Beyond Jumia and Swvl: Top African Stocks for Foreign Investors

8 min Read September 5, 2024 at 3:07 PM UTC

While high-profile listings like Jumia and Swvl have faced challenges, they don’t tell the whole story of African equities. The continent is home to numerous well-established, profitable companies that offer attractive investment opportunities, often with high dividend yields.

In recent years, Africa-focused companies like Jumia and Swvl have captured the attention of global investors by listing on major foreign exchanges.

Jumia, often dubbed the “Amazon of Africa,” debuted on the New York Stock Exchange in 2019, while Swvl, a Dubai-based mass transit company with significant operations in Egypt, went public via a SPAC merger on NASDAQ in 2022.

However, the performance of these stocks has been underwhelming since their listings.

Jumia’s share price has plummeted over 90% from its all-time high, while Swvl has faced delisting threats due to its low share price.

These disappointing outcomes have not only burned investors but also cast a shadow on the reputation of African equities in global markets.

Despite these setbacks, the African continent remains home to numerous high-quality public companies that offer attractive investment opportunities.

Many of these stocks even pay high-yield dividends, making them particularly appealing in the current economic climate.

Moreover, it’s now easier than ever for foreign investors to access African equities through ETFs and digital investment platforms like Daba.

Let’s explore some African stocks across various exchanges that foreign investors should consider:

1. MTN Nigeria (MTNN) – Nigeria

MTN Nigeria is the largest telecommunications provider in Nigeria, with over 70 million subscribers.

As a subsidiary of the South African MTN Group, it benefits from strong backing and extensive experience in African markets. The company has shown consistent growth in revenue and profitability, driven by increasing data usage and mobile money adoption.

MTN Nigeria offers a dividend yield of around 7-8%. It holds a strong market position in Africa’s largest economy and shows significant potential for growth in mobile internet and financial services.

2. Dangote Cement (DANGCEM) – Nigeria

Dangote Cement is Africa’s largest cement producer, with operations across ten African countries.

Founded by Africa’s richest man, Aliko Dangote, the company has a dominant market position in Nigeria and has been expanding its presence across the continent.

Dangote Cement boasts an impressive dividend yield of around 6%. The company is well-positioned to benefit from Africa’s ongoing infrastructure development and urbanization trends.

Its strong brand recognition and economies of scale contribute to its competitive advantage in the market.

3. Naspers Limited (NPNJn) – South Africa

Naspers is a multinational consumer internet company and one of Africa’s largest companies by market capitalization.

Its most valuable asset is a significant stake in Chinese tech giant Tencent, but it also has investments in various online classifieds, food delivery, and payment businesses globally.

While Naspers doesn’t offer regular dividends, it occasionally provides special dividends to shareholders and has a 17% return on equity.

The company offers diversified exposure to global tech trends and is currently trading at a discount to the value of its Tencent stake, potentially presenting a value opportunity for investors.

4. Gold Fields Limited (GFIJ) – South Africa

Gold Fields is one of the world’s largest gold mining firms, with operating mines in South Africa, Ghana, Australia, and Peru. The company has been focusing on increasing its production while reducing costs.

Gold Fields typically offers a dividend yield of around 3-4%. As a gold producer, it serves as a potential hedge against economic uncertainty and inflation. The company is also undergoing a shift towards more mechanized, cost-effective mining operations, which could improve its long-term profitability.

5. Safaricom Plc (SCOM) – Kenya

Safaricom is Kenya’s largest telecommunications provider and the company behind the revolutionary M-Pesa mobile money service.

M-Pesa has transformed financial inclusion in Kenya and is expanding to other African markets.

Safaricom offers a dividend yield of around 8%. The company shows strong growth potential in mobile data and financial services. The ongoing expansion of M-Pesa across Africa presents significant opportunities for future growth.

6. Orange Côte d’Ivoire (ORAC) – BRVM

Orange Côte d’Ivoire is the leading telecommunications operator in Ivory Coast. As a subsidiary of the French telecom giant Orange, it benefits from strong technical and financial support.

The company offers an attractive return on equity of around 17%. Orange Côte d’Ivoire is experiencing growth in mobile money and data services in a rapidly developing economy. It plays a key role in Orange’s broader African growth strategy.

7. Sonatel (SNTS) – BRVM

Société Nationale des Télécommunications du Sénégal (Sonatel) is the dominant telecommunications company in Senegal and has operations in several West African countries.

Sonatel provides a high dividend yield of around 8%. The company maintains a strong market position in multiple West African markets and shows potential for growth in broadband and mobile financial services.

8. Société Générale Côte d’Ivoire (SGBC) – BRVM

SocGen CI is a subsidiary of the French banking group Société Générale and one of the largest banks in Ivory Coast.

The bank offers a substantial dividend yield of around 8-9%. Investing in SocGen CI provides exposure to Ivory Coast’s growing economy and banking sector. The company benefits from the expertise and resources of its parent company, Société Générale.

