Kenya Revives Plans for Diaspora Bond to Fund Infrastructure Projects

TLDR

- Kenya revival plans for diaspora bond to fund infrastructure projects aimed at Kenyans living abroad, focusing on roads, hospitals, and key institutions.

- Initial bond proposal in February 2024 postponed over concerns on diaspora participation, now reactivated with positive economic indicators.

- Bond revival due to Kenya's increased budget deficit for the fiscal year ending June 2025 post controversial revenue collection plan change.

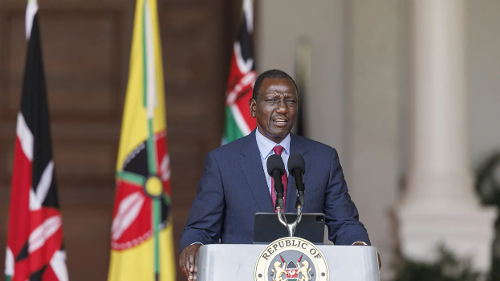

Kenya is reviving plans to issue a diaspora bond to raise funds for infrastructure projects, according to Prime Cabinet Secretary Musalia Mudavadi. The bond, which will target Kenyans living abroad, is part of a renewed effort to secure financing for key projects such as roads, hospitals, and other critical institutions.

Initially proposed in early February 2024, the bond’s development was put on hold due to concerns about whether the overseas Kenyan community would buy sufficient amounts of the debt. However, Mudavadi, addressing Kenyan diaspora members in Namibia, stated that the current economic figures indicate the country is now well-positioned to launch the bond.

The revival of the diaspora bond plan follows an increase in Kenya’s budget deficit forecast for the fiscal year ending June 2025, after the government was forced to abandon a controversial revenue collection plan.

Key Takeaways

Kenya’s renewed push for a diaspora bond reflects its growing reliance on remittances and overseas citizen investment to fund infrastructure projects amid a widening budget deficit. With remittances hitting record levels, the government is betting on diaspora support to help bridge its financing gap for key projects while navigating legal and economic challenges at home. Meanwhile, remittances from Kenyans abroad reached a record $4.19 billion in 2023, significantly supporting the nation's current account balance.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.