BRVM's Top Stocks of 2023: The Ultimate Investor's Recap

6 min Read January 7, 2024 at 9:56 PM UTC

The Bourse Régionale des Valeurs Mobilières (BRVM) is the regional stock exchange of the member states of the West African Economic and Monetary Union (WAEMU): Benin, Burkina Faso, Côte d’Ivoire, Guinea-Bissau, Mali, Niger, Senegal, and Togo.

The exchange is located in Abidjan, Côte d’Ivoire but maintains market offices in each of the affiliated countries.

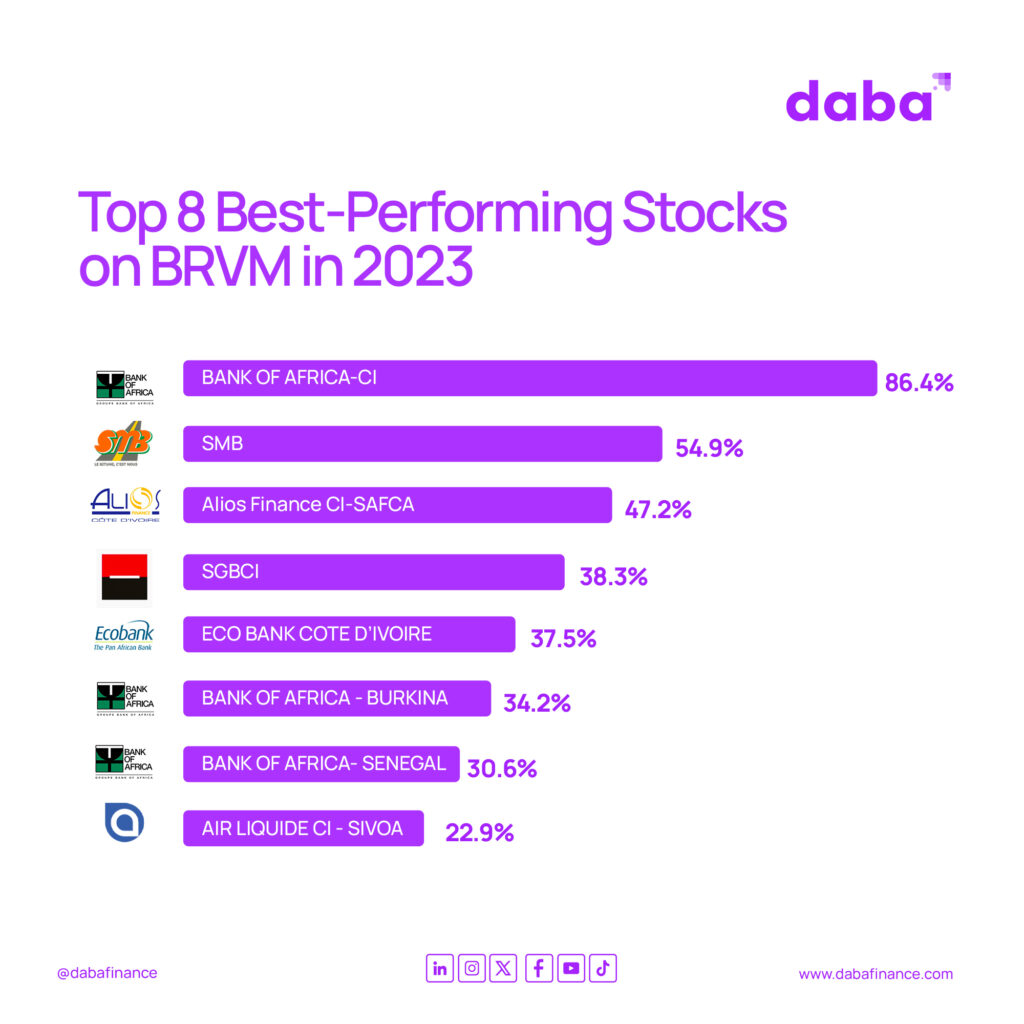

In an impressive year for the stock market, up to eight of the stocks posted double-digit share price gains in 2023 while the market capitalization surged past the XOF 8 trillion mark (around $13bn) for the first time in history in September.

As part of our 2023 recap series, we provide an overview of the best-performing stocks on the regional bourse—and the companies behind them—ranked by share price appreciation.

1. Bank of Africa (Cote d’Ivoire) – +86.4%

Bank of Africa Cote d’Ivoire SA is an Africa-based bank situated in Abidjan, Ivory Coast. It provides financial and insurance products and services to such customers as professionals, individuals, students, and local communities.

Bank of Africa – Côte d’Ivoire is traded on the BRVM under the ticker symbol “BOAC”. Its current share price is XOF 6,750 having surged more than 80% over the past year.

