Ghana’s central bank issues draft guidelines for crypto exchanges

TLDR

- Bank of Ghana introduces draft regulations for cryptocurrency industry, focusing on consumer protection, crime prevention, and financial inclusion.

- Virtual Asset Service Providers (VASPs) mandated to register and meet stringent standards; commercial banks prohibited from direct dealings with virtual asset businesses.

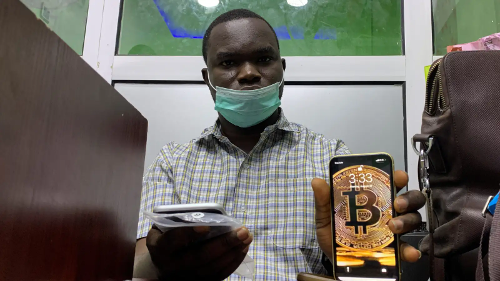

- Public feedback sought by central bank on proposed regulations regarding digital assets like Bitcoin (BTC) and USDT stablecoin.

The Bank of Ghana has introduced draft regulations to establish a framework for the cryptocurrency industry, focusing on consumer protection, crime prevention, and promoting financial inclusion.

The regulations mandate that Virtual Asset Service Providers (VASPs) register and adhere to stringent standards, while commercial banks are barred from directly engaging with virtual asset businesses.

This move follows an in-depth analysis of digital assets, including Bitcoin (BTC) and the USDT stablecoin. The central bank has opened the floor for public feedback on these proposed regulations before they are finalized.

Key Takeaways

The Bank of Ghana's analysis underscores the growing adoption of digital assets, driven by enhanced internet access and the rise of Virtual Asset Service Providers (VASPs). While cryptocurrency usage in Ghana is still modest compared to traditional financial systems, its role in cross-border payments and remittances has made regulation increasingly necessary. This move mirrors efforts in other African countries: South Africa's Financial Sector Conduct Authority (FSCA) began accepting license applications for crypto businesses in 2023, and Kenya is in the process of drafting new cryptocurrency trading laws. A sectoral working group in Kenya is developing a policy framework to establish the necessary regulations and designate the responsible regulatory bodies for digital asset providers.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.