why it’s a must-have tool for long-term investors across Africa and the diaspora.

What Is Daba Recurring Investment?

Daba Recurring Investment is an automated investing feature that allows you to invest a fixed amount regularly—weekly or monthly—into your chosen assets on the Daba platform.

This is essentially Dollar-Cost Averaging (DCA): a time-tested investing strategy where you buy more shares when prices are low and fewer shares when prices are high, ultimately reducing the average cost per share over time.

Instead of trying to guess the right time to invest in top-performing African stocks like Orange Côte d’Ivoire, Ecobank Côte d’Ivoire, or Société Générale Sénégal, Daba helps you stay disciplined, consistent, and less stressed by making your investing automatic.

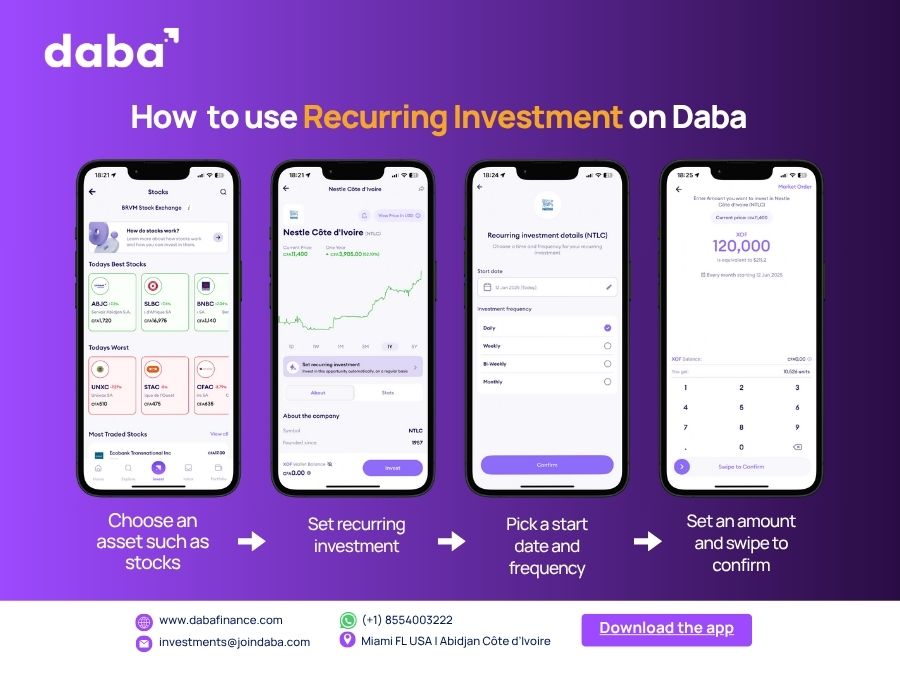

How Daba Recurring Investment Works

- Choose an Asset: Select a stock or a managed fund listed on the Daba mobile application

- Set Recurring Investment: Click on the option to enable you to automatically invest in the asset regularly.

- Pick a Start Date and Frequency: Choose a start date and the frequency of your investments (e.g., daily, weekly, bi-weekly, or monthly).

- Set an Amount and Swipe to Confirm: Decide how much money you want to invest regularly—say, 10,000 FCFA ($15 or 15 Euros) every month. Ensure you have sufficient funds in your wallet. Daba will automatically invest your chosen amount at the set interval, regardless of market conditions.

Over time, this builds a strong habit of investing, removes emotions from decision-making, and gives you better average prices.

Benefits of Daba Recurring Investment

- No Need to Time the Market: You don’t have to worry about when to invest. The system buys regularly, smoothing out price fluctuations.

- Lower Average Purchase Cost: DCA helps you buy more shares when prices are low and fewer when prices are high, improving long-term returns.

- Emotion-Free Investing: Markets can be volatile. Recurring investing keeps you disciplined, reducing panic-selling or fear-driven delays.

