Top 9 BRVM Highlights in 2023: Unveiling Africa's Potential

6 min Read February 18, 2024 at 12:38 PM UTC

One of the key questions investors looking to diversify their portfolios often ask is, “Where to invest in Africa?” African stocks offer some of the most promising opportunities for retail and institutional investors.

In this blog, we explore some of the standout trends on the bourse last year and why investors interested in Africa should look to the Bourse Régionale des Valeurs Mobilières (BRVM), the regional stock exchange serving eight francophone West African countries.

What is the BRVM?

The Bourse Régionale des Valeurs Mobilières (BRVM) serves as the regional stock exchange for the West African Economic and Monetary Union (WAEMU) member states.

These include Benin, Burkina Faso, Côte d’Ivoire, Guinea-Bissau, Mali, Niger, Senegal, and Togo.

Despite facing challenges like inflation and political tensions, the BRVM demonstrated resilience in 2023, with its composite index showing consistent growth.

1. BOA, Sonatel, Orange Lead The Pack

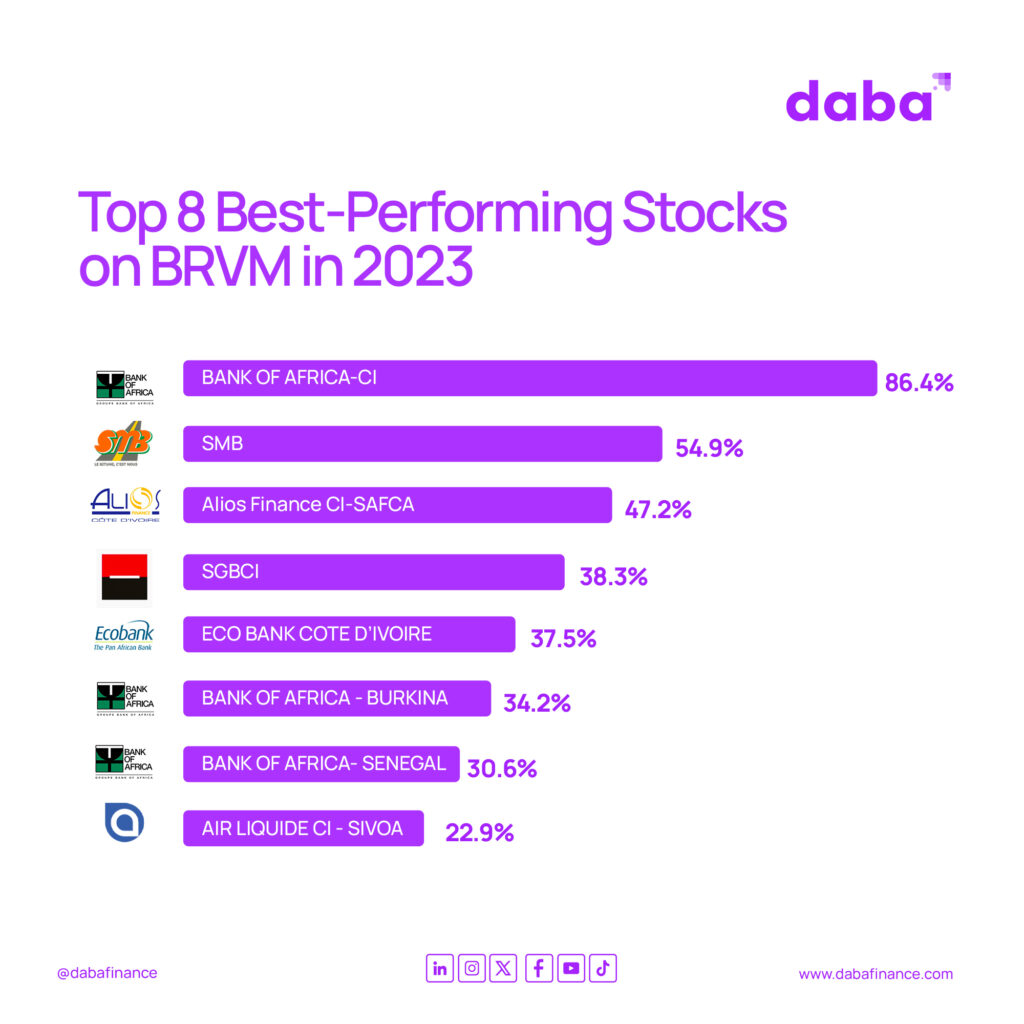

Last year, 21 stocks experienced prosperous periods, witnessing notable capital gains, while 23 stocks ended in decline, with 2 maintaining stability.

The finance and public services sectors notably contributed to the positive direction of the BRVM stock market, recording gains of 14.45% and 8.64%, respectively.

Notably, stocks within these sectors, such as Sonatel and Orange Côte d’Ivoire, played a pivotal role in this performance. BOA CI emerged as the top performer, boasting an impressive 86.35% gain, fueled by opportunities within the Ivorian banking sector.

The BRVM Composite, the comprehensive performance indicator, exhibited a modest initial growth to 203.22 points (+0.46%). However, it concluded the year with a notable surge of 5.38%, reaching 214.15 points, marking its third consecutive year of growth.

