Top Themes Africa Investors Should Watch in 2025

6 min Read February 4, 2025 at 2:06 PM UTC

2025 is shaping up to be a year with compelling opportunities across equities, venture capital, and infrastructure for Africa-focused investors.

Africa’s investment landscape is set for a transformative year. As markets adjust to shifting economic policies, geopolitical realignments, and a recalibration of global interest rates, investors are positioning themselves for what could be a pivotal year across the continent.

With nine of the world’s 20 fastest-growing economies, an improving macroeconomic backdrop, capital markets bustling with fundraising activity, and the digital economy’s next wave, 2025 is shaping up to be a year with compelling opportunities across equities, venture capital, and infrastructure for Africa-focused investors.

Here’s what investors need to watch.

Rapid Growth Amid Debt Restructuring and Fiscal Realignment

Africa’s economic outlook for 2025 is defined by rapid expansion in several economies, even as others continue to grapple with macroeconomic challenges. Per the International Monetary Fund (IMF), nine of the world’s 20 fastest-growing economies in 2025 will be in Africa, reinforcing the continent’s role as a global growth leader.

Countries such as Rwanda, Ethiopia, Ivory Coast, and Tanzania are expected to post growth above 6%, driven by diversified industries spanning agriculture, manufacturing, services, and technology. Meanwhile, frontier economies like South Sudan, Libya, Senegal, Sudan, Uganda, Niger, Zambia, Benin, and Rwanda are leading the way, benefiting from increased investment, infrastructure expansion, and rising consumer demand.

However, Africa’s growth story is not uniform. Resource-intensive economies, including Nigeria, Angola, and South Africa, have struggled with stagnation due to weak commodity prices and a lack of diversification. Debt sustainability remains a challenge, with many governments actively restructuring obligations to free up fiscal space for investment.

Public markets are reflecting this economic realignment. The BRVM, Nairobi Securities Exchange, and Johannesburg Stock Exchange are seeing heightened activity, with increased foreign investor inflows and a resurgence of local participation.

Also Read: Africa in 2025: The Fastest-Growing Economies

Political Transitions To Continue Testing Market Confidence

Election cycles are always a test for investor sentiment, and 2025 is no exception. 13 of the 17 elections scheduled for last year were held across Africa while 10 are expected to be held this year.

Key elections in Côte d’Ivoire, Malawi, and Tanzania will influence market direction but perhaps the most consequential shift has already taken place in South Africa, where the ANC lost its parliamentary majority for the first time since 1994.

The new coalition government has sparked optimism among investors, with the Johannesburg Stock Exchange rallying on expectations of pro-market policies. JPMorgan expects a surge in IPO activity, led by listings from Pick n Pay’s Boxer unit and Anglo American’s planned spinoffs.

Elsewhere, political risk remains a factor. Mozambique is grappling with post-election instability, while Mali, Burkina Faso, and Niger are exiting ECOWAS, realigning regional power structures. For investors, political stability will be as much a driver of capital flows as economic fundamentals.

Also Read: 2024 African Elections: A Year of Political Shifts

Africa’s Global Influence Expands—And So Do Investment Opportunities

Africa’s geopolitical weight continues to rise, underscored by South Africa’s G20 presidency—the first time the summit will be hosted on the continent. The African Union’s push for a greater voice in global economic governance is also gaining traction.

At the same time, major global investment summits—from TICAD in Japan to the US-Africa Business Summit in Angola—are drawing international capital towards Africa’s markets. These events will likely shape trade agreements, infrastructure financing, and cross-border capital flows.

For investors, the question is no longer whether Africa is part of the global investment conversation—it’s how to capitalize on its increasing influence.

The Green Energy Transition and Africa’s Critical Role

Africa’s vast reserves of lithium, cobalt, and copper are becoming increasingly strategic as the world races toward decarbonization. The continent’s position as a key supplier of electric vehicle batteries and renewable energy components is attracting new players into the market.

China remains a dominant force, but US and European firms are ramping up investments, looking to secure alternative supply chains and reduce dependence on existing sources. African governments, in turn, are seeking to capture more value by expanding domestic processing capacity rather than just exporting raw materials.

For investors, the challenge will be navigating regulatory risks while gaining exposure to a sector that is central to the global energy transition.