- Ideal for New and Busy Investors: You don’t need to be an expert or monitor the markets every day. Just set it and let it work for you.

- Perfect for BRVM Investing: Given the relatively low liquidity and visibility of African exchanges like the BRVM, recurring investments provide a low-risk entry into high-growth assets.

Who Should Use Daba Recurring Investment?

This strategy is ideal for:

- First-time investors who want to build wealth gradually without needing large sums upfront.

- Busy professionals who want to automate their financial goals without tracking market trends daily.

- Long-term investors who believe in Africa’s growth and want to invest consistently over the years.

- Diaspora investors looking to support and benefit from African capital markets in a structured, low-stress way.

Special Considerations

While dollar-cost averaging with Daba Recurring Investment is powerful, there are a few things to keep in mind:

- You still need to pick the right investments: Automating poor investment choices won’t help your portfolio. Daba’s research and managed portfolios can guide you.

- You must stay consistent: Skipping deposits during market dips defeats the purpose. Volatility is when DCA shines.

- Transaction costs: If you’re investing in individual stocks with small amounts, be mindful of fees. Luckily, Daba offers low-cost investing across most assets.

Example of Dollar-Cost Averaging with a BRVM Stock

Let’s say you decide to invest 50,000 FCFA monthly into Orange Côte d’Ivoire stock through Daba Recurring Investment:

| Month | Share Price (FCFA) | Amount Invested (FCFA) | Shares Bought |

| Jan | 1,850 | 50,000 | 27.03 |

| Feb | 2,100 | 50,000 | 23.81 |

| Mar | 3,200 | 50,000 | 15.63 |

| Apr | 4,500 | 50,000 | 11.11 |

| May | 5,200 | 50,000 | 9.62 |

| Jun | 5,790 | 50,000 | 8.64 |

| Total | — | 300,000 | 95.84 |

Average price per share = 300,000 / 95.84 ≈ 3,130 XOF

Current portfolio value (June 12, 2025): 95.84 × 5,790 = 554,913 XOF

Total return: 254,913 XOF profit (+85% gain)

Comparison: Lump Sum vs Dollar-Cost Averaging

If you had invested a lump sum of 300,000 XOF at different times:

- January (1,850 XOF): Would have bought 162.16 shares

- Current value: 162.16 × 5,790 = 938,906 XOF (+213% gain)

- March high (3,200 XOF): Would have bought 93.75 shares

- Current value: 93.75 × 5,790 = 542,813 XOF (+81% gain)

- June (5,790 XOF): Would have bought 51.81 shares

- Current value: 51.81 × 5,790 = 300,000 XOF (0% gain)

Key Insights from Example

Dollar-cost averaging with Filtisac provided:

- Reduced risk compared to lump sum investing at market highs

- Steady accumulation of shares despite price volatility

- Average entry price of 3,130 XOF – significantly lower than recent highs

- Protection against poor timing – even with Filtisac’s exceptional 213% YTD performance

Dollar-cost averaging helps smooth out volatility and can be particularly effective with high-performing but volatile stocks like Filtisac.

How Will I Use Dollar Cost Averaging in Real Life?

- As a young professional, you can set aside part of your salary each month to invest in blue-chip BRVM stocks.

- As a member of the African diaspora, you can automatically invest in West African markets, building your portfolio while supporting the region’s growth.

- As a student learning to invest, you can start with just 5,000 FCFA/month—building good habits and seeing your capital grow without high risk.

Getting Started

Daba Recurring Investment puts the power of Dollar-Cost Averaging into your hands, tailored for African markets.

Whether you’re a beginner or a seasoned investor, this feature helps you stay consistent, lower your average cost, and build long-term wealth without overthinking or stressing about timing.

Start your journey with Daba today, and let your money work for you—automatically, strategically, and locally.

📲 Download the Daba app now and activate your Recurring Investment in just a few taps.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.