Why Big Tech is Building Data Centers in Africa

8 min Read July 29, 2023 at 8:01 PM UTC

A rapidly growing digital economy in Africa is drawing investments from the world’s biggest tech companies into the continent’s data center market, which is largely untapped.

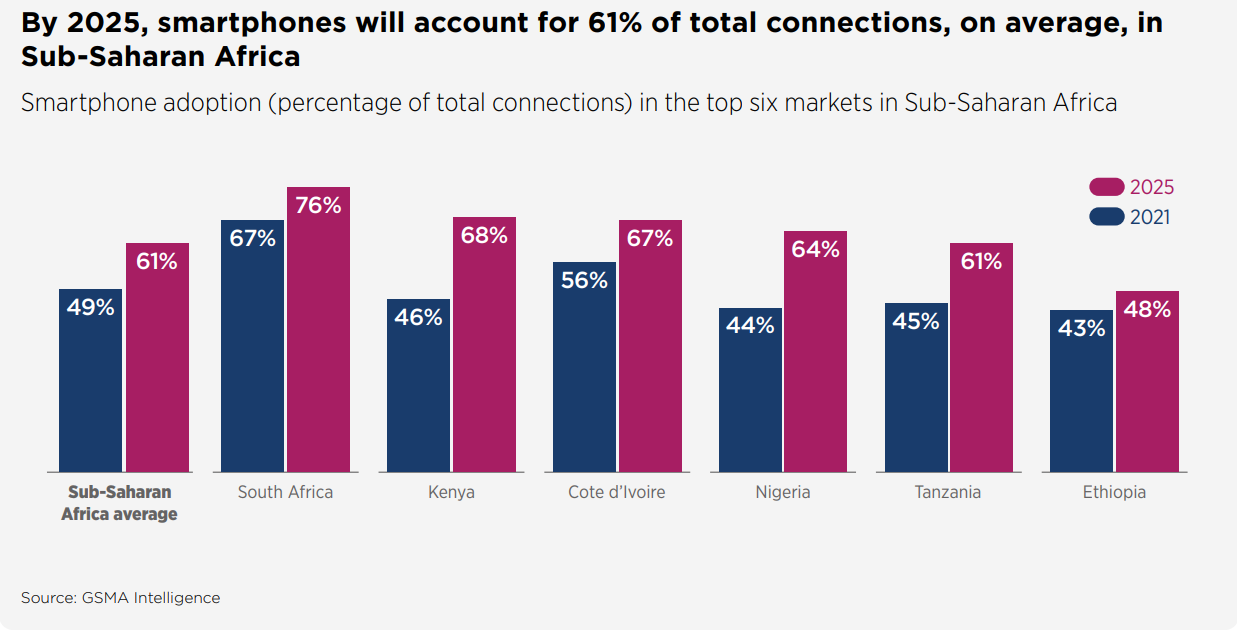

For over a decade, Africa has been experiencing a massive boom in mobile internet adoption, outpacing other regions globally.

This fast-growing mobile economy has enabled the emergence of several mobile-led tech solutions on the continent, such as mobile money and online shopping.

And the startups providing these services have drawn attention, and billions of dollars in venture funding, from the world’s biggest tech companies and investors.

In 2022 alone, African startups secured $6.5 billion in venture funding, an 8% increase from the previous year, while global VC investments declined -35%.

But it’s not just startups and software solutions pulling investments in Africa’s digital economy.

Foreign capital has also flown into digital, hardware infrastructure, especially data centers.

Oracle, Microsoft, Amazon, Equinix, and Huawei are some big names building or buying data centers across Africa.

Regional operators such as MainOne, Africa Data Centers, Raxio, Icolo.Io (Digital Realty), and IXAfrica as well as the likes of Telecom Egypt, NTT Global Data Centers, Paratus Namibia, Rack Centre, Teraco Data Environments (Digital Realty), and Wingu are also big players in the space.

In 2022, the market also witnessed the entry of investors like Vantage Data Centers, Airtel Nigeria, Cloudoon, Open Access Data Centres, and Kasi Cloud.

For instance, Open Access Data Centres opened more than 20 data center facilities in South Africa and Nigeria.

Together, they’ve invested well over $4 billion in data center projects across Africa since 2021 at least.

But, what exactly are data centers, and why are big tech players racing to build them in Africa?

The backbone of the digital world

The first things that come to mind when we hear words like “online”, “digital”, “digital world” or “technology” are probably the internet, social media, mobile apps, business software, etc.