Inflation Cools, Interest Rates Normalize, and IPOs Surge

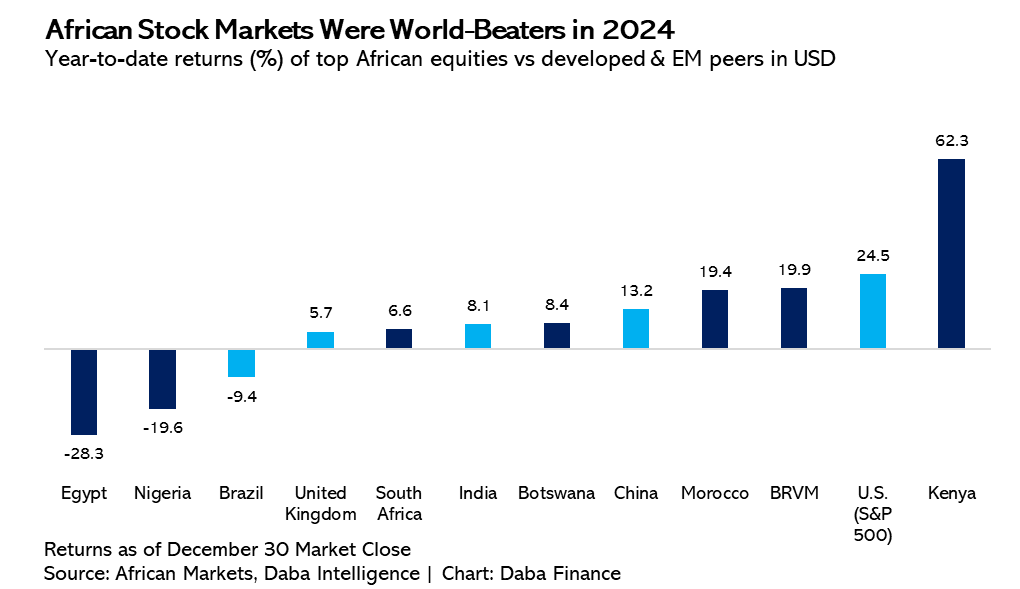

African equities are entering 2025 with strong momentum following a stellar 2024. With inflation easing and interest rates expected to stabilize in the second half of the year, capital markets are primed for further expansion.

South Africa’s JSE is preparing for one of its biggest IPO seasons in years, while financial institutions in Benin, Cameroon, Algeria, and Tunisia are gearing up for public listings. In West Africa, BRVM continues to attract institutional capital, cementing its position as a regional safe haven.

With rising liquidity and an improving macro backdrop, Africa’s public markets are increasingly competitive with other emerging markets, providing an attractive entry point for long-term investors.

Africa’s Digital Economy Set for Next Investment Wave

Africa’s technology sector remains a bright spot, even after a slight dip in venture capital inflows in 2024. Startups raised $3.2 billion last year per Partech data, with fintech, e-commerce, and AI-driven platforms leading the charge.

The prospect of lower borrowing costs and a stabilizing macroeconomic environment could trigger a fresh wave of venture funding in 2025. Meanwhile, the demand for AI-powered services, cloud computing, and data storage is creating an urgent need for new data centers and digital infrastructure investments.

For private equity and venture capital firms, Africa’s digital transformation remains one of the most compelling long-term investment stories.

Infrastructure Investment Accelerates as Capital Flows into Hard Assets

Africa’s infrastructure sector is seeing a massive inflow of capital, with investment surging in roads, rail networks, ports, and energy projects. Countries across the continent are scaling up connectivity, supported by the African Continental Free Trade Area (AfCFTA).

At the same time, Africa is experiencing a data center crunch, with demand for AI-driven computing and cloud storage far exceeding supply. Major tech firms, including Amazon Web Services, Google, and Microsoft, are ramping up investments.

For investors, this presents a dual opportunity—gaining exposure to Africa’s physical infrastructure boom and digital infrastructure expansion.

We Can Help

With inflation cooling, capital markets deepening, and geopolitical shifts bringing Africa closer to the global economic mainstream, 2025 presents a compelling investment landscape.

For those looking to gain exposure, Daba provides an all-in-one investment platform to access opportunities in Africa’s public and private markets, offering access to stocks, startups, and infrastructure projects.

The narrative around Africa is shifting. No longer just a frontier market, the continent is emerging as a core destination for institutional capital. The question isn’t whether to invest—but how soon.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.