Investor Updates: May 23 2022 - Egypt’s Sylndr raises $12.6m

3 min Read May 23, 2022 at 12:51 PM UTC

Egypt’s Sylndr raises $12.6m to scale its used cars platform

Highlights

- Sylndr, an Egypt-based online marketplace for used cars, has raised a $12.6 million pre-seed round, led by RAED Ventures, with participation from Algebra Ventures, Nuwa Capital, 1984 Ventures, Global Founders Capital, and a group of regional and global angel investors.

- Founded in 2021 by Amr Mazen and former chief financial officer of elmenus, Omar El Defrawy, Sylndr allows customers to buy and sell their cars and find financing solutions.

- The startup plans to use the fresh funding to scale its operations, technology infrastructure, and double the size of its team.

Source: Wamda

Our Takeaway

With over 6 million cars on Egypt’s roads, the majority of which are passenger cars and second-hand vehicles, the northern African nation has one of Africa’s most extensive vehicle fleets. Like every populous developing country, the large market for used cars, which is dominated by unorganized dealers and classifieds, has attracted startups looking to digitize sourcing and distribution. Cairo-based Sylndr is one of those used-car sale platforms and its fresh pre-seed round of $12.6 million is the largest of its kind in the region.

Moroccan healthtech Blink Pharma raises first funding round

Highlights

- Morocco-based healthcare tech startup Blink Pharma has raised investment from Azur Innovation Fund for an undisclosed amount.

- Launched in 2020 by Ali Sami and Adil Bertul, the B2B marketplace allows pharmacists, laboratories, and wholesalers to exchange orders, as well as provides them with a payment method.

- The new funding will help Blink Pharma develop its operations, including the launch of new products for the healthcare sector.

Source: Wamda

Our Takeaway

The importance of tech startups playing in Africa’s healthcare space can’t be overstated. Africa’s healthcare industry has for decades been plagued with several challenges, from supply chain challenges and fake drugs to a shortage of doctors, medical facilities, and drugs, all of which prevent universal access on the continent. importantly, increasing investor backing for startups shows one of Africa’s most crucial socio-economic problems can be tackled without forgoing returns.

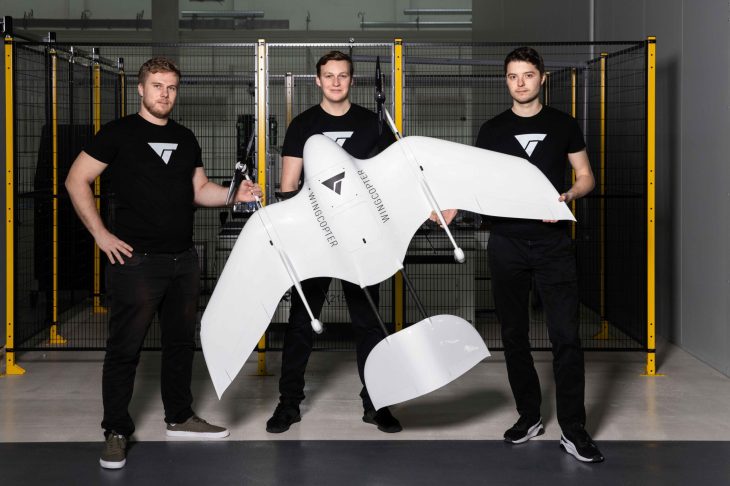

Wingcopter to deploy 12,000 delivery drones across Africa

Highlights

- German drone delivery firm Wingcopter this week announced a partnership with Continental Drones Ltd. to build a network of 12,000 Wingcopter 198 drones across Africa over the next five years.

- The proposed network would span 49 sub-Saharan African countries, expanding Wingcopter’s presence in Africa beyond Malawi. Once completed, the new service would become the largest commercial delivery drone deployment in the world.

- The companies also plan to focus primarily on streamlining on-demand deliveries of medical supplies like medicines, vaccines, and laboratory samples, but also essential goods.

Source: TechCrunch

Our Takeaway

Based on its increasing adoption, drone delivery looks set to be very much a part of the future of last-mile delivery. Moreover, Africa is a good fit for the system. The continent suffers from inefficient and unsustainable infrastructure, which has long been a barrier to universal health coverage. That creates the opportunity for a solution like a drone delivery, which requires only a digital infrastructure and is fast gaining prominence on the continent spearheaded by startups like Astral Aerial in Kenya, Drone Africa Service in Niger, UAV Industries in South Africa, etc.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.