But have you ever wondered where all the information on the internet we access through smartphones or computers is stored?

Well, data centers are like giant warehouses that store and protect all the data we see online.

They’re super crucial for the internet to work smoothly and are the major enablers of online services—think digital banking, social media, streaming services, video calls, and about everything we do online.

Just as a library stores and organizes books for easy access, data centers store and manage an immense amount of digital information.

And with the increasing amount of information and data to store as the digital economy continues to grow rapidly, they have become even more critical.

How does this concern Africa?

There’s a massive opportunity to build these data centers on the continent and make lots of money from it!

The data center opportunity in Africa

Emerging technologies such as AI, IoT, or cloud computing are not new in Africa.

But there has been a recent surge in the adoption of such enterprise digital solutions, especially among mid-to-large businesses across several sectors—a trend mainly induced by the Covid-19 pandemic.

In South Africa alone, the use of cloud computing is expected to grow 25%, generating up to $1.5 billion by 2024.

And seeing this growth, global cloud services providers such as Amazon Web Services, Microsoft, IBM, and Oracle are expanding their presence in Africa with new cloud regions being set up.

Be it enabling consumers to buy food or clothes online or make money transfers via mobile apps, these activities generate huge volumes of data that need to be stored adequately.

This, in turn, creates a higher demand for data centers.

For investors, this presents a great opportunity to fill significant gaps, as most of Africa’s data is currently stored outside the continent.

That leads to slower connections and data privacy concerns.

Messages sent from the continent’s southern tip to Europe and back can take as long as 180 milliseconds, causing frustration for individuals trading stocks or playing video games, per The Economist.

But significant multi-billion dollar investments in data centers are set to change this scenario.

These investments will significantly reduce internet latency and bring it much closer to African users, paving the way for a remarkable advancement in the continent’s digital economy.

More so, African governments are keen to build their data centers to ensure data sovereignty and stay competitive in the increasingly AI-powered world.

Investments in data centers skyrocket

As investors increasingly realize the opportunity in Africa’s data center market, the continent has seen a flurry of activities in the space over the last few years.

This ranges from the launch of new or expansion of data centers to millions of foreign investments pouring into operators.

Data from ReportLinker, an AI-driven market intelligence platform, indicate the sector recorded up to $2.6 billion in investments in 2021, including $200 million in debt and equity raised by WIOCC.

Around $5.4 billion is expected to be invested in the next four to five years alone but going by investment trends last year, the continent might smash those estimates!

In 2022, Vantage launched a $1 billion campus in Johannesburg to house three data centers.

Khazna Data Centers is entering Egypt with a $250 million hyper-scale data center.

And in April, Raxio Data Centres secured up to $170 million—from Proparco and the Emerging Africa Infrastructure Fund—for data center projects across multiple African countries.

Acquisitions are also growing…

Alongside huge capital raises, Africa’s data center market has also been seeing major investments in the form of mergers and acquisitions.

One such example is the $320 million acquisition of West Africa operator MainOne by US-based Equinix in 2021.

In the same year, Digital Realty bought Nigeria-based Medallion Data Centers and South Africa’s Teraco Data Environments.

Meanwhile, African Infrastructure Investment Managers (AIIM), a private equity firm, acquired Ngoya Etix Data Centers, all for undisclosed sums.

Most of these deals go unnoticed as digital infrastructure such as submarine cables, fiber optics, telecom towers, and data centers belong in the not-so-shiny segment of the tech ecosystem.

But they’re crucial to the continued functioning of the digital world as most people know it.

