Investors update: Ethiopia asks to join the BRICS bloc of emerging economies

3 min Read June 30, 2023 at 12:42 PM UTC

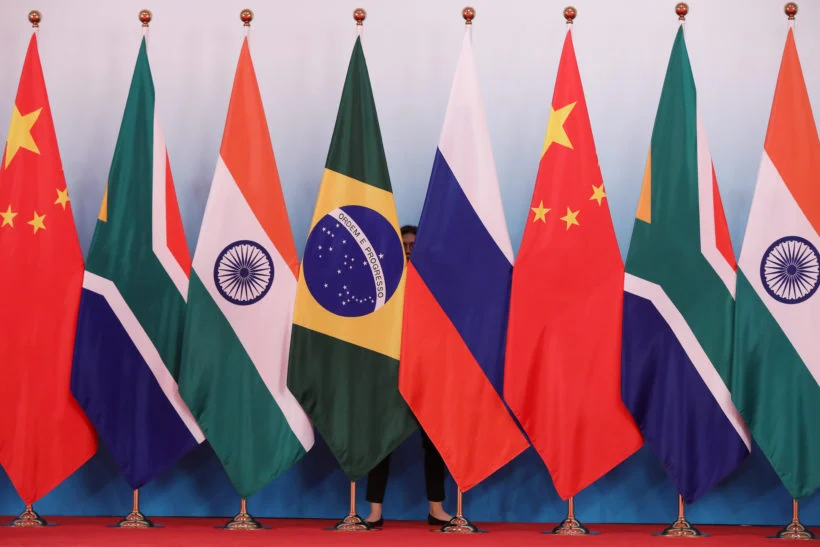

Ethiopia asks to join the BRICS bloc of emerging economies

Highlights

- Ethiopia, one of Africa’s fastest-growing economies, has asked to join the BRICS bloc of emerging markets, the foreign ministry said on Thursday.

- The term BRIC was coined by Goldman Sachs economist Jim O’Neill in 2001 to describe the rise of Brazil, Russia, India, and China. The BRIC powers had their first summit in 2009 in Russia while South Africa joined in 2010.

- BRICS countries account for more than 40% of the world’s population and about 26% of the global economy.

Source: CNBC Africa

Our Takeaway

The Horn of Africa nation has the second-largest population in Africa, but its economy ranks only 59th in the world according to the International Monetary Fund and is less than half the size of the smallest BRICS member South Africa. Joining BRICS offers Ethiopia a plethora of advantages; as an emerging global economic alliance, the bloc provides access to immense markets, investment opportunities, and technological advancements that could help the country foster economic growth, enhance trade relations, and tap into new avenues for development.

ENGIE and Meridiam acquire African firm BTE Renewables

Highlights

- ENGIE and Meridiam have signed an agreement with ACTIS to acquire BTE Renewables, a developer, owner, and operator of renewable assets in Africa, with a presence in South Africa and Kenya.

- The deal includes a carve-out of the Kenyan assets by ENGIE to Meridiam and will bring an additional 340 MW net of renewable operating assets to ENGIE (150 MW of onshore wind and 190 MW of solar photovoltaic (PV).

- More so, the acquisition reinforces ENGIE’s South Africa presence and will capitalize on the Group’s industrial value in the country, where it already operates 315 MW of renewable assets.

Source: ABC

Our Takeaway

For a country like South Africa currently grappling with frequent power cuts that threaten its economy, news of ENGIE doubling down on its renewable energy operations in the country comes as a welcome development. Given its vast resources, South Africa could realistically, and cost-effectively, supply 49% of its electricity mix from renewables by 2030, nearly a third higher than the share to be expected from current plans and policies. With renewable power, heat, and fuels all factored in, renewables could provide 23% of South Africa’s total final energy consumption in 2030, up from just 9% overall in 2015.

StanChart backs 15 Kenyan startups via Women in Tech program

Highlights

- Standard Chartered Kenya in partnership with iBizAfrica – Strathmore University has selected 15 women-led startups to undergo 12 weeks of business incubation training under the Women in Tech Program.

- The program supports female-led entrepreneurial teams with business management training, mentoring, and seed funding of $10,000 each.

- The selected companies are Ecorich, Imani Health, Sol Active, Saidiwa Rides, Ento Farm, AgriTech Analytics, Techtenum Minds, MyAfya Africa, Rhea Soil Health, Know Learning, Sign With Us, Acre-insights, Instruct Africa, Panacare, and Tynka Global.

Source: Disrupt Africa

Our Takeaway

In Africa, female entrepreneurs are taking their place in the male-dominated tech world. However, gender bias still makes it harder for them to access finance and grow their businesses. Per Briter Bridges, only 3% of the total funding raised by startups in Africa since 2013 has gone to all-women co-founded teams. Efforts and initiatives like this are crucial to increasing female representation in and contribution to the startup space, which remains minute against a faster-growing percentage of ventures run by men.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.