Francophone Africa: A Rising Hub for Tech Startups

7 min Read October 29, 2023 at 11:31 AM UTC

From Senegal’s hubs to Cote d’Ivoire’s fintech advancements, exciting tech developments are shaping the future in francophone Africa.

Did you know that Africa is home to the largest number of French speakers in the world?

Yes, you read that right.

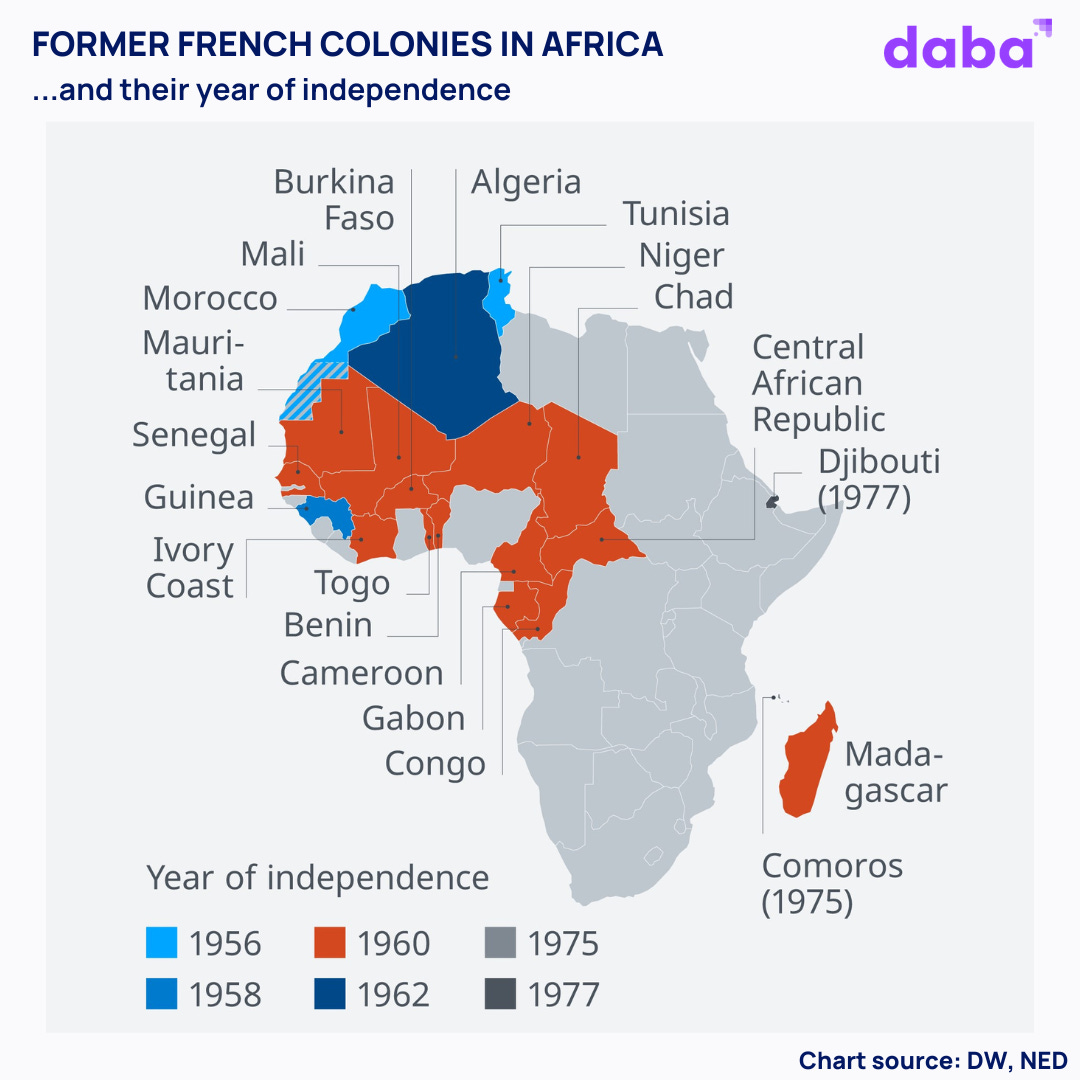

The French language, brought to the continent through colonialism by France and Belgium, is today spoken by an estimated 167 million people in Africa in 2023, who make up 51% of the global French-speaking population.