Impressive figures, but not nearly enough

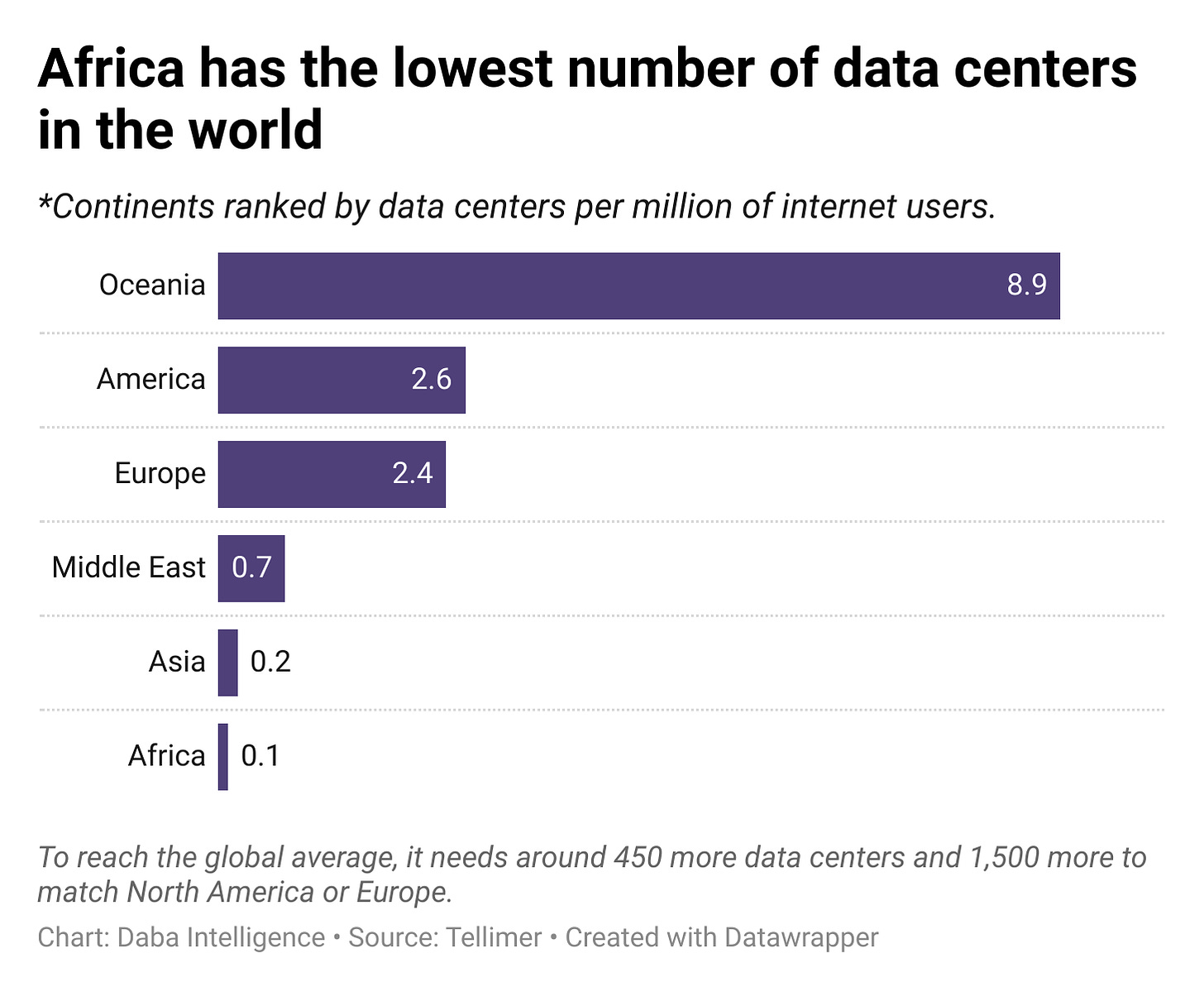

Despite the investment deals and figures, Africa still needs way more data centers to match other continents than is currently being built.

