Unlock Africa's Potential: A Guide for Diaspora Investors

4 min Read March 10, 2024 at 1:44 AM UTC

Africa’s entrepreneurial spirit is soaring, with startups and small businesses driving much of the innovation, job creation, and economic growth on the continent.

As a member of the African diaspora, investing in these promising ventures presents a unique opportunity to generate financial returns while creating meaningful social impact in the communities you care about.

But navigating the vast and diverse African startup ecosystem can be daunting for investors. Where do you start? How do you identify and access high-potential deals? And what mindset shifts are needed to see beyond outdated perceptions and unlock Africa’s immense entrepreneurial potential?

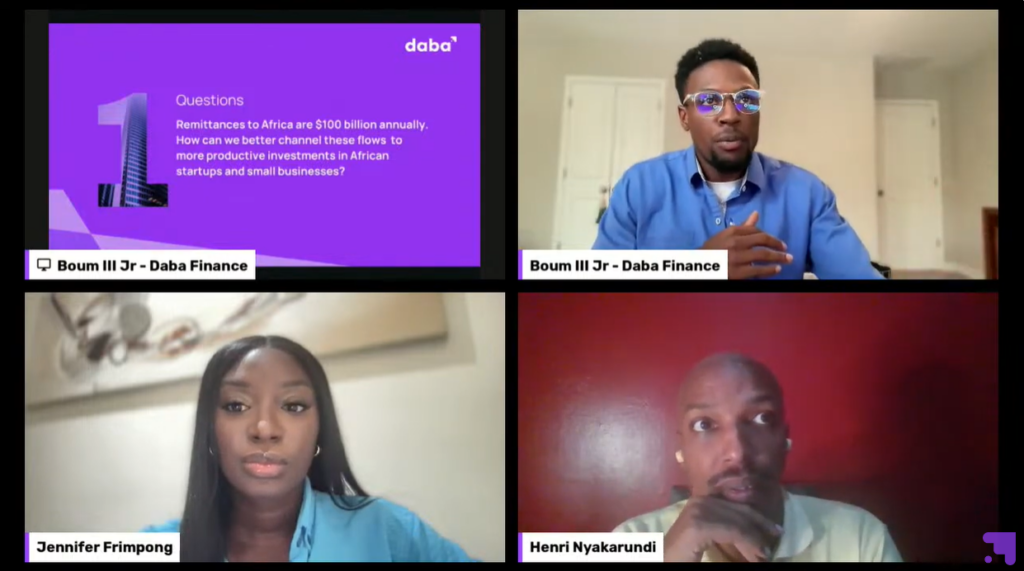

Here are 5 key things to know based on insights shared by expert panelists Jennifer Frimpong of Ma Adjaho & Co and ARED CEO Henri Nyakarundi during the recent Part 1 of our diaspora investment-focused webinar series.

Vetted Platforms Bridge the Trust Gap

1. Vetted platforms build trust and expand opportunity. With 54 countries, Africa is a vast and diverse continent. Identifying and accessing high-quality investment opportunities requires trusted access and local expertise.

Platforms like Daba thoroughly vet startups and small businesses, conducting rigorous due diligence to surface promising ventures across sectors and borders. This allows investors to confidently explore deals beyond just familiar countries and regions, expanding their opportunity set.

Shedding Outdated Perceptions

2. Look beyond outdated perceptions of Africa’s business landscape. Too often, investors still view the continent through an outdated lens focused primarily on extractive industries like mining and oil & gas. But vibrant new sectors like agribusiness, fintech, logistics, and renewable energy now offer immense potential for innovation and growth.

Evaluate each startup or small business opportunity on its own merits, rather than dismissing entire industries due to old stereotypes about the African market.

Nurturing the Path to Investment Readiness

3. It’s important to understand that many promising African startups and small businesses require nurturing and support to reach the scale and “investment readiness” that makes them attractive to investors.

They have brilliant ideas and massive potential but need help optimizing their business models, securing early funding rounds, building robust operations and governance, and bridging other capability gaps on the path to becoming a proven, scalable venture.

This is where partnering with expert organizations operating on the ground across Africa can be invaluable. Accelerators, incubators, angel networks, and other players deeply engrained in local entrepreneurship ecosystems can help identify diamonds in the rough, provide mentorship and capacity-building support, and nurture startups to key milestones that make them compelling investment propositions.

The Impact Imperative

4. For diaspora investors, funding African startups and small businesses should be about more than just financial returns. These enterprises are catalyzing inclusive economic growth, creating quality jobs, and empowering people and communities to thrive. When you invest, you become a key enabler of this transformative impact. Let social impact be a core part of your investment thesis and decision criteria.

5. Telling success stories can inspire a rising tide of diaspora investment. As you identify and fund promising African startups that go on to create value and drive positive change, share those examples widely. The more visible success stories and role models this ecosystem produces, the more it will raise awareness and catalyze other members of the diaspora to get involved as investors and supporters.

Catalyzing The Continent’s Entrepreneurial Future

The time is now for the diaspora to play a catalytic role in investing in Africa’s entrepreneurial future. With projections that Africa will have the world’s largest working-age population in just a few decades, empowering and unleashing the ingenuity of the continent’s young entrepreneurs today can set a thriving course for generations to come.

Follow the insights above to engage strategically in Africa’s startup investment ecosystem. Adopt the right mindset and partnerships to go beyond outdated perceptions. Leverage trusted platforms to access opportunities across the continent’s diversity of industries and markets. And anchor your investment approach in the driving force of creating positive social impact through economic empowerment.

If you could not join the webinar or would like to watch it again, you can catch the recording on our YouTube channel. And to find more about how Daba enables investing in Africa opportunities for individual and institutional investors, visit our webpage or get our mobile app.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.