Want to diversify your portfolio? BRVM’s bellwether stocks offer promising opportunities for investors. Check out the Daba app to access them.

2. Increased Dividend Distribution

Despite challenges in 2022 and cautious directives from the BCEAO regarding dividend distributions from banks, BRVM-listed companies significantly increased shareholder remuneration in 2023. Dividends distributed to investors rose by 25.82%, totaling 647.8 billion FCFA.

Companies such as Sonatel, Orange CI, Société Générale CI, Ecobank CI, and Société Ivoirienne de Banque stood out by distributing substantial sums to their shareholders.

3. Brandon McCain Acquires Shares in BICICI

Brandon McCain Capital, led by Ahmed Cissé, acquired a 19.11% stake in BICICI from the SUNU bancassurance group. This transaction, valued at 22.12 billion FCFA, marks a significant change in BICICI’s shareholding structure.

4. Vista Group Negotiates Oragroup Share Repurchase

The Vista Group engaged in discussions for the repurchase of ECP’s shares in Oragroup. This agreement, with a consortium led by Emerging Capital Partners, aims to make Vista the majority shareholder of Oragroup, holding over 61% of shares.

However, valuation discrepancies between ECP and Simon Tiemtoré’s group pose challenges to the deal’s completion.

5. BRVM Surpasses 8 Trillion FCFA Mark

A significant milestone achieved by the BRVM in 2023 was its historic crossing of the 8,000 billion FCFA mark in market capitalization. This momentous occasion occurred on September 12, 2023, propelled by notable peaks in Société Générale CI and Orange CI stocks amid widespread increases.

Subsequently, on September 20, 2023, the BRVM ascended to become the fifth-largest market in Africa, boasting a market capitalization of 12.861 billion dollars, surpassing the Nairobi stock exchange’s capitalization of 9.77 billion dollars.

The listing of Orange Côte d’Ivoire at the end of 2022 significantly contributed to this achievement, accounting for around 20% of the overall market capitalization.

Despite a decline in overall volume transacted by 45.8% compared to 2022, the value of transactions increased by 41.2%, reaching 246 billion FCFA in 2023, reflecting positive market evolution.

Looking for a simple way to tap into the BRVM growth story? Daba offers a seamless experience for investors. Join us today and begin your journey!

6. Credit d’Afrique Group’s Acquisition of Alios Finance

On December 12, Tunisie Leasing et Factoring announced its agreement with Credit d’Afrique Group, led by successful entrepreneur Serge BILE, for the acquisition of its subsidiaries.

This acquisition includes majority shares in Alios Finance subsidiaries in Ivory Coast, Cameroon, and Gabon. While the Ivorian subsidiary faced financial challenges, this sale potentially stemmed from the subsidiaries’ financial performance.

Safca, controlled at 52.02% by Alios Finance, experienced a significant increase of 47.16% in its stock value at BRVM by the year’s end.

7. Historic Highs for Ecobank CI, Société Générale CI, and SIB

2023 saw certain stocks reaching their highest prices since their introduction to the BRVM. Notably, Ecobank CI, Nestlé CI, Orange CI, Société Générale CI, and SIB achieved significant milestones in their price evolution.

These developments, while reflecting positive market sentiment, may impact profits, dividends, and net assets. Investors’ high expectations could lead to increased price-earnings ratios and a decline in average profitability, affecting stocks’ attractiveness based on dividend yield.

8. Highest Returns Offered During Publications

With the release of financial statements for 2022 during 2023, several companies stood out for the level of shareholder remuneration they offered. BOA BF led the rankings with a notable dividend yield of 11.09%, followed by Palmci at 11.05%.

Nestlé CI, BOA CI, and SOGB rounded out the top 5 with respective returns of 10.79%, 10.40%, and 10.30%. This indicator, with an average dividend yield of more than 10%, contributed to reinforcing investors’ confidence in the stock market.

Ready to enjoy juicy dividends from BRVM Stocks? With Daba’s intuitive platform, investing has never been easier. Download the app now to get started.

9. Sonatel’s Concessions

Despite its long-standing dominance, Sonatel found itself displaced as the market capitalization giant at BRVM, ceding the top position to its Ivorian counterpart, Orange CI.

Orange Côte d’Ivoire’s successful IPO, the largest ever conducted on the BRVM market, triggered market excitement, propelling its stock value by around 15% in just two sessions.

However, post-IPO consolidation allowed Sonatel to reclaim its position, now sharing the market dominance with Orange CI, collectively commanding over 42% of the overall market capitalization.

Why You Should Invest In Stocks On West Africa’s BRVM

Investing in African stocks, particularly through platforms like the BRVM, offers investors a gateway to diverse and promising opportunities.

By understanding market trends, strategic developments, and sectoral performance, investors can make informed decisions on where and how to invest in Africa’s thriving stock markets, unlocking the continent’s growth potential and contributing to long-term investment success.

Daba’s cutting-edge investment platform provides investors with a seamless and effective way to discover, trade, and monitor investments on the BRVM. Get the Daba application now to start building your BRVM portfolio today.

XOF 1 = USD 0.0016 as of February 18, 2024.

Disclosure: This article was originally published on Sika Finance and regenerated with AI.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.