WAEMU Q1 GDP Growth: A Robust Start to 2024

5 min Read August 2, 2024 at 2:16 PM UTC

The region’s Q1 2024 growth is slightly lower compared to Q1 2023 but it shows an upward trend from the previous quarter.

The West African Economic and Monetary Union (WAEMU) recorded robust economic performance in the first quarter of 2024, per a recent report from the regional central bank BCEAO (Central Bank of West African States).

WAEMU, comprising eight member states including Benin, Burkina Faso, Côte d’Ivoire, Guinea-Bissau, Mali, Niger, Senegal, and Togo, maintained a positive growth trajectory, making it an attractive region for investment.

This report delves into the detailed GDP growth across the member countries, highlighting the economic trends, sectoral contributions, and implications for potential investors.

GDP Growth Analysis

Aggregate GDP Growth

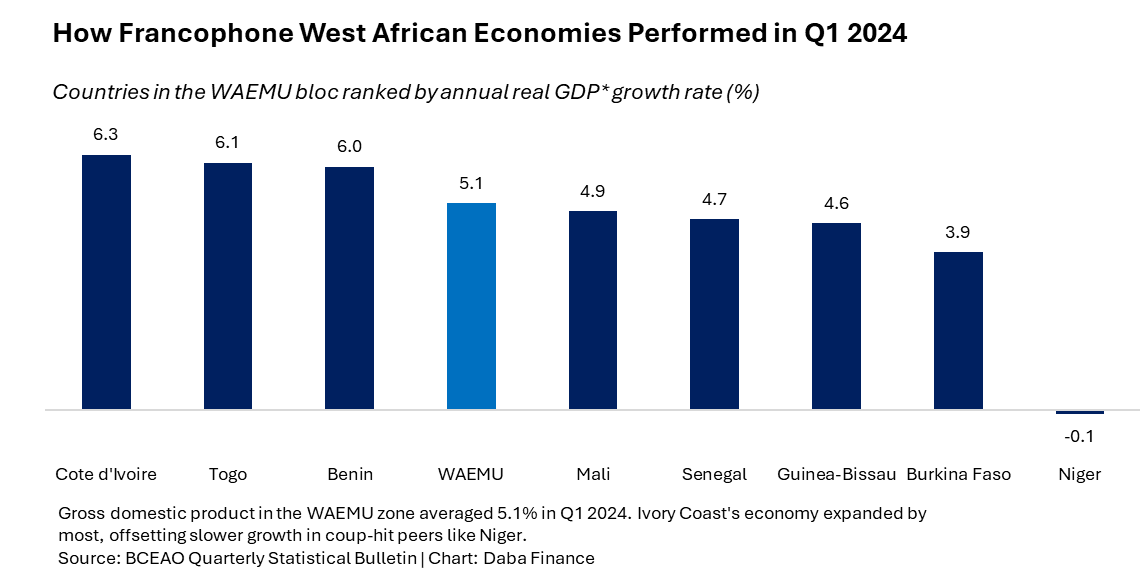

In Q1 2024, WAEMU recorded a GDP growth of 5.1%, demonstrating resilience in the face of global economic uncertainties.

Although this growth is slightly lower compared to the 5.6% growth in Q1 2023, it shows an upward trend compared to the previous quarter.

The steady performance can be attributed to various macroeconomic policies and favorable external conditions.

Country-Specific Performance

Benin

Benin experienced a GDP growth of 6.0% in Q1 2024, maintaining its performance from the previous quarter. The primary sector, driven by agriculture, played a significant role in this growth, along with substantial contributions from the secondary and tertiary sectors.

Burkina Faso

Burkina Faso reported a GDP growth of 3.9%, slightly down from 4.1% in the previous quarter. Despite the challenges posed by security issues, the country has managed to sustain growth through its primary and secondary sectors, particularly in mining and agriculture.

Côte d’Ivoire

Côte d’Ivoire, one of the largest economies in WAEMU, posted a GDP growth of 6.3%, up from 5.4% in Q4 2023. This impressive performance is largely due to strong industrial output and robust export activities.

Guinea-Bissau

Guinea-Bissau saw a modest growth of 4.6%, down from 5.4% in the previous quarter. The country continues to face challenges in economic diversification, relying heavily on its agricultural sector.

Mali

Mali’s GDP growth stood at 4.9%, a slight decrease from 5.4% in Q4 2023. Political instability continues to affect economic activities, but the country has seen growth in its mining sector.

Niger

Niger experienced a marginal decline in GDP growth, reporting a -0.1% growth rate in Q1 2024, down from -0.2% in the previous quarter. The ongoing security challenges have impacted economic stability.

Senegal

Senegal posted a robust GDP growth of 4.7%, slightly down from 4.9% in Q4 2023. The tertiary sector, particularly services, has been a significant contributor to this growth.

Togo

Togo saw a GDP growth of 6.1%, down from 5.1% in the previous quarter. The growth is supported by improvements in the industrial and services sectors.

Sectoral Contributions

Primary Sector

The primary sector, encompassing agriculture, fishing, and mining, remains a cornerstone of WAEMU’s economy. Countries like Benin and Côte d’Ivoire have seen substantial growth in agricultural output, which has bolstered their overall economic performance.

Secondary Sector

The secondary sector, including manufacturing and construction, has shown mixed results across the region. Côte d’Ivoire’s industrial output has been a standout, contributing significantly to its GDP growth. In contrast, countries like Guinea-Bissau are still working on enhancing their industrial capacities.

Tertiary Sector

The tertiary sector, which includes services such as banking, trade, and telecommunications, has been a major growth driver, especially in Senegal and Togo. The expansion of financial services and telecommunications has provided a boost to these economies.

Implications for Investors

Investment Opportunities

The positive GDP growth across WAEMU presents numerous investment opportunities, particularly in the primary and tertiary sectors.

Investors looking at agriculture and mining can find promising prospects in countries like Benin and Mali.

Meanwhile, the burgeoning services sector in Senegal and Togo offers avenues for investment in financial services and telecommunications.

Stock Market

Investors can gain exposure to these growing economies through the BRVM Stock Exchange, which lists several companies from WAEMU member states.

Check out the best-performing stocks on the bourse in the first six months of the year here.

Daba provides an easy and efficient way for investors to buy and trade BRVM stocks, including high-performing ones like Servair (ABJC).

With features designed to simplify the investment process, Daba is a valuable tool for accessing the dynamic markets of WAEMU. And in case you’re not sure what you should be buying, Daba Pro provides relevant insights, such as weekly stock recommendations, to help navigate the complex and dynamic world of BRVM stocks with confidence.

Conclusion

The first quarter of 2024 has demonstrated WAEMU’s economic resilience and growth potential.

With a steady GDP growth rate and significant contributions from various sectors, the region offers attractive opportunities for investors. Platforms like Daba can help investors capitalize on these opportunities, ensuring they stay ahead of the market trends.

Whether you are interested in the agricultural boom in Benin, the industrial growth in Côte d’Ivoire, or the services expansion in Senegal, WAEMU presents a promising landscape for investment.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.