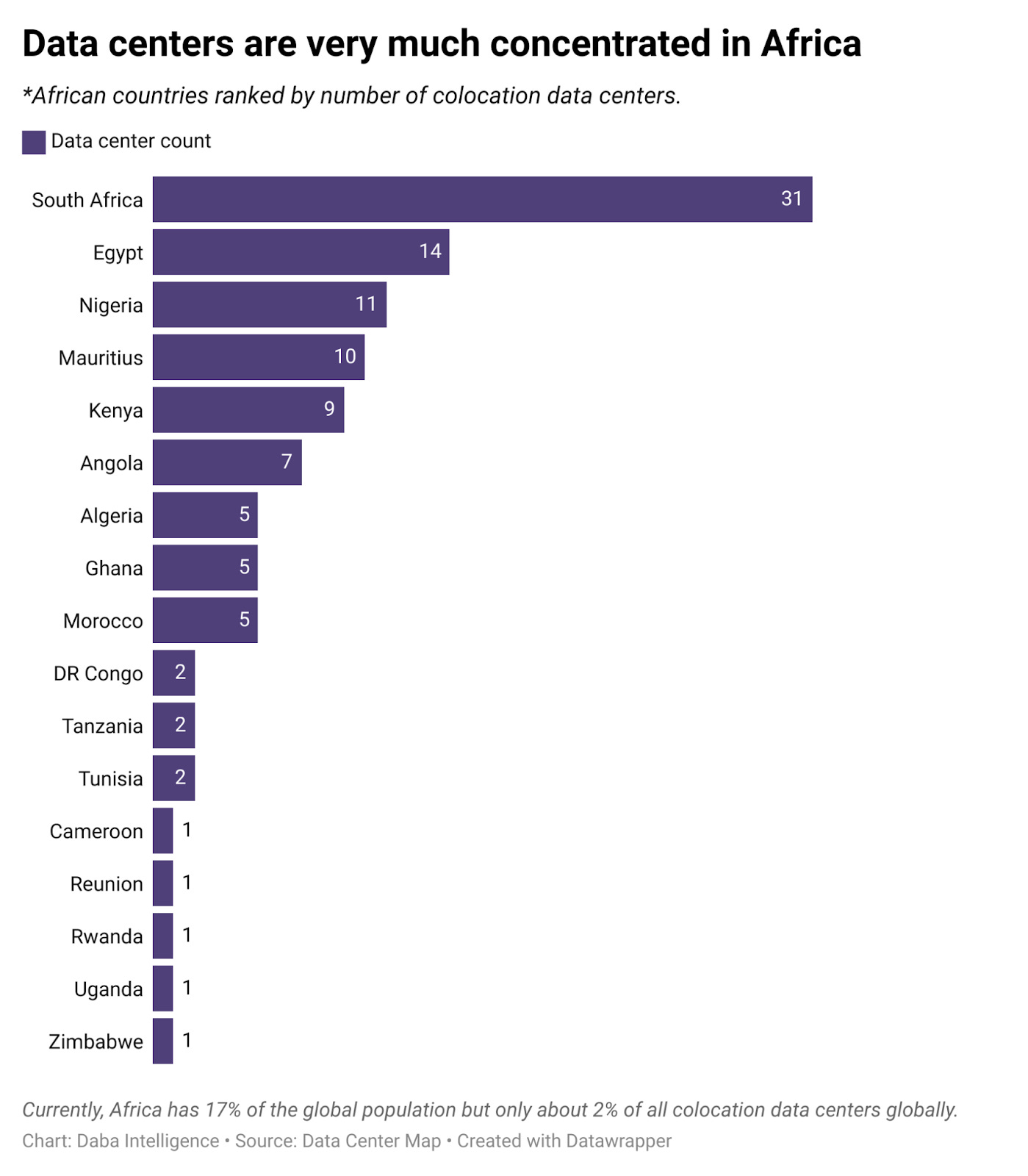

Currently, Africa has 17% of the global population but only about 2% of all colocation data centers globally—quite a gap!

For a better perspective, the continent has only 0.1 data centers per million internet users, far behind the global average of 0.9.

And as of last year, it only had five more data centers than the Indian city of Mumbai alone.

To reach the global average, Africa needs around 450 more data centers and 1,500 more to match North America or Europe.

In addition to the growing demand for cloud-based services among businesses, more of these facilities are needed to support Africa’s growing digital population.

The existing data centers on the continent are also very much concentrated in a few African countries.

For instance, Nigeria, Kenya, and South Africa together host about 60% of sub-Saharan Africa’s commercial data centers.

The latter alone has the most data centers in the region and is expected to account for the bulk of Africa’s $5 billion data center market by 2026.

The major data center markets will continue to attract the lion’s share of investment into the sector.

But the good news is that smaller economies such as Ethiopia, Morocco, Algeria, Ghana, Cote d’Ivoire, Zambia, DRC, Namibia, and Rwanda are starting to attract noticeable funding.

They’ve received up to $700 million of capital investment annually for two years now, per research firm Xalam Analytics, which closely monitors the industry.

Big tech’s increasing investments in Africa’s data center capacity expansions indicate significant growth potential for the market.

And it comes as Africa’s digital revolution needs more capacity to support its growing smartphone and internet users, 4G expansion, and 5G rollout.

The increasing number of data centers across the continent also creates new opportunities for telecom players.

It’s a huge opportunity for investors that big tech companies are moving fast to capture, as the numbers show.

An exciting future

Amid a rapidly growing digital economy, we can expect more data center capacity expansion across various countries in Africa.

And as large numbers of data centers along with large power capacities come up, Africa can be called—and rightly so—the next frontier of the data center industry.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.