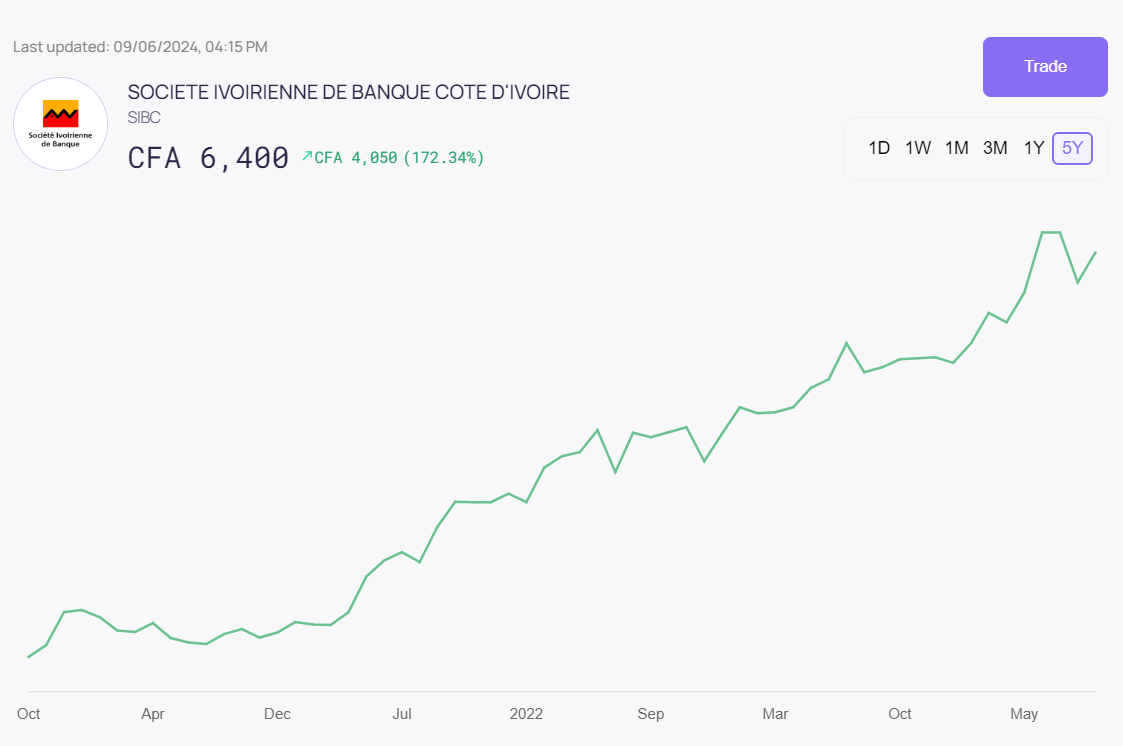

9. Société Ivoirienne de Banque (SIBC) – BRVM

SIBC is another major bank in Ivory Coast, majority-owned by Morocco’s Attijariwafa Bank. SIBC typically provides a dividend yield of 8%.

The bank holds a strong position in Ivory Coast’s corporate and retail banking sectors. It has the potential to benefit from increasing financial inclusion and overall economic growth in the country.

10. Société Multinationale de Bitumes (SMBC) – BRVM

SMB is a leading bitumen producer in West Africa, supplying essential materials for road construction and maintenance. The company offers an impressive dividend yield of around 7%.

SMB is well-positioned to benefit from ongoing infrastructure development across West Africa. Its business model benefits from relatively stable demand due to the continuous need for road maintenance.

Major Banks and Financial Institutions Worth Considering

In addition to the stocks mentioned above, several major African banks and financial institutions offer attractive investment opportunities:

FirstRand Limited (South Africa) is one of Africa’s largest financial services groups, with operations across banking, insurance, and investment management. Standard Bank Group (South Africa) is Africa’s largest bank by assets, with a presence in 20 African countries and major financial centers globally.

Guaranty Trust Holding Company (Nigeria) is a leading African financial services group with strong positions in Nigeria and an expanding presence across Africa. Zenith Bank (Nigeria) is one of Nigeria’s largest banks, known for its strong retail banking franchise and digital banking initiatives.

Equity Group Holdings (Kenya) is a rapidly growing financial services group with operations in several East African countries. Attijariwafa Bank (Morocco) is Morocco’s largest bank with significant operations across North and West Africa.

These financial institutions offer exposure to Africa’s growing banking sector, increasing financial inclusion, and the continent’s overall economic development.

Bottom Line

While high-profile listings like Jumia and Swvl have faced challenges, they don’t tell the whole story of African equities. The continent is home to numerous well-established, profitable companies that offer attractive investment opportunities, often with high dividend yields.

Moreover, accessing these stocks has never been easier. Investors can gain exposure through Africa-focused ETFs, which offer diversified portfolios of African equities. Digital investment platforms like Daba also break down barriers, allowing individual investors from around the world to directly purchase shares in African companies.

As Africa continues its economic growth trajectory, driven by factors such as a young population, increasing urbanization, and technological adoption, now may be the perfect time to consider adding African stocks to your investment portfolio.

Don’t let the underwhelming performance of a few high-profile stocks deter you from exploring the wealth of investment options across Africa’s stock exchanges. Take the time to research these companies, consider consulting with a financial advisor familiar with African markets, or subscribe to premium investment advisers like Daba Pro to get weekly curated stock picks.

Whether you’re seeking high dividend yields, exposure to fast-growing economies, or simply looking to diversify your investments, African equities offer compelling opportunities.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.