This population is spread across 29 countries, more than half of Africa’s 55, extending from the Maghreb in North Africa to sub-Saharan nations in the center and west such as Senegal, Ivory Coast, and Cameroon.

Up to 21 of those countries are known as “francophone countries”, where French is either the official or commonly spoken language.

And, according to some estimates, there will be 700 million French speakers by 2050, 80% of them in Africa.

Yet for all its ubiquity and predominance, the francophone region often remains overshadowed in discussions surrounding one of the continent’s most prominent trends: the surge in technology innovation and startups.

For the better part of the last decade, much of the attention, and investments, have been skewed toward startups in predominantly English-speaking countries.

For context, francophone Africa typically attracts less than 20% of Africa’s annual VC funding.

But that isn’t for lack of exciting ventures.

Far from that, the region has produced some of the most notable fintech and software startups in Africa.

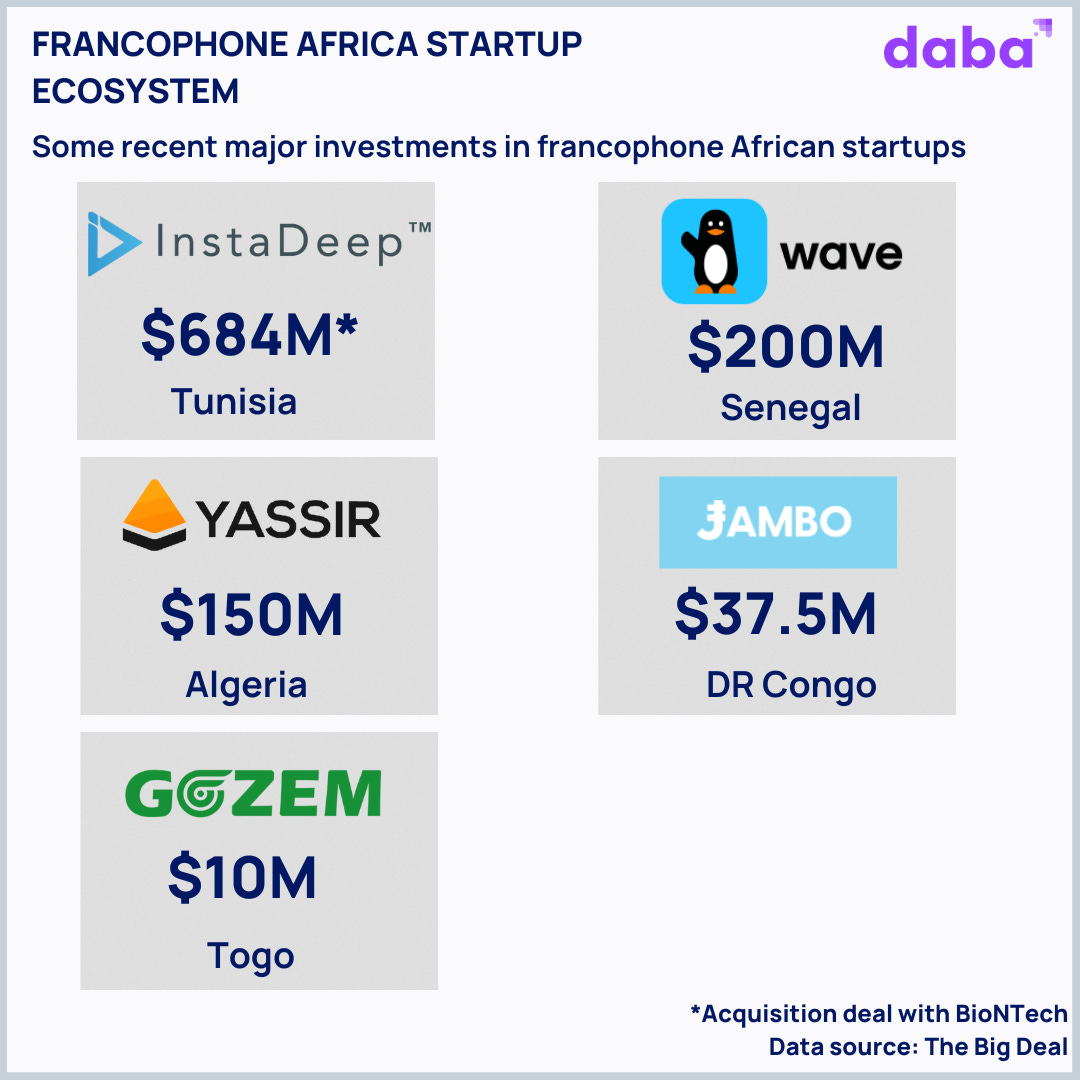

Senegal’s Wave (mobile money service), Tunisia’s InstaDeep (AI solutions provider recently acquired by BioNTech SE in a $684m deal), Morocco’s Chari (an e-commerce platform for small retailers), and Algeria’s Yassir (a super App for on-demand, ride-hailing, last-mile delivery, payment services, and more) are some shining examples.

So why does francophone Africa get sidelined?

Language barriers and investor preferences play a role in this disparity.

Most venture capital investors and firms active in Africa originate from the US and UK, favoring Anglophone markets due to familiarity.

Meanwhile, French investors are scarce in the African startup scene, contributing to the uneven funding distribution.

Another major reason for the lag in francophone African startups’ funding is their recent entry into the scene.

Their emergence in the last three years and early-stage status hinder larger funding rounds.

Beating the odds: the rise of francophone startups

In 2021, Senegalese fintech Wave achieved a remarkable milestone as the country’s inaugural startup to reach a $1bn valuation after raising $200m.

Notably, it also stood out as the first unicorn outside of the traditionally dominant tech hubs such as Nigeria, South Africa, Egypt, and Kenya—and the pioneer in French-speaking Africa.

The IFC-led funding received significant attention, sparking curiosity about tech progress in the broader region.

Since then, investment in French-speaking African startups has steadily increased.

