Kenya's Startup Bill will give tax break to startups

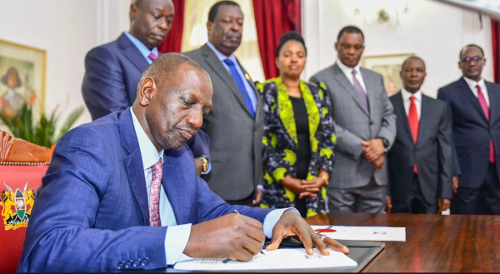

Kenya's President, William Ruto, recently revealed that the Startup Bill 2022 is scheduled to be signed into law by April 2024. The bill, aimed at creating employment opportunities for Kenyan youth and providing tax breaks for startups, was disclosed during the Kenya Innovation Week (KIW).

The Startup Bill includes provisions for incentives, such as tax breaks, for registered startups. Additionally, it introduces a platform for startups to access information on resources and support. The bill outlines a credit guarantee scheme to offer financial support and training for the growth of startups.

Moreover, the legislation will establish a legal framework to promote technological growth, foster innovation, and attract talent and capital. It assigns crucial roles to both national and county governments, including promoting innovation, facilitating technology transfer, generating employment and wealth, and establishing connections between research institutions and businesses.

Key Takeaways

Kenya is currently facing challenges in providing employment opportunities for its youth, a significant portion of whom are unemployed. Given the scarcity of job opportunities, President William Ruto is optimistic that fostering the growth of young Kenyan entrepreneurs and startups will contribute to improving the country's employment rate and sustaining economic growth. In the context of Africa's tech ecosystem, there have been past tensions between tech stakeholders and government officials due to a lack of well-defined rules and regulations governing the ecosystem. The introduction of Startup Bills is anticipated to create a conducive environment for startups in the country. The Big Tent approach, involving relevant parties in the startup ecosystems and government officials during the development and approval of these bills, is expected to play a crucial role. The architects of the Startup Bills envision bringing about change in four key areas: capital, regulation, infrastructure, and talent. This comprehensive approach aims to address various challenges and facilitate the growth of the startup ecosystem in Kenya.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.