Kenya mulls sustainability debt swap before $2bn Eurobond deadline

TLDR

- Kenya considers debt swap to improve financial position and prioritize social services

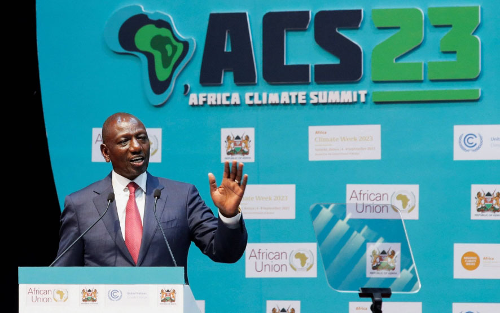

- President William Ruto suggests issuing sovereign green bonds and debt-for-nature swaps for climate initiatives

- Specifics of the proposed swap transaction and operations remain undisclosed.

Kenya is exploring a potential debt swap to enhance its financial position amid an impending crucial repayment deadline. The aim is to direct funds towards essential social services, as revealed by individuals familiar with the preliminary discussions cited by Bloomberg.

Recently, President William Ruto of Kenya announced the nation's contemplation of issuing sovereign green bonds and engaging in debt-for-nature swap arrangements to finance climate-related initiatives.

This approach, frequently utilized by governments to alleviate immediate financial challenges, underscores Kenya's commitment to debt management and the preservation of fiscal stability. Nevertheless, the details of this proposed swap transaction and its operational aspects are yet to be disclosed.

Key Takeaways

These financial instruments present a novel strategy for a nation to alleviate its debt load while reinforcing its dedication to environmental initiatives. Ilan Goldfajn, the president of the Inter-American Development Bank, has echoed this sentiment, highlighting the pivotal role of innovative finance in assisting countries in securing necessary resources. Despite such praise, critics have emerged, contending that the intricate nature and elevated fees associated with these products make them an unduly costly avenue for financially challenged emerging markets to restructure their debt.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.