Planet42 secures $16m local currency funding from Standard Bank

TLDR

- Planet42 secures $16 million in funding from Standard Bank to repay euro-denominated loans, enhancing financial stability.

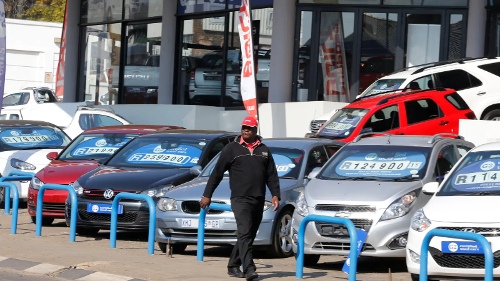

- Founded in 2017 by Estonian entrepreneurs, Planet42 offers car access to underbanked customers in South Africa.

- The partnership with Standard Bank allows Planet42 to expand its car offerings and empower more South Africans.

Planet42, a South Africa-based car subscription company, recently secured $16 million (R300 million) in local-currency debt and equity funding from Standard Bank. This funding aims to repay costly euro-denominated loans, providing financial stability and flexibility for the company.

Founded in 2017 by Estonian entrepreneurs Eerik Oja and Marten Orgna, Planet42 specializes in offering personal car access to its predominantly underbanked customer base in South Africa. The recent funding comes a year after raising $100 million in equity, credit facility, and debt. The company has so far raised around $150 million.

The partnership with Standard Bank will enable Planet42 to buy more cars to empower many more South Africans. More than 70% of vehicle finance applications in the country get rejected by banks, per Cars.co.za. Planet42 is one of the few upstarts, including Moove, Autochek, and FlexClub, focused on the African market tackling this inequality via different mobility offerings. Meanwhile,

Key Takeaways

African startups that have raised funds in foreign currencies are grappling with challenges related to rising inflation and currency devaluation, impacting how they report revenue to investors. The fluctuations in local currency values against foreign currencies have led to uncertainties in financial reporting, prompting startups to seek solutions to mitigate these risks. Experts suggest that raising funds in local currencies can help alleviate the effects of currency volatility. By securing investments denominated in local currencies, startups can better shield themselves from the adverse impacts of currency devaluation and inflation. This approach provides a level of stability and predictability in financial planning and reporting, offering greater confidence to both investors and stakeholders.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.