Investors update: Techstars raising $150m for new accelerator fund

3 min Read June 29, 2023 at 12:18 PM UTC

Techstars is raising $150m for its new accelerator fund

Highlights

- Startup accelerator Techstars is seeking a fresh $150 million ahead of the end of the deployment period of its third institutionally-backed fund, Techstars Accelerator 2021, later this year.

- Startups going through Techstars’ three-month program receive $20,000 and a $100,000 convertible note in exchange for 6% to 9% of common stock, in addition to access to its network and mentorship, amongst other resources.

- Like its predecessors, the new fund, Techstars Accelerator 2024, is expected to be used for accelerator-stage and/or post-accelerator investments.

Source: TechCrunch

Our Takeaway

Founded in 2006, Techstars runs more than 50 accelerator groups in major cities across the globe, including New York, Los Angeles, London, Boston, Tel Aviv, and Lagos. The accelerator set up the Lagos (Nigeria) arm last year in partnership with ARM Labs and to double down on its growth and expansion, Techstars recently launched new funds to bolster its investment efforts. As Africa catches up with the developed world in terms of technological progress, accelerators, and investment firms help to bridge this gap by providing crucial access to capital and mentorship to startups.

Ghana’s Berry Health raises $1.6m pre-seed funding

Highlights

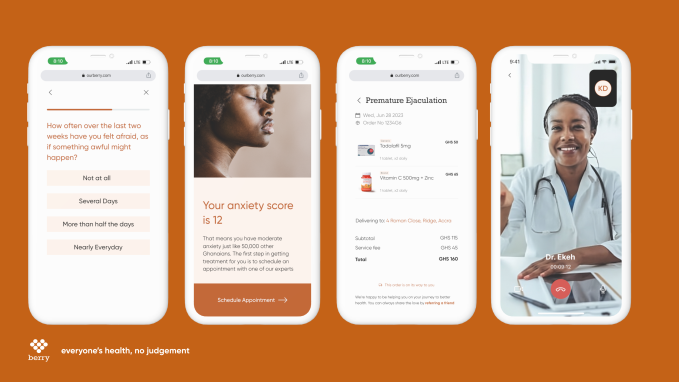

- Berry Health has raised $1.6m from Lightspeed Venture Partners and General Catalyst to democratize access to healthcare in Africa, starting with mental health, sexual health, and dermatology.

- Sexual and mental health stigmatization in Africa has reached alarming levels, resulting in high rates of sexually transmitted infections (STIs) and mental health cases.

- The startup offers remote diagnosis and treatment for conditions such as anxiety, depression, sexual health issues, dermatology, and hair loss through telemedicine and online consultations.

Source: BusinessWire

Our Takeaway

Africa faces significant challenges in addressing sexual and mental health due to deep-rooted stigmatization, boasting the highest suicide rate globally, one of the highest for STIs, and at the same time a severe shortage of doctors. However, telemedicine and virtual care platforms have gained momentum in Africa, bridging the healthcare gap. Startups like Berry Health have capitalized on this trend, attracting investor interest in Africa’s health tech sector. Other beneficiaries in the African health tech market include Yodawy, Reliance Health, Healthtracka, Helium Health, Esaal, and MyHealth Africa.

Paymob, Chefaa partner to digitize pharmacies in Egypt

Highlights

- Egyptian startups Paymob and Chefaa have partnered to digitize pharmaceutical payments in Egypt.

- Paymob’s omnichannel gateway offers more than 40 payment methods and empowers merchants to manage and scale their businesses while Chefaa’s platform assists customers and chronic patients in managing their medication needs.

- The partnership aims to power seamless and secure online card payments and point-of-sale (POS) payments upon delivery. Chefaa customers can also access several BNPL payment methods through Paymob’s gateway.

Source: Disrupt Africa

Our Takeaway

Egypt’s huge, cash-dominated small business economy offers strong opportunities for fintech companies like Paymob, which continue to witness exponential growth in the market. The startup currently has 200,000 local and international merchants using its payment gateways and plans to reach a third of Egypt’s 3 million SMEs in the next few years. That ambition drives its recent partnership with Chefaa, which should also advance the uptake of BNPL and create an ecosystem that delivers value to merchants and exceptional customer experiences, boosting the technology industry. Paymob has raised over $68.5 million – making it one of the most funded MENA startups.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.