The Best Performing BRVM Stocks of 2024

7 min Read January 2, 2025 at 9:28 PM UTC

The BRVM had a standout year in 2024, marked by strong performance in both local and foreign currency terms.

The Bourse Régionale des Valeurs Mobilières (BRVM) had a standout year in 2024, marked by strong performance in both local and foreign currency terms.

The BRVM Composite Index, which tracks the overall market performance, rose by an impressive 27.11% in local currency, driven by a robust economic environment in the West African Economic and Monetary Union (WAEMU). In foreign currency terms, the index also recorded double-digit returns, thanks to the stability of the CFA franc, which is pegged to the euro.

A historic moment came earlier in December when the market capitalization of the BRVM surpassed 10 trillion CFA francs ($16 billion), marking a remarkable growth of over 1,100% since its launch in 1998. This milestone reflects the robust economic growth across WAEMU countries, which have maintained an average GDP growth rate of 5.8% over the past two decades.

One of the highlights of the year was the successful IPO of Benin’s National Lottery (Loterie Nationale du Bénin), which raised $69 million. The listing, alongside record-high performances in key stocks, cemented the BRVM’s position as a leading regional exchange in Africa.

In this article, we rank the best-performing stocks on the BRVM in 2024 by their appreciation in share price, providing insights into their performance, business activities, sectors, and contributions to the market.

BICICI (Financials, Côte d’Ivoire) – 89.92%

The top-performing stock on the BRVM in 2024 was BICICI, a major player in the financial services sector. The stock soared by an impressive 89.92%, closing the year at 14,225 CFA francs. BICICI, headquartered in Côte d’Ivoire, is a subsidiary of BNP Paribas and operates as a full-service bank offering corporate, retail, and investment banking services.

The bank’s strong financial results and strategic focus on digital transformation contributed to its stellar performance, as investors saw it as a reliable and innovative financial institution.

SAPH (Consumer Goods, Côte d’Ivoire) – 76.17%

SAPH, one of Côte d’Ivoire’s leading rubber producers, was another standout performer, with a 76.17% increase in its share price to 4,140 CFA francs. The company specializes in the cultivation and processing of natural rubber, primarily for export markets.

As global rubber demand surged in 2024, SAPH benefited from favorable market conditions and operational efficiency. Its performance underscored the resilience of Côte d’Ivoire’s agricultural export sector, which remains a cornerstone of the national economy.