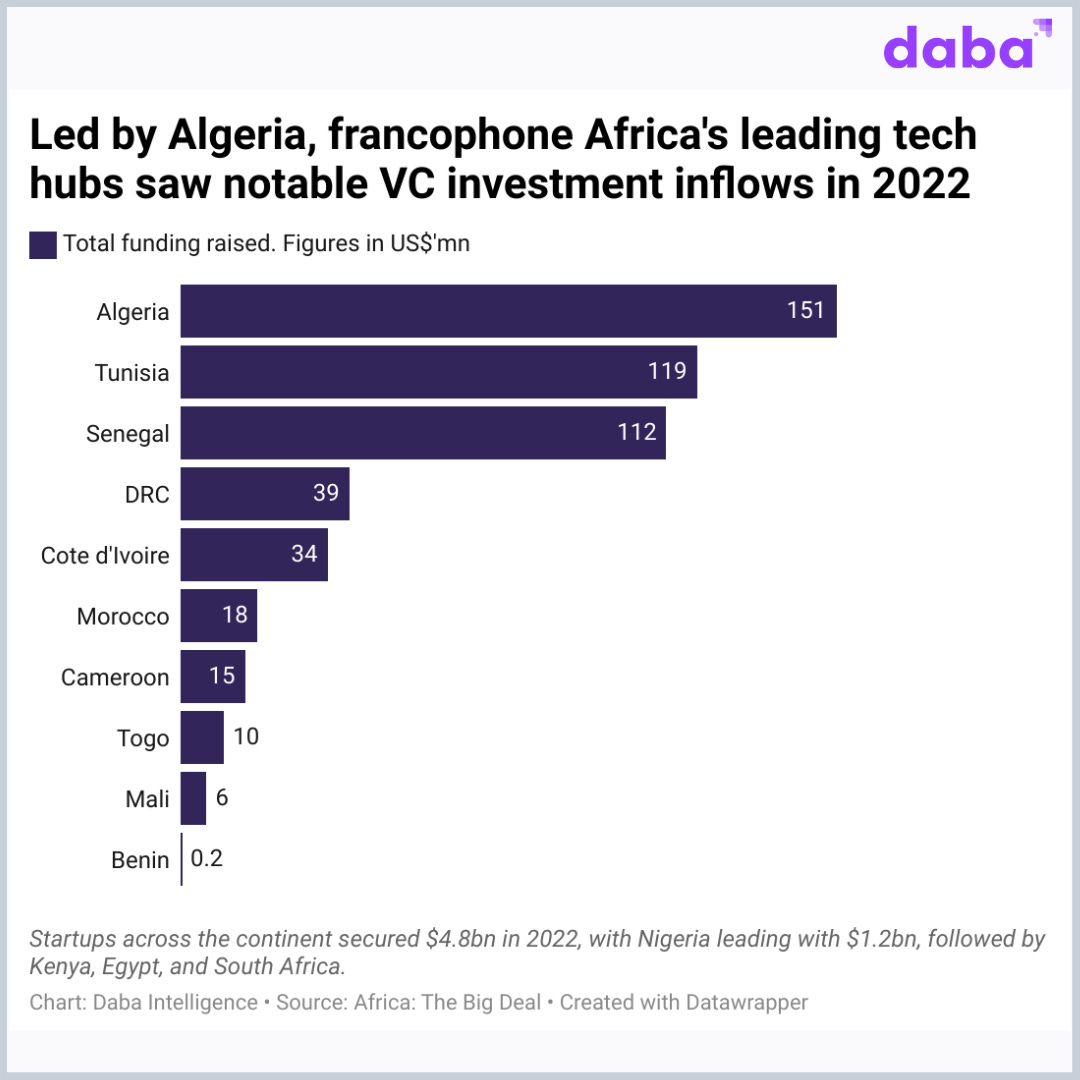

African startups raised $4.8bn in 2022, with Nigeria leading with $1.2bn, followed by Kenya, Egypt, and South Africa.

But data from Africa: The Big Deal, a publication that tracks venture funding in Africa, revealed a shift in momentum beyond the “Big Four.”

French-speaking countries like Algeria, Tunisia, and Senegal attracted $151m, $119m, and $112m respectively.

Côte d’Ivoire raised $34m, and Togo reached the $10m funding mark for the first time. Mali also marked its most successful year with $6m.

While investment in central francophone Africa remains lower than in other regions, Chad, Cameroon, Congo, and DRC saw increased investment inflows: from $24m in 2021 to $50m in 2022.

What does the future hold for “the French” in Africa?

Several trends indicate a change in the tech venture fortunes of French-speaking Africa.

For one, the region boasts some of the highest mobile phone adoption rates, which is fueling the rise of even more tech-driven startups. Some of these are:

- Julaya (Côte d’Ivoire): provides African businesses with digital accounts to make payments, and disburse mobile money transactions to their employees and suppliers.

- Gozem (Togo): a super app that offers a host of services – including transport, e-commerce, and financial services – across several countries in francophone Africa.

- Daba (pan-African): enables people, primarily in francophone Africa, access a wide range of investment products, from stocks listed on the regional exchange BRVM, bonds, and mutual funds to early-stage ventures, all through a mobile application.

