How to Invest in African Bonds: A Guide for Investors

5 min Read February 7, 2025 at 3:35 AM UTC

African bonds offer high yields and stable returns, making them attractive for both local and international investors and smart choice for yield-seekers.

Investing in bonds is one of the most stable and predictable ways to grow your wealth.

Unlike stocks, which can be volatile, bonds offer fixed income and are considered lower-risk investments. But how do bonds work, especially in the primary market, where they are first issued?

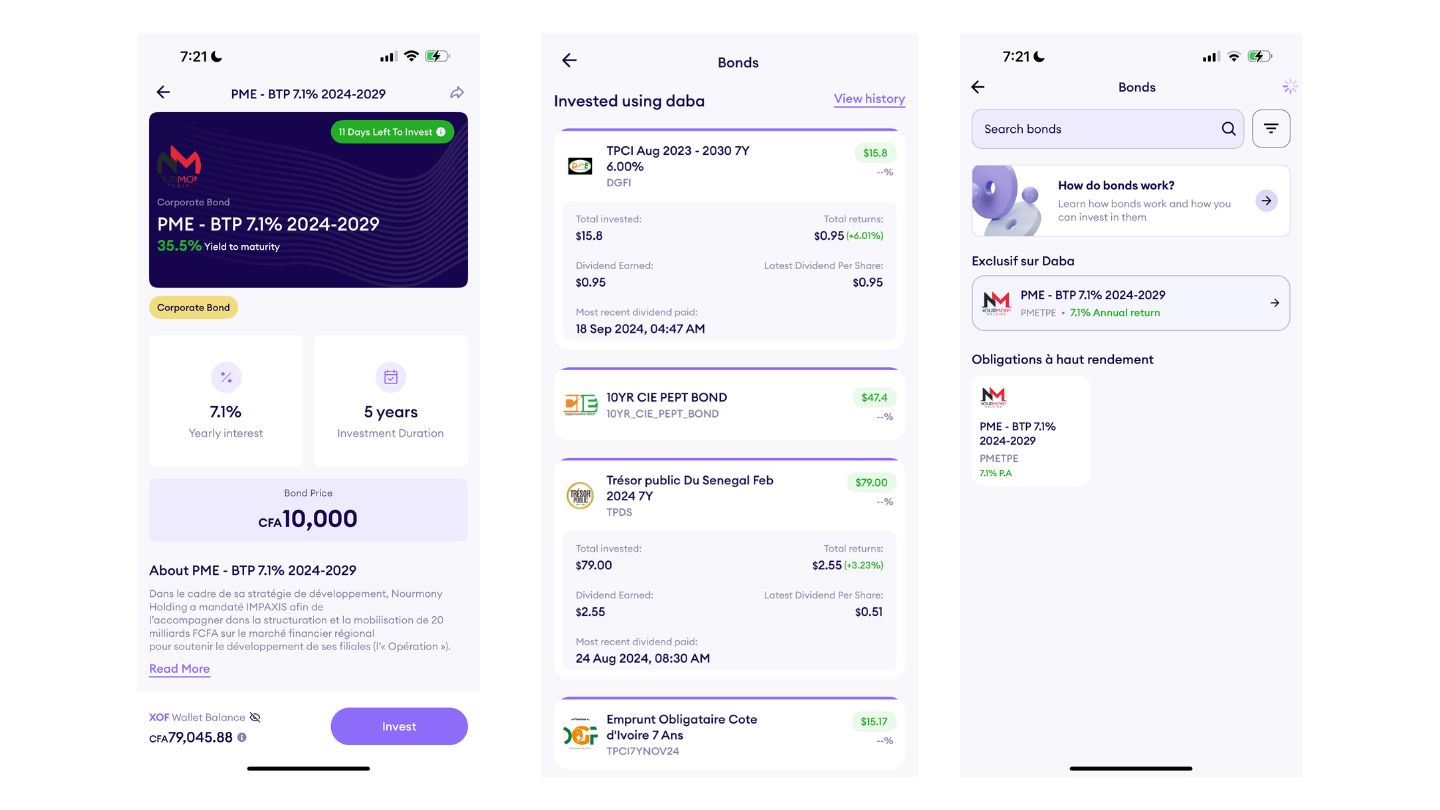

In this guide, we’ll break it down step by step, making it easy for you to understand how to invest in bonds through Daba’s platform.

