SAPH Sees Six-Week Stock Surge After Decent Q1 2024

5 min Read July 10, 2024 at 1:10 PM UTC

The stock ranks third on the BRVM in terms of year-to-date share price growth, having surged 26.8% since starting the year at 2,350 XOF.

SAPH, a leading company in the natural rubber industry headquartered in Abidjan, Côte d’Ivoire, has reported a strong financial performance for the first half of 2024.

This period saw significant revenue growth, driven by increased production and favorable global market conditions.

Here’s a detailed look at SAPH’s performance, its significance for the industry, and potential investment opportunities.

Financial Highlights

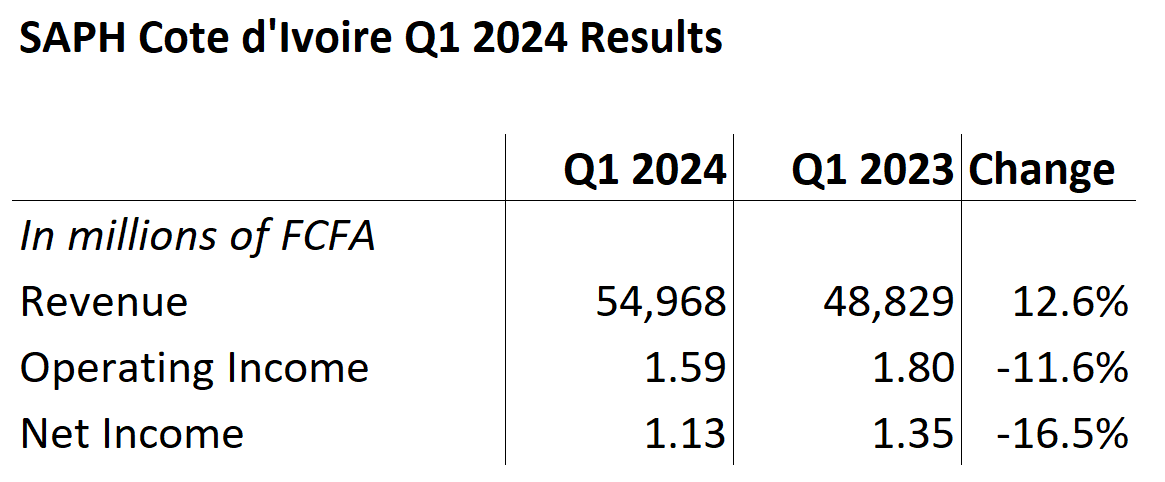

Revenue Growth:

- Q1 2024: XOF 54.968 billion

- Q1 2023: XOF 48.829 billion

- Change: +13% (XOF 6.139 billion)

Operating Income:

- Q1 2024: XOF 1.592 million

- Q1 2023: XOF 1.801 million

- Change: -12% (XOF -209 million)

Net Income:

- Q1 2024: XOF 1.126 million

- Q1 2023: XOF 1.349 million

- Change: -17% (XOF -223 million)

Net Income to Revenue Ratio:

- Q1 2024: 2%

- Q1 2023: 3%

Key Insights

Revenue Growth:

SAPH achieved revenue of XOF 54.968 billion in Q1 2024, reflecting a 13% increase compared to Q1 2023. This growth is primarily due to an 11% increase in production sold, with a limited impact from the average sales price.

Operating and Net Income:

Despite the increase in revenue, the operating income and net income declined by 12% and 17%, respectively. This decline is attributed to higher operating expenses related to lower stock levels and increased costs due to inflation and tax levies.

Global Rubber Market Trends:

The average price of rubber increased by 15%, from USD 1.3737 per kilogram in Q1 2023 to USD 1.5737 per kilogram in Q1 2024. This upward trend in global rubber prices has positively influenced SAPH’s revenue.

Market Outlook:

The resurgence in global rubber consumption observed since early 2024 could be impacted by the new crisis in the Middle East, prompting a cautious outlook for the remainder of the year.

SAPH plans to commercialize rubber compliant with the new European Union Deforestation Regulation (EUDR) from July 2024, which is expected to enhance its sales price and create value in the second half of the year.

Also Read: Best Performing Stocks on BRVM: H1 2024 Market Recap

Strategic Initiatives

Production Increase:

SAPH’s growth in production sold highlights its ability to scale operations and meet increasing demand, contributing significantly to the revenue increase.

Cost Management:

The rise in operating expenses due to inflation and fiscal charges underscores the need for effective cost-management strategies to maintain profitability.

Compliance and Market Adaptation:

The introduction of EUDR-compliant rubber positions SAPH to capitalize on regulatory changes and potentially command higher prices in the European market.

Stock Performance

SAPH’s (SPHC) impressive financial performance is mirrored in its stock performance. The company closed its last trading day (Monday, July 8, 2024) at 2,980 XOF per share on the BRVM Exchange, recording a 0.5% drop from its previous closing price of 2,995 XOF.

Starting the year with a share price of 2,350 XOF, SAPH has gained 26.8% in price valuation, ranking it third on the BRVM in terms of year-to-date performance.

Shareholders have reasons to be optimistic, as the stock has accrued 23% over the past four-week period alone, making it the best performer on the BRVM in this timeframe.

This strong performance highlights the potential for growth and the attractiveness of investing in SAPH.

What This Means for Investors

SAPH’s robust performance underscores the resilience and potential of the natural rubber industry in Africa.

The company’s ability to leverage global market trends, implement strategic initiatives, and expand production demonstrates a solid business model and growth strategy.

For potential investors, SAPH presents a compelling investment opportunity. The company’s strong financial results, coupled with its impressive stock performance, highlight its potential for long-term growth and profitability.

Investors looking to tap into this opportunity can easily buy and trade BRVM stocks like SAPH using the Daba platform. Daba offers a convenient way to invest in high-performing stocks on the BRVM, providing access to dynamic and rapidly growing markets.

Get Premium Investment Insights with Daba Pro

While some investors may have missed out on this rally, Daba Pro, a premium subscription service, is designed to help navigate the complex and dynamic world of African stocks with confidence. With Daba Pro, investors can spot opportunities like this before the rally, ensuring they stay ahead of the market and make informed investment decisions.

SAPH’s Q1 2024 report reflects strong revenue growth driven by increased production and favorable global rubber prices. However, the decline in operating and net income due to higher operating expenses indicates challenges in cost management.

The company’s strategic move to commercialize EUDR-compliant rubber from July 2024 could enhance its market position and profitability in the second half of the year.

For investors, the company’s impressive stock performance and strong financial health make it an attractive investment. Platforms like Daba offer a convenient way to invest in SAPH and other high-performing BRVM stocks, providing access to promising investment opportunities in Africa’s dynamic markets.

*1 USD = 609.4 XOF as of Tuesday, July 9, 2024

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.