- Jambo (DRC): focused on bringing Web3 to African markets with a mission to onboard the next billion African users.

- Hub2 (Côte d’Ivoire): a leading fintech startup in interoperability and payment infrastructure in Francophone Africa, present in 14 countries.

- Djamo (Côte d’Ivoire): offers digital banking solutions to people excluded financially.

- Auto24 (Côte d’Ivoire): a direct-to-consumer used car company that provides new, innovative solutions to ensure transparent and secure transactions.

- Bizao (Côte d’Ivoire): digitizes payments for local and international companies. Since 2019, Bizao has signed over 30 partnerships with telecom operators, banks, and mobile money operators in Africa.

- Oko (Mali): develops affordable mobile-based crop insurance products to provide smallholder farmers with the financial security they need, regardless of unstable climate trends. The startup operates in Mali and Uganda and has brought insurance to more than 15,000 farmers.

- Paps (Senegal): is a technology-driven transportation and logistics company that offers end-to-end services for customer satisfaction.

The region also has a more conducive policy environment for innovation while offering startups a relatively easy regional expansion route due to shared culture, language, regulations, and currency.

Fourteen countries use the CFA franc, regulated by the West African Monetary and Economic Union and the Central African Economic and Monetary Community.

The currency is pegged to the Euro and does not fluctuate, providing the kind of foreign exchange stability that’s not available elsewhere on the continent.

Both unions represent 14% of Africa’s total population and 12% of its GDP.

