Looking to Frontier Equity Markets Can Cushion Turmoil

5 min Read August 9, 2024 at 8:04 PM UTC

Equity markets like the BRVM remain bullish at a time when traditional safe havens look less secure and could help hedge against downturns in more developed markets.

In times of market turbulence, savvy investors often look beyond their borders for opportunities to diversify and potentially hedge against domestic market volatility.

The recent global market downturn, triggered by events in Japan and exacerbated by geopolitical tensions, serves as a stark reminder of the importance of a well-diversified portfolio. For one, investors can consider placing their money overseas during challenging market conditions.

The global financial markets experienced a significant shock on August 5, 2024, when Japan’s Nikkei 225 index plunged 12.4%, its largest drop since 1987. This dramatic fall was primarily due to the unwinding of the long-standing ‘yen carry trade’ strategy.

For years, investors had been borrowing money from Japanese banks at ultra-low interest rates and investing it in higher-yielding assets elsewhere. However, the Bank of Japan’s decision to increase interest rates by 15 basis points caused the yen to appreciate rapidly against the US dollar, forcing investors to hastily close their positions.

This event didn’t occur in isolation, however.

The US market has also been facing challenges, with growing unemployment data stoking recession fears. The Nasdaq, for instance, sank 3% on the same day as the Japanese market crash. Adding to the global economic uncertainty, geopolitical tensions have risen, with Iran vowing retaliation against Israel following the death of a Hamas leader.

In such a volatile environment, investors naturally seek ways to protect and grow their wealth. Investing overseas can be an effective strategy, offering exposure to different economic cycles and potentially uncorrelated returns.

You can follow Daba’s reporting on Africa on WhatsApp. Sign up here

Why Consider Overseas Investments?

Diversification is a key reason to consider overseas investments. By spreading investments across different countries and regions, you can reduce your overall portfolio risk. Some overseas markets may offer higher growth potential than your domestic market, especially during local downturns.

Investing in foreign markets can also provide a hedge against currency fluctuations in your home country while certain industries or companies may be better represented in foreign markets, offering unique investment opportunities.

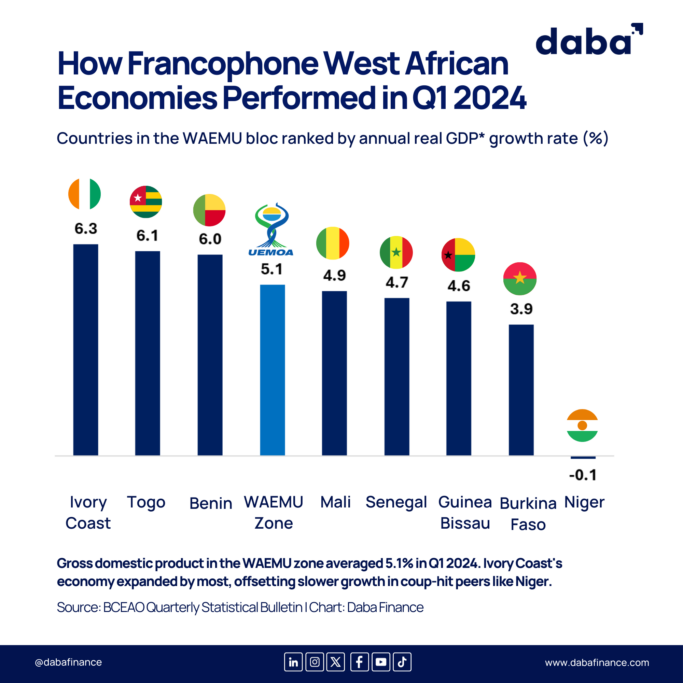

The BRVM (Bourse Régionale des Valeurs Mobilières), for instance, offers exposure to a rapidly growing region that many investors overlook. The exchange serves the eight countries of the West African Economic and Monetary Union (WAEMU): Benin, Burkina Faso, Côte d’Ivoire, Guinea-Bissau, Mali, Niger, Senegal, and Togo – all of which are experiencing strong economic growth.

And amid the global stock market rout, BRVM stocks hit fresh highs to send overall market capitalization above 9 trillion CFA franc (around $15 billion) for the first time ever. Its benchmark Composite Index has delivered 15.74% year-to-date compared to CAC 40 (France): -3.39%, S&P 500 (USA): 14.09%, FTSE 100 (UK): 6.65%, SSE Composite (China): -3.18% and Ibovespa (Brazil): -0.54%.

Given the BRVM’s performance comes at a time when traditional safe havens are looking less secure, it represents an opportunity to tap into a different economic cycle and potentially hedge against downturns in more developed markets.

Emerging markets such as India, Brazil, and Indonesia also offer high growth potential, though they come with increased risk. European markets, while facing challenges, can offer value and dividend opportunities. The Asian Tigers – countries like South Korea, Taiwan, and Singapore – have dynamic economies and globally competitive companies. Commodity-rich nations such as Australia or Canada can be attractive during certain economic cycles.

How to Invest Overseas

For investors looking to add international exposure to their portfolios, there are several avenues to consider. Mutual funds and ETFs are often the simplest way for retail investors to gain international exposure. Many funds focus on specific regions, countries, or sectors.

American Depositary Receipts (ADRs) and Global Depositary Receipts (GDRs) allow you to invest in foreign companies through your domestic stock exchange. More experienced investors can open accounts with brokers that provide access to foreign markets. This approach offers the most control but requires more research and potentially higher fees.

Investing in domestic companies with significant international operations can also provide indirect overseas exposure.

While overseas investments can offer significant benefits, they also come with unique risks. Currency fluctuations can impact returns, and changes in government policies or regulations can affect foreign investments. It may be harder to obtain accurate, timely information about foreign companies and markets. Overseas investments also often involve higher fees and potentially unfavorable tax treatment while some foreign markets may have lower trading volumes, making it harder to buy or sell investments quickly.

You can follow Daba’s reporting on Africa on WhatsApp. Sign up here.

Still, in times of market downturn, looking overseas for investment opportunities can be a prudent strategy for diversification and potential growth. While the BRVM in West Africa has shown impressive performance, investors could also consider a range of international options based on their risk tolerance, investment goals, and understanding of foreign markets.

For those new to international investing, starting with broad-based ETFs or mutual funds can provide a good entry point. More experienced investors might consider direct investment in foreign markets or specific ADRs.

Successful overseas investing requires careful research, an understanding of the unique risks involved, and potentially the guidance of a partner with international expertise. By thoughtfully incorporating overseas investments into a well-balanced portfolio, investors can potentially navigate market downturns more effectively and position themselves for long-term growth.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Articles do not reflect the views of DABA ADVISORS LLC and do not provide investment advice to Daba’s clients. Daba is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Next Frontier

Stay up to date on major news and events in African markets. Delivered weekly.

Pulse54

UDeep-dives into what’s old and new in Africa’s investment landscape. Delivered twice monthly.

Events

Sign up to stay informed about our regular webinars, product launches, and exhibitions.