Ghana's Dash reportedly shuts down after raising over $85m

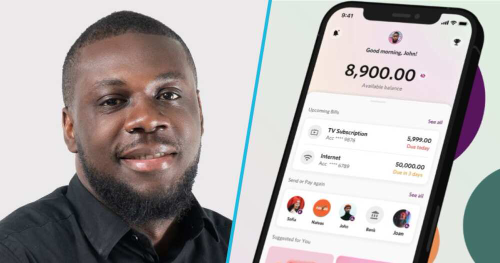

Ghanaian fintech company Dash, which aimed to connect mobile money wallets and bank accounts across Africa, is reportedly ceasing its operations. Founded in 2019 by Ghanaian entrepreneur Prince Boakye Boampong, Dash initially showed promise in addressing a significant issue in the financial sector.

Dash's mission was to simplify and streamline money transfers across Africa by ensuring interoperability between mobile money wallets and bank accounts throughout the continent. The company managed to secure substantial funding during its existence. In 2021, it raised an impressive $32.8 million in a single seed round, making it one of the highest-funded African firms. Investors included Insight Partners, Global Founders Capital, 4DX Ventures, and ASK Capital. Additionally, Dash secured further funding through convertible notes and debt financing from October 2021 to 2022.

During its operation, Dash claimed to have processed $1 billion in transactions and attracted a million users across Ghana, Nigeria, and Kenya, reflecting a remarkable fivefold increase in its user base within just five months. Despite its promising start, the company has decided to shut down its operations following a tumultuous journey filled with accusations of financial misconduct.

Key Takeaways

The closure of Dash amid allegations of financial misconduct could have significant repercussions for the African startup ecosystem, particularly when VC funding is facing challenges. Firstly, it may erode investor confidence in African startups, leading to heightened scrutiny and cautious investment practices. This, in turn, could make it more challenging for other promising startups to secure funding. Furthermore, the negative publicity surrounding Dash's closure might deter potential entrepreneurs and investors from engaging in the African startup scene, limiting the growth potential of innovative ventures. The African startup ecosystem has been on an upward trajectory, and Dash's fall could cast a shadow over this progress. Increased transparency, robust regulatory oversight, and adherence to ethical business practices will become even more critical to mitigate these impacts. The incident underscores the importance of integrity and accountability within the startup ecosystem to maintain trust and continue attracting investment at a time when VC funding is already declining.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.