In addition, the region is home to six out of the seven fastest-growing economies in sub-Saharan, per the IMF

French VC investors like Saviu, Orange Ventures, Newfund Capital, Proparco, CFAO, and AfricInvest are also increasingly backing startups in the region.

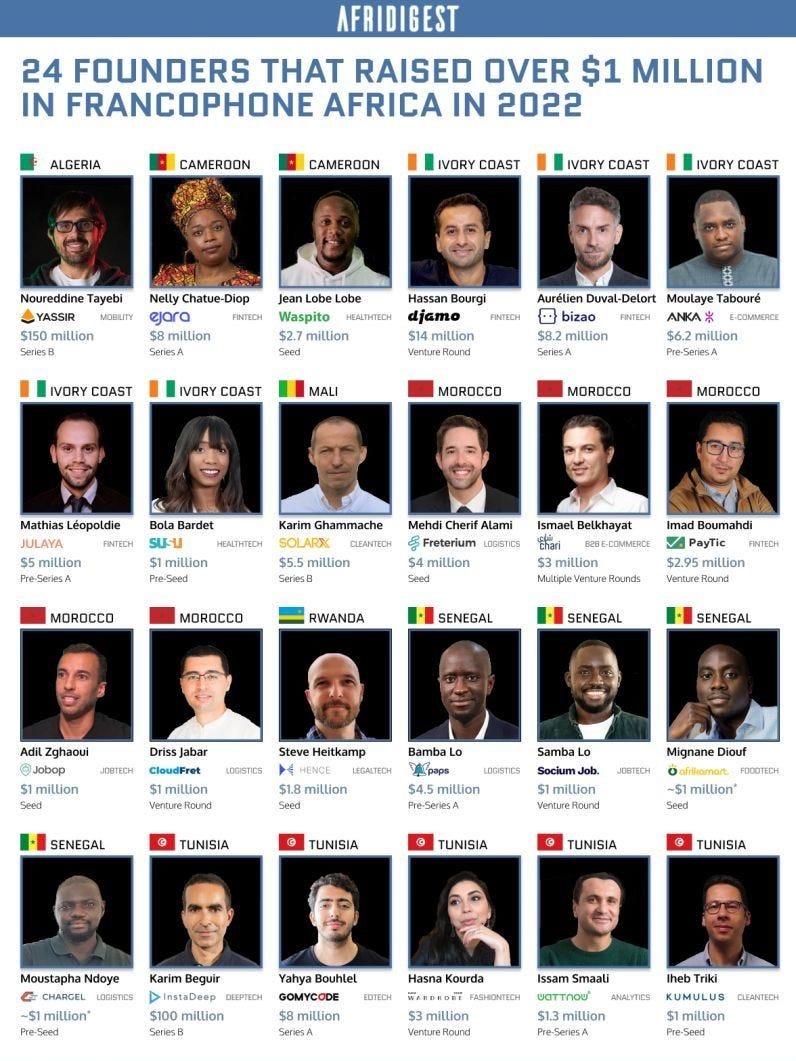

At least 24 startup founders in the region raised over $1m in 2022.

The presence of a robust early-stage support system in the form of competitions, incubators, accelerators, technological hubs, and venture studios is also contributing to entrepreneurship growth in the region.

Mstudio, for instance, supports early-stage entrepreneurs, and in terms of competitions, tech incubator Hadina RIMTI organizes the Entrepreneur’s Marathon in Mauritania.

For entrepreneurship training in Mali, workshops have been designed and conducted by local incubators CREATEAM and Impact Hub.

Jambar Tech Lab and Traction Camp meanwhile, are getting entrepreneurs in Senegal and Kenya ready to scale their businesses by partnering with incubators on the ground, CTIC Dakar & iHub.

And, open innovation programs like the Mali-based hackathon organized by DoniLab, CREATEAM, Jokkolabs, Teteliso & Impact Hub led to the design of a new urban mobility app for a large local firm.

The 400-million-population-strong francophone African market offers a distinctive opportunity as its tech ecosystem unfolds, and startups attract more attention and capital from regional and global investors.

While readiness for digital services varies across countries, recent successes like Wave and InstaDeep illustrate the region’s collective potential.

From Senegal’s tech hubs to Cote d’Ivoire’s fintech advancements, exciting tech developments are shaping the future of business and services in francophone Africa as much as they are in the more “popular” region.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.