PepsiCo, Absa Back Mobile Marketplace for Farmers Khula

TLDR

- PepsiCo’s South African development fund and local lender Absa Group are supporting Khula

- Khula, which has 20,000 users ranging from smallholder to commercial farmers, aims to raise R200 million ($10.7 million) by mid-2024

- Khula plans to use its Series A funding to scale operations in South Africa and pilot expansion into East Africa and Latin America

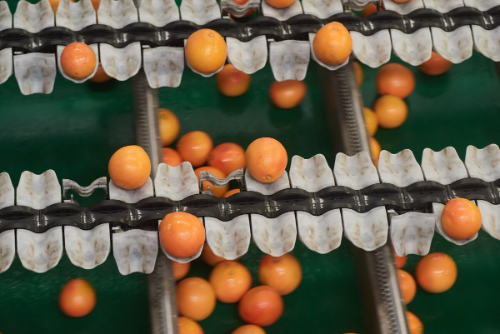

PepsiCo’s South African development fund and local lender Absa Group are supporting Khula, a mobile marketplace that helps farmers sell their products, access logistics, technical expertise, and secure financing.

Khula, which has 20,000 users ranging from smallholder to commercial farmers, aims to raise R200 million ($10.7 million) by mid-2024. It has already secured R126 million in a funding round led by E Squared Investments, with existing shareholders, including AECI and the company’s founders, also participating. PepsiCo is the largest buyer on Khula’s closed trading platform, where pre-approved farmers can sell directly to supermarkets and other bulk buyers.

The investment aligns with South Africa’s equity-equivalence programs, which require multinationals to support local economic initiatives instead of selling shares to Black South Africans. Khula plans to use its Series A funding to scale operations in South Africa and pilot expansion into East Africa and Latin America. The company’s valuation has grown tenfold since its 2023 seed round.

Daba is Africa's leading investment platform for private and public markets. Download here

Key Takeaways

Khula’s funding reflects a broader push to modernize Africa’s agriculture sector, which employs 60% of the continent’s workforce but faces major financing and infrastructure gaps. The African Development Bank estimates the sector has a $65 billion annual funding shortfall. By integrating artificial intelligence, Khula helps farmers diagnose crop diseases through image recognition, improving productivity. The startup is also testing financing solutions for farmers, addressing one of the biggest barriers to agricultural growth in Africa. With major backers like PepsiCo and Absa, Khula’s model could help bridge the gap between farmers and commercial buyers, improving food security and supply chain efficiency across Africa.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.