Inside BRVM Best-Performer Servair Abidjan Strong Start to Year

3 min Read July 3, 2024 at 8:24 AM UTC

Starting the year with a share price of 1,330 XOF ($2.18), Servair has gained 51.9% in price, ranking first on the BRVM in terms of year-to-date performance.

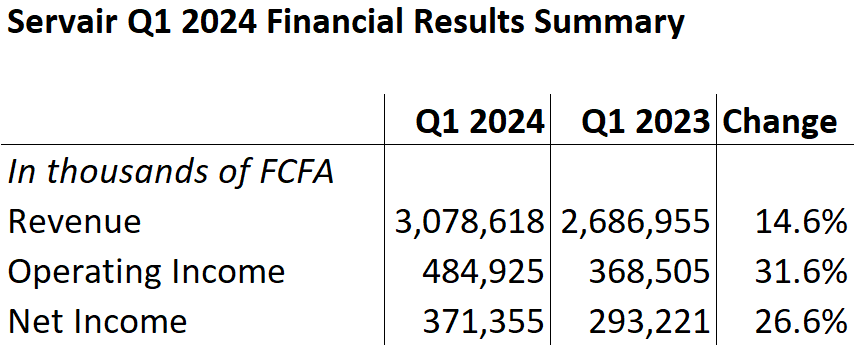

Servair Abidjan, a public limited company headquartered at Felix Houphouet Boigny Airport in Abidjan, Côte d’Ivoire, has reported an impressive financial performance for the first quarter of 2024.

This robust start to the year highlights significant improvements in revenue and profitability, driven by strategic initiatives and favorable market conditions.

Also Read: Best Performing Stocks on BRVM: H1 2024 Market Recap

Financial Highlights

Quarterly Activity Report

The company’s activities in the first quarter were significantly bolstered by the Africa Cup of Nations (CAN), held in January and February 2024 in Côte d’Ivoire. This major event contributed to a 15% increase in revenue compared to the same period last year.

Servair Abidjan’s net income for Q1 2024 reached 371 million FCFA, marking a 26.6% improvement over Q1 2023. This was achieved through the combined effect of the CAN event and the implementation of action plans to counter inflation.

In addition, the company launched a strategy to develop non-aviation business, starting with a collective catering contract (GMP) in March 2024.

Strategic Initiatives

Servair Abidjan has demonstrated its ability to capitalize on major events and strategic initiatives to boost financial performance.

The signing of a DSP (Délégation de Service Public) royalty agreement at the end of March 2024, with the promulgation process underway, underscores the company’s proactive approach to expanding its business portfolio.

Stock Performance

Servair Abidjan’s impressive financial performance is reflected in its stock (ABJC) performance.

The company closed its last trading day (Tuesday, July 2, 2024) at 2,020 XOF per share on the BRVM.

Starting the year with a share price of 1,330 XOF, Servair Abidjan has gained 51.9% in price valuation, ranking first on the BRVM in terms of year-to-date performance.

Shareholders have reasons to be optimistic, as the stock has accrued 10% over the past four-week period, making it the sixth-best performer on the BRVM. This strong performance highlights the potential for growth and the attractiveness of investing in Servair Abidjan.

You may have missed out on the ABJC rally but with weekly stock recommendations offered by Daba Pro, you can spot and take advantage of opportunities like this before others. TAP HERE to get our premium service for informed investment decisions.

Significance for the Industry and Potential Investors

Servair Abidjan’s impressive performance is a testament to the resilience and potential of the aviation and catering industry in Africa.

The company’s ability to leverage major events, implement strategic initiatives, and expand into non-aviation sectors demonstrates a robust business model and growth strategy.

For potential investors, Servair Abidjan presents a compelling investment opportunity. The company’s strong financial results, coupled with its impressive stock performance, highlight its potential for long-term growth and profitability.

Investors looking to tap into this opportunity can easily buy and trade BRVM stocks like Servair Abidjan using the Daba platform, which offers a convenient way to invest in high-performing stocks on the BRVM, providing access to dynamic and rapidly growing markets.

Conclusion

Servair Abidjan’s Q1 2024 report reflects a strong start to the year, with significant revenue and net income growth. The positive impact of the Africa Cup of Nations and strategic initiatives to diversify into non-aviation businesses have contributed to these results.

The company’s proactive approach to countering inflation and expanding its business portfolio positions it well for continued growth in the coming quarters.

For investors, the company’s impressive stock performance and strong financial health make it an attractive investment.

Platforms like Daba offer a convenient way to invest in Servair Abidjan and other high-performing BRVM stocks, providing access to promising investment opportunities in Africa’s dynamic markets.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.