Bank of Africa – Côte d’Ivoire is currently the 15th most valuable stock on the BRVM with a market capitalization of XOF 135 billion, which is about 1.71% of the equity market.

It is the 16th most traded stock on the Exchange over the past three months.

2. Societe Multinationale de Bitumes (Cote d’Ivoire) – +54.69%

Societe Multinationale de Bitumes (SMB) SA is engaged in refining crude oil for the production and marketing of road bitumen and by-products.

SMB is traded on the BRVM under the ticker symbol “SMBC”. It is currently the 22nd most valuable stock on the bourse with a market capitalization of XOF 81.1 billion, which is about 1.02% of the equity market.

The current share price of SMB Côte d’Ivoire is XOF 10,400. It rose more than 54% last year and is the 31st most traded stock over the past three months.

3. Alios Finance (Cote d’Ivoire) – +47.2%

Alios Finance Safca SA, formerly Societe Africaine de Credit Automobile (SAFCA) SA, provides financial services including financing of motor cars, and agricultural or commercial equipment, including second-hand equipment.

It is traded on the BRVM under the ticker symbol “SAFC” and is currently the 41st most valuable stock on the exchange with a market capitalization of XOF 8.73 billion, which makes up about 0.11% of the equity market.

The stock’s current price is XOF 1,075 and it is the second most traded stock on the BRVM over the past three months.

4. SGB (Cote d’Ivoire) – +38.3%

Société Générale de Banques en Côte d’Ivoire provides banking products and services to individuals, corporations, institutions, and professionals in the Ivory Coast.

The company offers accounts, including remote banking products and money transfers; credits, such as real estate loans; life and non-life insurance; savings and investments; and loyalty programs for individuals.

SGB is traded on the BRVM under the ticker symbol “SGBC” and is currently the third most valuable stock with a market capitalization of XOF 492 billion, which is about 6.21% of the equity market.

SGB Côte d’Ivoire is the 29th most traded stock over the past three months.

5. EcoBank (Cote d’Ivoire) – +37.5%

Ecobank Cote d’Ivoire SA is a commercial bank that provides several products and services. Apart from the Ivory Coast, the Company also operates in Mozambique, Nigeria, and Tanzania, among others.

Ecobank is traded on the BRVM under the ticker symbol “ECOC” and is currently the fourth most valuable stock with a market capitalization of XOF 369 billion, which is about 4.66% of the equity market.

The current share price of Ecobank Côte d’Ivoire is XOF 6,700 and is the seventh most traded stock on the Exchange over the past three months.

6. Bank of Africa (Burkina Faso) – +34.2%

Bank of Africa Burkina Faso SA is a commercial bank operating in the retail, corporate, and financial markets. The Bank provides financial products such as deposit accounts, including checking, savings, and time deposits, and extends loans to individuals and businesses.

Burkina Faso is traded on the BRVM under the ticker symbol “BOABF”. Bank of Africa – Burkina Faso is currently the 10th most valuable stock with a market capitalization of XOF 151 billion, which makes up about 1.9% of the equity market.

The current share price of Bank of Africa – Burkina Faso is XOF 6,850 and is the 35th most traded stock on the Exchange over the past three months.

7. Bank of Africa (Senegal) – +30.6%

Bank of Africa Senegal provides a range of banking products and services to individuals and businesses. BOA Senegal operates as a subsidiary of BOA Group, a holding company that provides financial services such as banking and insurance through its subsidiaries in Africa.

It is traded on the BRVM under the ticker symbol “BOAS” and is currently the 25th most valuable stock with a market capitalization of XOF 76.2 billion, which makes up about 0.962% of the equity market.

Bank of Africa – Senegal is the 19th most traded stock over the past three months with a current share price of XOF 3,175.

8. Air Liquide (Cote d’Ivore) – +22.9%

Air Liquide Cote d’Ivoire SA, formerly Societe Ivoirienne d Oxygene et d Acetylene SA, (SIVOA), is an Ivory Coast-based company engaged in the chemical industry.

It produces industrial and medical gases, equipment and medical consumables, cutting and welding equipment, hygiene materials, and firefighting products. It also provides installation and maintenance services.

Air Liquide is traded on the BRVM under the ticker symbol “SIVC” and is currently the 42nd most valuable stock with a market capitalization of XOF 7.25 billion, which is about 0.092% of the equity market.

The current share price of Air Liquide Côte d’Ivoire (SIVC) is XOF 830 and it is the sixth most traded stock on the BRVM over the past three months.

XOF 1 = USD 0.0017 as of January 7, 2024.

Information credits: BRVM, African Exchanges, Reuters Markets

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.