Investors update: African startups raised $4.85bn venture funding in 2022

3 min Read January 4, 2023 at 12:24 PM UTC

African startups raised $4.85bn venture funding in 2022

Highlights

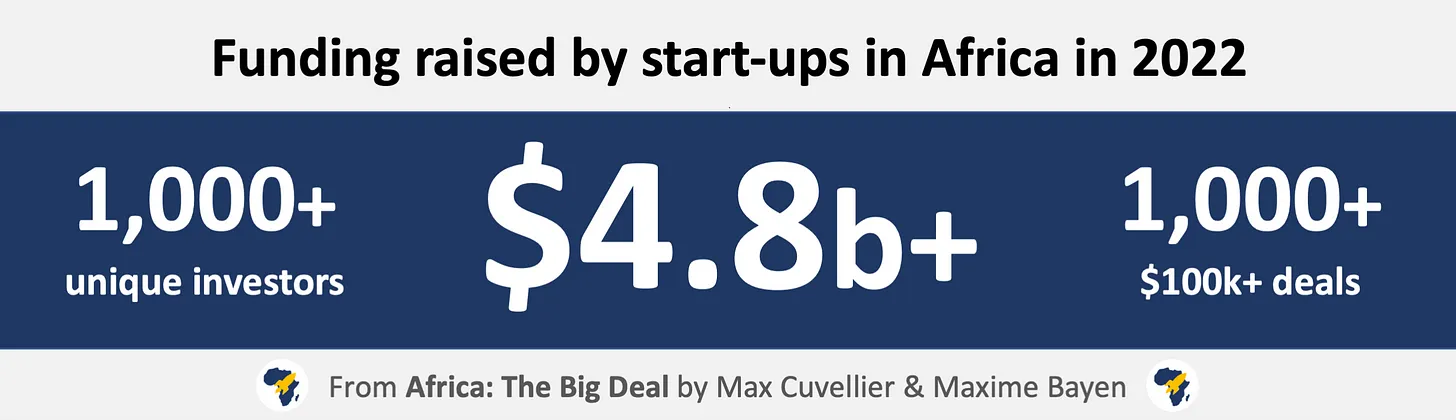

- Startups in African countries raised around $4.85 billion in 2022, per data from The Big Deal, which tracks venture funding on the continent.

- That figure could cross the $5 billion threshold after delayed funding announcements from investors are made. More than 1,000 deals of $100,000 or more were announced in 2022, an 11% year-on-year increase from 2021.

- More so, 75% of the total fund raised were in the big four countries, Nigeria ($1.2bn), Kenya ($1.1bn), Egypt ($820m), and South Africa ($550m) while fintech startups maintained their dominance with 37% of deals in the year.

Source: The Big Deal

Our Takeaway

Generally, African startups had a strong performance in 2022; globally, the region was the only one that recorded a year-on-year increase in venture funding last year helped by a great first half of the year. But in what was a worldwide bear market, shaken by a global economic decline and rising inflation & interest rates, deal activity slowed in the second half. The continent also attracted more interest than ever before: Over 1,000 unique investors participated in at least one deal in Africa in 2022, a +15% increase compared to 2021.

Nigerian equities kick off 2023 bullish with $416m gain

Highlights

- Tuesday’s trading activities on the floor of the Nigerian Exchange (NGX) closed with a gain of N187 billion ($416 million) in market capitalization, as bulls maintained their grip on the local bourse.

- The All Share Index (ASI) increased by 1.89% to close at 51,595.66 points. In the same vein, market breadth closed positive as BUA Foods led 23 gainers while there were 11 losers.

- As of the close of the market on Tuesday, the stock market value stood at N28.1 trillion, from N27.915 trillion ($63 billion) as of December 30.

Source: Nairametrics

Our Takeaway

The NGX had a stellar 2022 as equities in Africa’s largest economy braved the storm of rising inflation and interest rate hikes. The bourse closed the year with a market capitalization of N27.915 trillion ($63 billion) as of December 30, from N22.296 trillion at the start of the year. During the year, it recorded several landmark listings in equity and fixed income, and remarkably, its 19.98% gain saw it ranked one of the best globally.

Sierra Leone is first in Africa to hike interest rate this year

Highlights

- Sierra Leone’s central bank became the first in Africa and second globally after Israel to raise interest rates this year.

- A combination of factors, ranging from higher commodity costs to uncertainty around the Covid-19 pandemic, are keeping price pressures elevated in the West African nation.

- The Bank of Sierra Leone’s monetary policy committee hiked its key rate for a fifth straight meeting to 18.25% from 17%, bringing cumulative increases in just over a year to 425 basis points.

Source: Bloomberg

Our Takeaway

While the vast majority of countries saw a decline in interest rates over recent years, soaring inflation, the war in Ukraine, and strengthening economies spurred interest rate increases around the world in 2022. Analysts and economists can’t agree on the trajectory of rates this year but there seems to be a somewhat major consensus that there will be further monetary tightening in the first half of 2023 before we see a reversal in the other half, as the base effect triggers a reversal in inflation.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.