Chinese loans to Africa fall to near 20-year low

Chinese sovereign lending to Africa fell below $1 billion last year – the lowest level in nearly two decades – underscoring Beijing’s shift away from a decades-long big-ticket infrastructure spree on the continent.

The drop in lending reflected in data from Boston University’s Global China Initiative comes as several African nations struggle with debt crises and China’s own economy is facing growing headwinds.

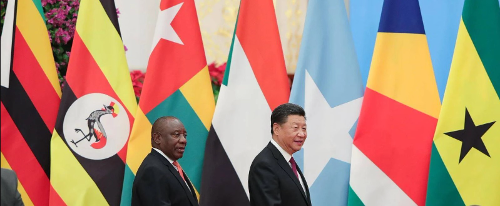

Africa has been a focus of President Xi Jinping’s ambitious Belt and Road Initiative (BRI), launched in 2013 to recreate the ancient Silk Road and extend China’s geopolitical and economic influence through a global infrastructure development push.

Key Takeaways

While African governments largely welcomed Chinese lending and infrastructure projects, Western critics have accused Beijing of saddling poor nations with unsustainable debt. Zambia – a major Chinese borrower – became the first African country to default during the COVID-19 pandemic in late 2020. Other governments, including Ghana, Kenya, and Ethiopia, are also struggling. China, meanwhile, is facing its own problems at home as policymakers struggle to revive growth amid persistent weakness in the crucial property industry, a faltering currency, and flagging global demand for its manufactured goods.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.