Nigerian SEC Grants First Preliminary Approval to Two Crypto Exchanges

TLDR

- SEC Nigeria grants provisional approval to digital asset exchanges Busha and Quidax under ARIP program.

- Busha offers cryptocurrency transactions using fiat currency through mobile and web apps. Quidax operates a trading platform for existing crypto tokens on its blockchain.

- Five other firms, including Trovotech and Dream City Capital, admitted to SEC's Regulatory Incubation Program for testing innovative digital asset products.

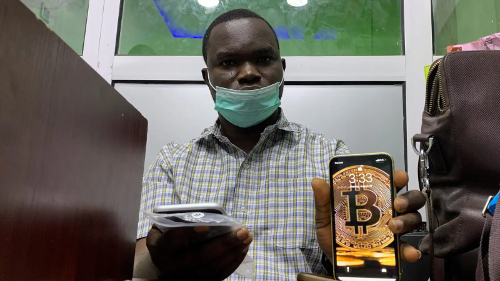

The Securities and Exchange Commission (SEC) of Nigeria has granted provisional approval to two digital asset exchanges, Busha and Quidax. This approval, granted under the Accelerated Regulatory Incubation Programme (ARIP), marks a significant step for both companies as they begin operations in Nigeria’s evolving digital asset market.

Busha facilitates cryptocurrency transactions using fiat currency through its mobile and web applications. Users can engage in activities like buying, selling, storing, and trading cryptocurrencies. Quidax operates a cryptocurrency trading platform that lists and trades existing crypto tokens using its proprietary blockchain.

In addition to Busha and Quidax, five other firms, including Trovotech and Dream City Capital, have been admitted to the SEC's Regulatory Incubation Program (RI), which evaluates business models and tests innovative digital asset products under SEC supervision.

You can follow Daba’s reporting on Africa on WhatsApp. Sign up here

Key Takeaways

The crypto landscape in Nigeria has been tumultuous. Following a ban on crypto-related banking transactions by the Central Bank of Nigeria (CBN), the government accused traders of manipulating the naira through P2P trading. In early 2024, reports emerged of crypto exchanges seeking licenses from the Securities and Exchange Commission (SEC) after the CBN lifted its two-year ban. However, by May, the SEC directed exchanges to remove the naira from P2P trading. This regulatory back-and-forth highlights the ongoing challenges for crypto adoption in Nigeria. For crypto services to fully integrate into the country's financial system, alignment between the SEC and CBN's regulatory approaches is crucial. The situation underscores the complex interplay between innovation, financial stability, and regulatory oversight in the evolving Nigerian crypto market.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.