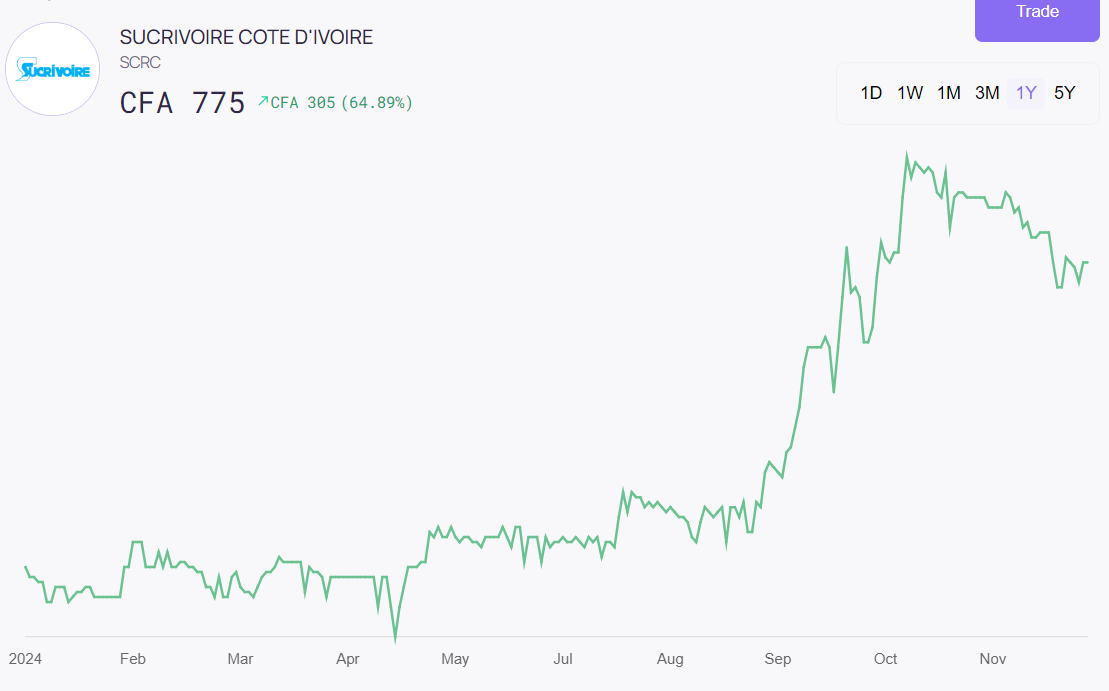

Sucrivoire (Consumer Goods, Côte d’Ivoire) – 58.95%

Sucrivoire, a prominent sugar producer in Côte d’Ivoire, delivered a 58.95% return, closing the year at 755 CFA francs. The company operates in the consumer goods sector, focusing on the cultivation, production, and distribution of sugar products.

Increased domestic and regional demand for sugar, combined with operational enhancements, drove Sucrivoire’s growth. Its strategic investments in infrastructure to expand capacity and improve efficiency further cemented its position as a market leader.

Orange Côte d’Ivoire (Telecom, Côte d’Ivoire) – 55.96%

Telecommunications giant Orange Côte d’Ivoire recorded a 55.96% growth in its share price, which ended the year at 17,000 CFA francs. As a leading telecom operator in the region, Orange provides mobile, broadband, and digital services across Côte d’Ivoire, Burkina Faso, and Liberia.

The company’s continued investment in infrastructure and its ability to grow its customer base boosted investor confidence. Orange’s strong dividend payouts and consistent revenue growth made it a favorite among investors seeking stable returns in the telecom sector.

Servair Abidjan (Industrials, Côte d’Ivoire) – 42.86%

Servair Abidjan, a leading player in the industrials sector, posted a 42.86% increase in its share price to 1,900 CFA francs. The company specializes in catering and ground handling services for the aviation industry in West Africa.

In 2024, Servair benefited from the recovery of global travel and increased air traffic in the region. Its operational excellence and ability to secure major contracts contributed to its strong financial performance and share price growth.

SOGB (Consumer Goods, Côte d’Ivoire) – 39.30%

The Société des Caoutchoucs de Grand-Béréby (SOGB), a key producer of palm oil and rubber in Côte d’Ivoire, saw its stock climb by 39.30%, closing at 4,555 CFA francs. The company operates in the consumer goods sector, focusing on sustainable agricultural practices.

Rising global demand for palm oil and rubber, coupled with SOGB’s commitment to environmental sustainability, drove its performance in 2024. The company’s strategic focus on expanding its export markets also added to its appeal among investors.