What Are Bonds?

A bond is essentially a loan that you, as an investor, give to a government, corporation, or institution. In return, they promise to pay you back the money (called the principal) on a specific date, along with regular interest payments (coupons) for lending them the money.

Why Invest in African Bonds?

African bonds offer high yields and stable returns, making them attractive for both local and international investors.

For Local Investors: Higher yields than savings accounts, providing better passive income and stability.

For International Investors: Diversified fixed-income exposure with higher returns than developed markets.

For example, Côte d’Ivoire’s Eurobonds yield 6-9%, outperforming many global bonds while offering economic stability and regular payouts.

With strong growth and rising global interest, African bonds are a smart choice for yield-seeking investors.

Primary Market vs. Secondary Market

- Primary Market – This is where new bonds are issued for the first time. Investors buy directly from the issuer (government or company).

- Secondary Market – This is where existing bonds are traded between investors after being issued.

Let’s walk through how you can participate in a bond issuance step by step.

Step 1: Issuance of a Bond (Government or Corporate)

Bonds are typically issued by governments or corporations that need to raise capital. They set the bond terms, including:

- Face Value (Par Value): The amount you’ll get back at maturity (e.g., $1,000).

- Interest Rate (Coupon Rate): The fixed annual return you’ll earn (e.g., 7% per year).

- Maturity Date: The date when the issuer will repay your initial investment.

- Minimum Investment Amount: Some bonds require a minimum purchase amount.

Governments and companies often work with banks or investment platforms like Daba to sell these bonds to investors.

Step 2: Subscription Period – Investors Apply to Buy the Bonds

When a bond is issued in the primary market, there’s a subscription period (usually a few weeks) where investors can place orders.

On Daba’s platform, this works as follows:

- Browse Available Bonds – Log into Daba and explore the listed bonds. Each listing includes key details like interest rate, duration, and minimum investment amount.

- Select a Bond – Choose the bond that fits your investment goals (e.g., government bonds for stability or corporate bonds for higher returns).

- Place Your Order – Enter the amount you want to invest and submit your request during the subscription period.

Once the subscription period closes, the issuer will allocate the bonds to investors.

Step 3: Bond Allocation and Settlement

After the subscription period ends, the issuer finalizes the list of investors and allocates the bonds accordingly. If demand is high, you might get only a portion of the bonds you requested.

Settlement Process:

- You transfer funds to purchase the allocated bonds.

- The bonds are issued and registered in your name.

- The issuer confirms the transaction, and your investment officially begins.

On Daba, once settlement is complete, you will see the bond in your portfolio.

Step 4: Receiving Interest Payments (Coupon Payments)

After you purchase a bond, you start earning regular interest payments (typically every 6 months or annually). These payments are deposited directly into your Daba account, providing a steady income stream.

Step 5: Maturity and Principal Repayment

When the bond matures, the issuer pays back the full face value of the bond. If you invested $1,000, you’ll get your $1,000 back, plus all the interest you earned over the period.

At this point, you can either reinvest in a new bond or withdraw your funds.

Why Invest in Bonds on Daba?

Secure and Predictable Returns: Bonds provide a steady fixed income, making them great for conservative investors.

Access to African Bond Markets: Daba allows you to easily invest in bonds issued across Africa, whether government or corporate.

User-Friendly Process: Daba simplifies bond investing by offering an intuitive platform where you can browse, invest, and track your returns seamlessly.

What Happens After I Invest in a Bond on Daba?

Once you invest in a bond on Daba, you have two options:

- Hold Until Maturity – You’ll receive semi-annual or annual interest payments based on the bond’s terms, and at maturity, you’ll get back the principal amount.

- Sell on the Secondary Market – If you want to exit before maturity, you can sell your bond on Daba’s platform at the prevailing market price.

This flexibility allows you to earn passive income or trade your bonds based on your investment strategy.

Final Thoughts

Investing in bonds on the primary market is a straightforward way to earn passive income while preserving capital. With Daba, you get access to a range of secure, high-yielding bonds across Africa, all from one platform.

Ready to invest? Sign up on Daba today and start growing your wealth with bonds!

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.