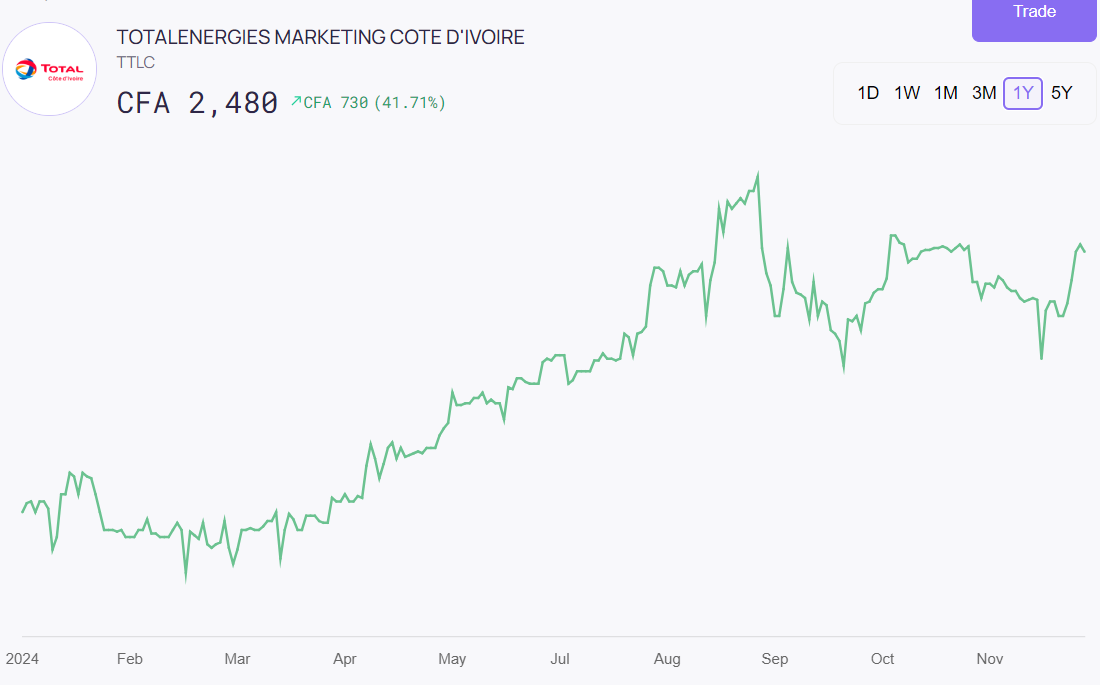

TotalEnergies Marketing Côte d’Ivoire (Oil & Gas, Côte d’Ivoire) – 37.78%

TotalEnergies Marketing Côte d’Ivoire recorded a 37.78% growth in its share price, which ended the year at 2,480 CFA francs. As a leading player in the oil and gas sector, the company distributes petroleum products and lubricants across the region.

The recovery in global oil prices and TotalEnergies’ strategic focus on renewable energy projects contributed to its strong performance. Its diversification into solar energy initiatives and improved operational efficiency made it an attractive option for investors seeking exposure to energy markets.

Sonatel (Telecom, Senegal) – 32.37%

Senegalese telecom operator SONATEL posted a 32.37% gain, with its share price reaching 23,800 CFA francs by year-end. As the leading telecom operator in West Africa, SONATEL provides mobile, broadband, and IT services across Senegal, Mali, Guinea, Guinea-Bissau, and Sierra Leone.

The company’s focus on expanding its digital services and customer base, coupled with strong financial performance, solidified its reputation as a stable and growth-oriented stock on the BRVM.

Sicor (Consumer Goods, Côte d’Ivoire) – 30.25%

Sicor, a Côte d’Ivoire-based company specializing in consumer goods, achieved a 30.25% return, closing the year at 3,940 CFA francs. The company’s primary business is the cultivation and processing of coffee and cocoa, two of Côte d’Ivoire’s key export commodities.

Strong global demand for cocoa, combined with favorable weather conditions, boosted SICOR’s operational output and financial results, making it a solid performer in the consumer goods sector.

Unilever Côte d’Ivoire (Consumer Goods, Côte d’Ivoire) – 29.50%

Unilever Côte d’Ivoire rounded out the list with a 29.50% growth, closing the year at 6,475 CFA francs. The company is a subsidiary of the global consumer goods giant Unilever and produces a range of household and personal care products.

Increased domestic demand and strong brand loyalty contributed to its growth. Unilever’s focus on local production and distribution also enhanced its appeal to investors looking for exposure to the consumer goods sector.

The BRVM’s strong performance in 2024 reflects the increasing depth and vibrancy of its capital markets. With a stable currency, high-profile IPOs, and robust performances from top companies, the exchange has proven to be a reliable platform for investors seeking growth and stability in Africa.

As the region continues to implement reforms and attract international capital, the BRVM is poised for another promising year in 2025.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.